Overview

The article delves into best practices for document signatures, underscoring the critical importance of compliance and efficiency in the signing process. It begins by addressing the challenges legal firms encounter, setting the stage for a discussion on the various types of signatures available. By highlighting the advantages of digital methods, the article generates interest in innovative solutions. Furthermore, it provides comprehensive guidelines for implementing effective electronic signature solutions, supported by compelling data that illustrates significant reductions in processing errors and enhanced operational performance. This structured approach not only informs but also prompts legal professionals to consider adopting these solutions for improved efficiency.

Introduction

In the dynamic realm of document management, signatures are crucial for ensuring both authenticity and compliance. As technology advances, organisations are faced with a variety of signature options, ranging from traditional wet signatures to sophisticated electronic and digital signatures. Grasping the distinctions among these types is vital for businesses aiming to streamline their operations while remaining compliant with legal standards. The increasing adoption of electronic signatures not only promises enhanced efficiency but also fortifies security, rendering them essential in industries where document integrity is critical.

This article explores the various types of document signatures, their significance, and best practices for implementation, providing insights into how organisations can adeptly navigate the complexities of contemporary signing solutions.

Understanding Document Signatures: Types and Importance

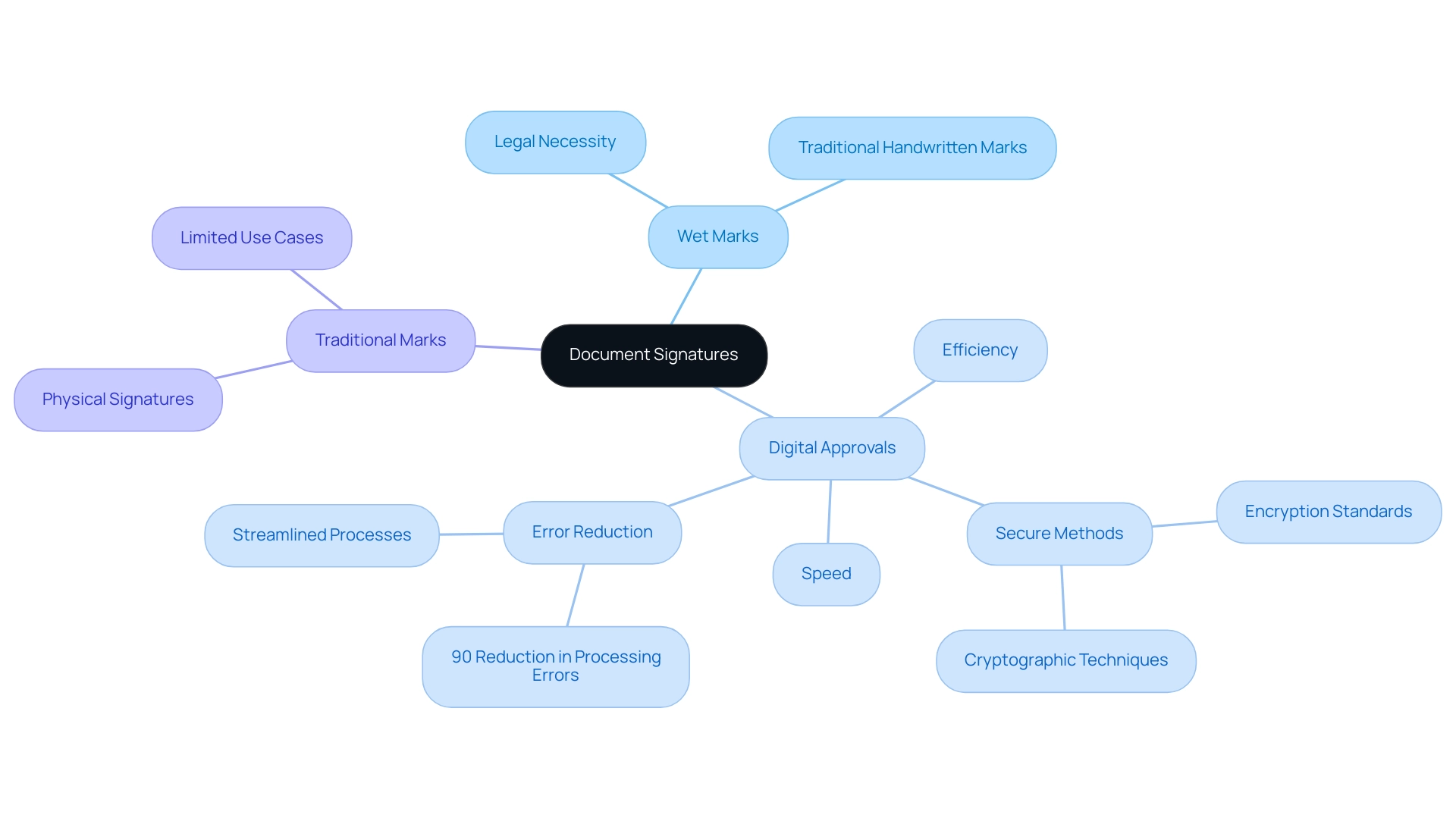

Document approvals can be categorised into three main types: wet marks, digital approvals, and traditional marks. Wet endorsements, comprising traditional handwritten marks, remain essential for certain legal documents. In contrast, digital endorsements encompass any digital method of showing agreement, such as typing a name or pressing an ‘I agree’ button.

Document signatures employ cryptographic methods to enhance security and authenticity, making them especially important in sensitive transactions.

