Coming Soon: MyDocSafe + TaxNav Integration — A Game Changer for Accountants Preparing for MTD ITSA

Making Tax Digital for Income Tax Self Assessment (MTD ITSA) is fast approaching, and for many accountants, staying compliant is only part of the challenge. The real test lies in managing every moving part — from gathering client data and monitoring submissions to maintaining clear communication and audit-ready records.

That’s exactly what TaxNav and MyDocSafe are coming together to solve.

MyDocSafe — The Digital Hub for Accountants

MyDocSafe is a secure client management and workflow automation platform trusted by accounting firms across the UK. It helps practices bring every element of client interaction into one branded, compliant environment.

With MyDocSafe, you can:

- Create secure client portals – Centralised spaces for all communication, document exchange, and collaboration.

- Use built-in e-signatures – Get engagement letters, returns, and agreements signed quickly and securely.

- Automate onboarding – Send quotes, collect AML/KYC data, and onboard new clients with custom workflows.

- Build your own forms – Capture client information digitally and reduce time spent chasing details.

MyDocSafe is designed for small and medium-sized accounting firms looking to streamline operations, improve compliance, and enhance client experience — all while maintaining full control over branding and data security.

Coming Soon: Integration with TaxNav

The upcoming integration between MyDocSafe and TaxNav will take digital client management to the next level.

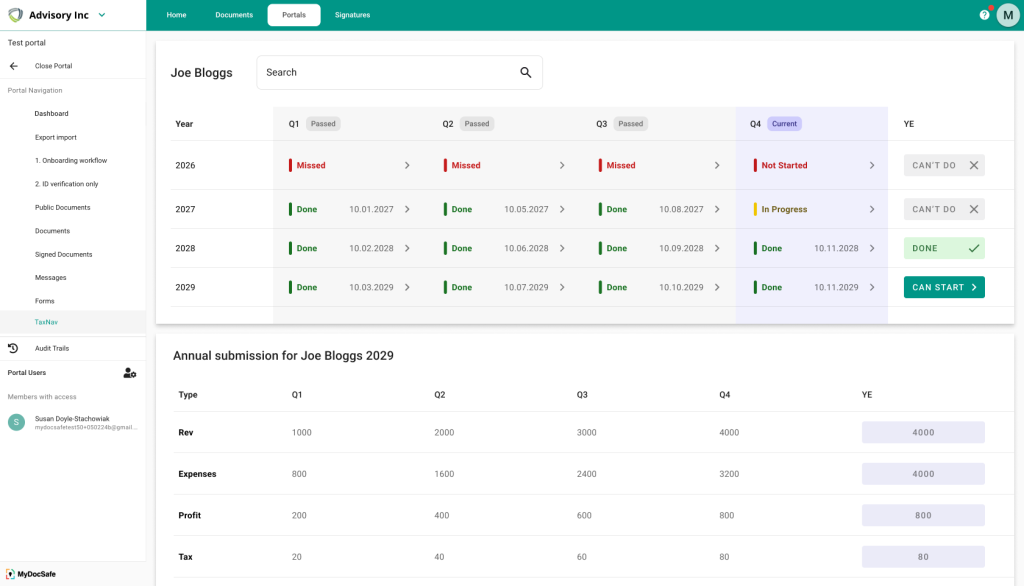

When launched, this integration will allow accountants to monitor MTD ITSA filing progress directly from within their MyDocSafe portals, combining TaxNav’s digital filing capabilities with MyDocSafe’s secure client collaboration environment.

You’ll be able to:

- View the status of clients’ MTD ITSA submissions in real time

- Receive alerts and reminders when filings are due

- Keep all related documents, confirmations, and correspondence in one place

- Offer clients a seamless digital experience that connects tax filing and communication

With MyDocSafe and TaxNav working together, accountants will gain a complete, end-to-end digital solution — from engagement to compliance monitoring.

Why It Matters

As MTD ITSA becomes a reality, efficiency and visibility will be critical. Accountants who can combine client management and tax compliance in one ecosystem will be better positioned to serve more clients, reduce errors, and scale their practice confidently.

The MyDocSafe + TaxNav integration will do just that — offering a single, secure environment for managing, filing, and communicating with clients throughout the MTD process.

Stay Tuned

The integration is currently in development and will launch soon.

If you already use MyDocSafe or are planning to adopt TaxNav, this collaboration will unlock even greater value from both platforms.

👉 Subscribe to updates on TaxNav.digital to be the first to know when the integration goes live — and start preparing your practice for the future of digital tax.

If you are new to MTD ITSA

MTD ITSA stands for Making Tax Digital for Income Tax Self Assessment.