Understanding these distinctions is crucial for organisations to select the appropriate method of authentication that aligns with their compliance needs and operational goals. For example, while handwritten approvals may still be necessary in specific legal situations, digital and online endorsements provide significant advantages in terms of speed and efficiency. MyDocSafe offers a comprehensive suite of features, including secure document management, digital signing capabilities, client access portals, virtual data rooms, and ID verification services, all of which support the document signature process and enhance client onboarding across various sectors.

In fact, a survey by MSB Docs reveals that companies utilising digital methods can reduce processing errors by an impressive 90%, addressing the inaccuracies often associated with paper-based signing methods. This substantial reduction in errors is further corroborated by a case study titled ‘Error Reduction with E-signatures,’ which underscores the streamlined processes and diminished risk of mistakes that digital methods facilitate, thereby enhancing overall business performance.

The impact of digital methods on operational efficiency is particularly pronounced in the legal and healthcare sectors, where timely agreements are paramount. As organisations increasingly embrace digital methods, they not only streamline their workflows but also improve customer and employee experiences by minimising storage and transport costs. MyDocSafe’s reminder features for request approvals, questionnaires, and portal invitations further bolster client engagement, ensuring that vital documents are processed efficiently.

The robust security and regulatory framework of MyDocSafe, including stringent encryption standards, guarantees that document signatures are both legally valid and secure. As the legal sector continues to recognise the importance of document signatures for compliance, many companies leverage these tools to meet regulatory requirements effectively. This shift underscores the growing reliance on digital endorsements as a cornerstone of modern file management practices, ensuring that legal firms can operate effectively while adhering to regulations.

Navigating Legal Compliance in Document Signing

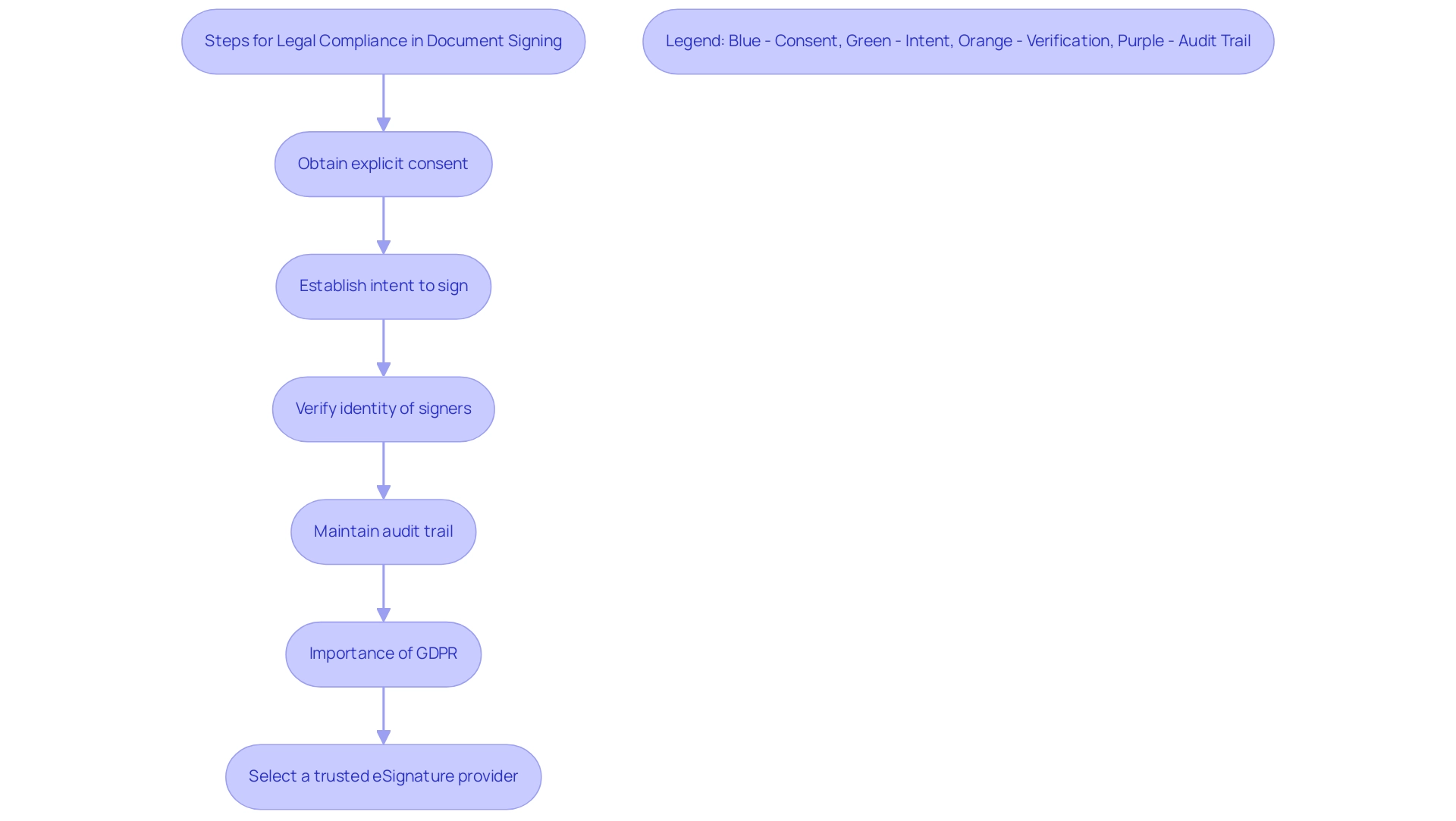

Legal adherence in document signature is fundamentally influenced by regulations such as the ESIGN Act and UETA in the United States, confirming that digital marks hold the same legal significance as conventional handwritten signatures. To ensure compliance, organisations must implement electronic signature processes that meet specific legal criteria. These include:

- Obtaining explicit consent from signers for the use of a document signature

- Clearly establishing the intent to sign

- Employing reliable methods for verifying the identity of signers

As we approach 2025, maintaining an audit trail has become increasingly critical for demonstrating adherence to regulations and addressing potential disputes. This is particularly vital for legal firms, which must prioritise compliance to safeguard client confidentiality and maintain the integrity of legal documents, especially regarding document signatures. Statistics reveal that a significant portion of organisations are now keeping audit trails for digital approvals, demonstrating an increasing dedication to regulatory adherence.

It is also important to recognise that a Qualified Electronic Signature (QES) is legally valid across all EU member states, further emphasising the global significance of these standards.

Moreover, selecting a trusted eSignature provider, such as MyDocSafe, is essential for ensuring robust fraud protection and legal enforceability. MyDocSafe’s Terms of Service and Acceptable Use Policy provide a framework for users to understand their rights and responsibilities when utilising electronic signatures. As Tara Kachaturoff noted, “Its ease of use for managing client contracts” highlights the user-friendly nature of reliable eSignature solutions.

A case study on selecting a trustworthy eSignature provider emphasises the importance of adhering to global security and legal standards, including encryption and certification of compliance. By opting for a provider that prioritises these aspects, legal firms can enhance document integrity and protect against fraud, which is crucial for secure digital transactions.

Expert insights into the ESIGN Act and UETA adherence reveal that organisations successfully implementing these regulations not only streamline their document signature processes but also bolster their legal standing. Furthermore, GDPR considerations are crucial, as organisations must ensure that personal data is managed according to these regulations. As the landscape of digital agreements continues to evolve, legal firms must remain vigilant in their adherence efforts to effectively navigate the complexities of online transactions involving document signatures.