It’s a UK government initiative by HMRC designed to modernise the way individuals and businesses report and pay income tax. It’s part of the broader Making Tax Digital (MTD) programme, which aims to make tax administration more effective, efficient, and easier for taxpayers.

Here’s what it means in practical terms:

🧾 Who it applies to

- Self-employed individuals and landlords with annual business or property income over £50,000 (from April 2026).

- It will later expand to those earning over £30,000 (from April 2027, as currently planned).

Eventually, most individuals who currently file Self Assessment tax returns will fall under MTD ITSA.

🧩 What changes under MTD ITSA

Instead of submitting one annual Self Assessment return, affected taxpayers will:

- Keep digital records of their income and expenses using compatible accounting software (like TaxNav).

- Send quarterly updates to HMRC via the software (every 3 months).

- Submit an End of Period Statement (EOPS) at the end of the tax year to finalise each business or property’s figures.

- Submit a Final Declaration (replacing the current Self Assessment return) to declare all income and calculate final tax due.

💻 Why HMRC introduced it

- To reduce errors caused by manual record-keeping.

- To give taxpayers more real-time visibility of their tax liabilities.

- To streamline compliance by requiring software-based submissions.

⚙️ How it works with software

Taxpayers must use HMRC-recognised MTD-compatible software that:

- Maintains digital records.

- Communicates directly with HMRC’s systems through an API (Application Programming Interface).

- Supports quarterly submissions and the year-end process.

For example:

MyDocSafe + TaxNav integration would allow accountants to monitor clients’ MTD ITSA submissions, manage communications, and store documents securely — all in one client portal.

Excellent — here’s a clear and practical MTD ITSA timeline and compliance checklist tailored for accountants and tax advisors preparing their clients.

🗓️ MTD ITSA Timeline (as of 2025)

| Date | Event | Who It Affects |

|---|---|---|

| April 2026 | Mandatory start for self-employed individuals and landlords with total business and/or property income over £50,000 | First cohort (“digital filing only”) |

| April 2027 | Threshold lowers to £30,000 | Second cohort |

| TBC | HMRC consultation on including partnerships and trusts | Not yet scheduled |

| Current (2025) | Voluntary registration and software testing period | Early adopters; recommended for accountants to pilot |

✅ Compliance Checklist for Accountants

1. Client Identification and Segmentation

- Export list of all Self Assessment clients.

- Identify clients with gross business or property income > £50k.

- Flag complex cases (joint ownership, multiple trades, overseas property).

- Prepare communication templates to notify clients of new obligations.

2. Software Readiness

- Choose or confirm MTD-compatible software (e.g. TaxNav, Xero, QuickBooks, FreeAgent).

- Ensure the software supports quarterly submissions and EOPS.

- Check API bridging tools if using spreadsheets.

- Set up MyDocSafe portals for document exchange, digital signatures, and client onboarding.

🟢 Tip: Use MyDocSafe + TaxNav integration to consolidate tax filing data with digital workflows and signed authorisations.

3. Digital Record-Keeping

- Migrate clients from paper or Excel to digital bookkeeping.

- Ensure each income stream (trade, property, etc.) is recorded separately.

- Review transaction categorisation (align with HMRC record-keeping rules).

4. Quarterly Filing Workflow

- Set internal deadlines (e.g., 30 days after quarter-end).

- Automate reminders and digital approval workflows in MyDocSafe.

- Standardise file naming and retention policies.

| Quarter | Period | Filing Deadline |

|---|---|---|

| Q1 | 6 Apr – 5 Jul | 5 Aug |

| Q2 | 6 Jul – 5 Oct | 5 Nov |

| Q3 | 6 Oct – 5 Jan | 5 Feb |

| Q4 | 6 Jan – 5 Apr | 5 May |

5. End-of-Year Compliance

- Prepare End of Period Statement (EOPS) for each business/property.

- Prepare the Final Declaration (replacing the SA100).

- Review adjustments for reliefs, capital allowances, and private use.

- Archive final signed documents in MyDocSafe.

6. Client Education & Engagement

- Run short webinars or produce explainers (“Your First Quarterly Update”).

- Provide checklists or email templates showing what data clients must provide.

- Offer a digital onboarding pack with portal login instructions and MTD FAQs.

7. Internal Practice Preparation

- Update engagement letters to reference MTD ITSA obligations.

- Train staff on software workflow and HMRC digital submission rules.

- Review pricing models (quarterly filing = 4× more touchpoints per year).

- Implement client segmentation for resource allocation.

8. Optional Add-Ons for Efficiency

- 💼 MyDocSafe workflow automation for onboarding and digital approvals

- 🧮 TaxNav MTD dashboard for monitoring client filing status

- 🔐 MyDocSafe secure document vaults for tax records, receipts, and authorisations

- 🤖 Automated reminders (email) for upcoming deadlines