MyDocSafe’s extensive security and compliance framework, featuring encryption standards and blockchain solutions, further aids legal adherence and operational guidelines for digital signing and document management solutions.

Leveraging Technology: The Rise of Electronic Signatures

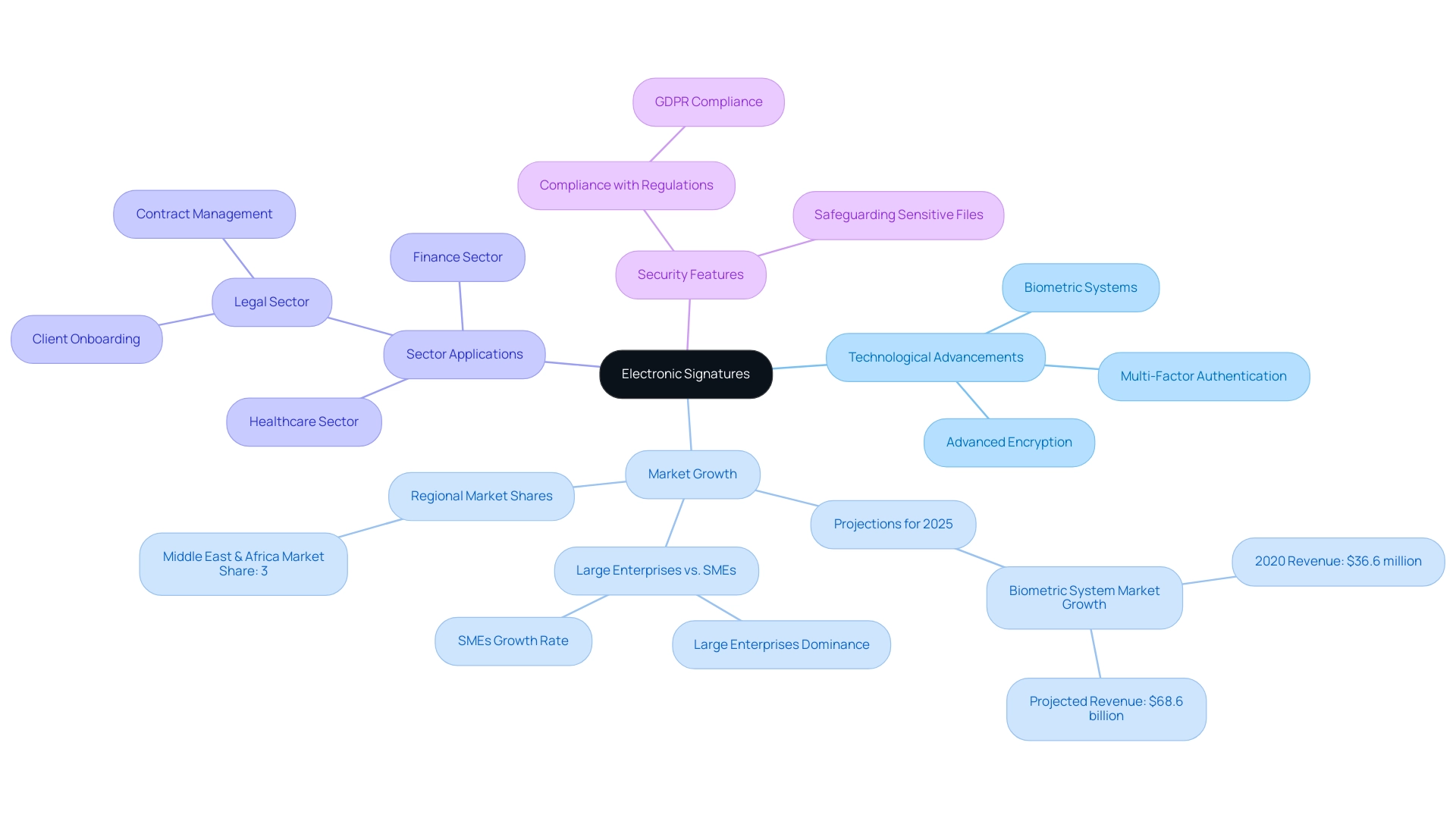

The rise in digital approvals is closely linked to technological advancements that not only streamline the document signature process but also significantly enhance security. By 2025, modern digital signing solutions, such as those offered by MyDocSafe, will employ advanced encryption techniques and multi-factor authentication, ensuring that sensitive information remains secure from unauthorised access. These technologies enable quicker turnaround times for materials and reduce reliance on physical paperwork, thereby fostering environmental sustainability.

Organisations are increasingly integrating digital signing solutions into their existing workflows, improving file management and enhancing client interactions. MyDocSafe’s features—including customisable client portals, automated workflows, ID verification services, encrypted email, and virtual data rooms—demonstrate how businesses can engage prospects and expedite deal closures. The biometric system market, crucial for authenticating digital documents, generated approximately $36.6 million in 2020 and is projected to surge to $68.6 billion by the end of 2025, highlighting the rising significance of secure signing technologies.

Notably, the Middle East & Africa region holds the fifth highest market share in this sector, accounting for 3%.

As companies embrace digital transformation, the acceptance of electronic signatures is becoming standard practice across various sectors, including legal, healthcare, and finance. Large enterprises are expected to dominate the digital document market due to their increasing IT budgets and the adoption of e-business and paperless systems. However, small and medium enterprises are anticipated to exhibit the highest growth rate, driven by their commitment to digitalisation for enhancing operational efficiency.

A case study titled ‘E-Business Trend Impact on Large Enterprises’ illustrates how the digital authentication market is segmented by enterprise type, with large enterprises leading the charge.

The advantages of encryption and multi-factor authentication in electronic signatures are paramount. These features not only safeguard sensitive files but also ensure compliance with stringent regulations, such as GDPR. As organisations continue to prioritise security, the integration of these technologies into document signature processes is becoming indispensable.

In the legal sector, for instance, firms are leveraging digital endorsements to simplify document signatures, client onboarding, and contract management. MyDocSafe’s solutions exemplify this trend, as noted by Tara Kachaturoff, who remarked on “its ease of use for managing client contracts.” Case studies reveal that firms adopting these technologies experience heightened efficiency and improved client satisfaction.

As the landscape evolves, the impact of technology on electronic authentication will only intensify, solidifying its role as a fundamental component of contemporary record management.

To discover more about how MyDocSafe can enhance your management and signing processes, contact our team today.

Best Practices for Implementing Document Signatures in Your Organization

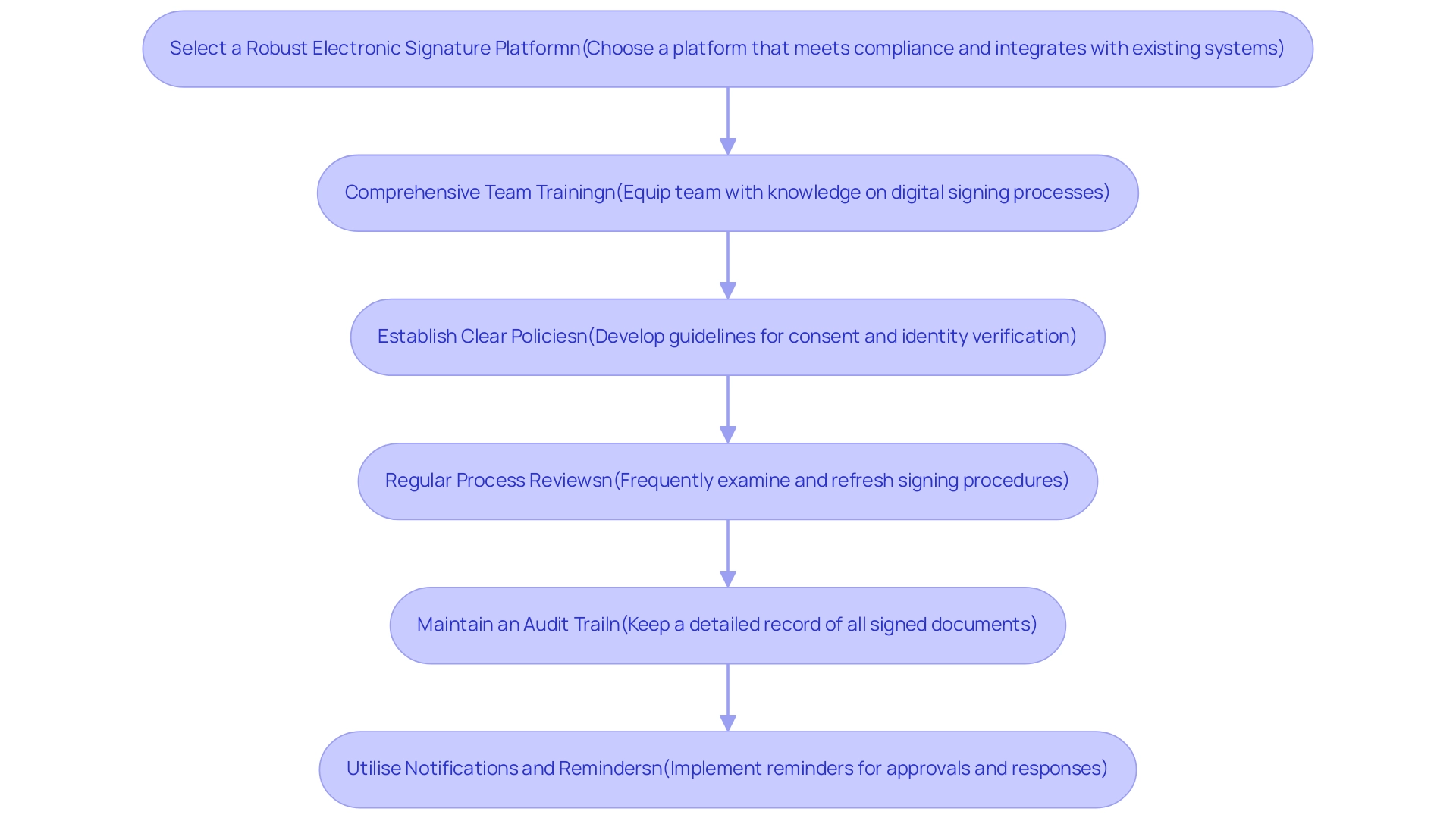

Implementing document signatures effectively within your organisation requires adherence to several best practises:

- Select a Robust Electronic Signature Platform: Choose a platform like MyDocSafe that not only meets your compliance requirements but also integrates seamlessly with your existing systems, including Google Workspace. This ensures a smooth transition and effective utilisation of all functionalities, such as advanced security features and customisable client portals. As highlighted in the case study “Choosing the Right Electronic Signature Solution,” evaluating factors such as the number of users, document volume, security, and usability is crucial in selecting the right tool.

- Comprehensive Team Training: Equip your team with the necessary knowledge and skills to navigate the new digital signing processes. Training programmes should address potential concerns regarding security and usability, fostering confidence in the system. A considerable portion of organisations are prioritising training staff on digital signing processes in 2025, acknowledging its vital role in successful adoption. As Tara Kachaturoff noted, MyDocSafe’s ease of use for managing client contracts can significantly enhance user experience.

- Establish Clear Policies: Develop and communicate clear guidelines regarding the use of digital endorsements. This includes protocols for obtaining consent and verifying the identity of signers, which are essential for maintaining the integrity of the document signature process. MyDocSafe’s comprehensive document management solutions support these policies by ensuring secure and compliant document signature processes.

- Regular Process Reviews: Stay proactive by frequently examining and refreshing your digital signing procedures. This practice helps organisations adapt to evolving regulations and technological advancements, ensuring ongoing compliance and efficiency. The potential financial repercussions of failing to implement electronic signatures properly are significant, with GDPR fines reaching up to €20 million or 4% of global annual revenue.

- Maintain an Audit Trail: Implement a system that keeps a detailed audit trail for all signed documents. MyDocSafe enhances accountability by simplifying audits, providing a clear record of all transactions. The software’s capability to store, validate, and monitor marks, along with producing unique secure keys for encryption during the document signature process, further enhances adherence and security.

- Utilise Notifications and Reminders: MyDocSafe provides reminders for different scenarios, such as requests for digital approvals, completing questionnaires, and accepting invitations to portals. This feature enhances client engagement and ensures timely responses, which is crucial for maintaining workflow efficiency.

By following these best practises and leveraging MyDocSafe’s advanced features, including the automation of compliance, onboarding, and contract renewal processes, organisations can significantly enhance their operational efficiency while ensuring compliance with legal standards. The introduction of electronic marks is not merely a trend; it is a strategic action that can result in enhanced productivity and client satisfaction, as demonstrated by the experiences of over 10,000 companies globally that have embraced such solutions. Additionally, consider starting a 30-day free trial to experience the benefits of MyDocSafe firsthand.

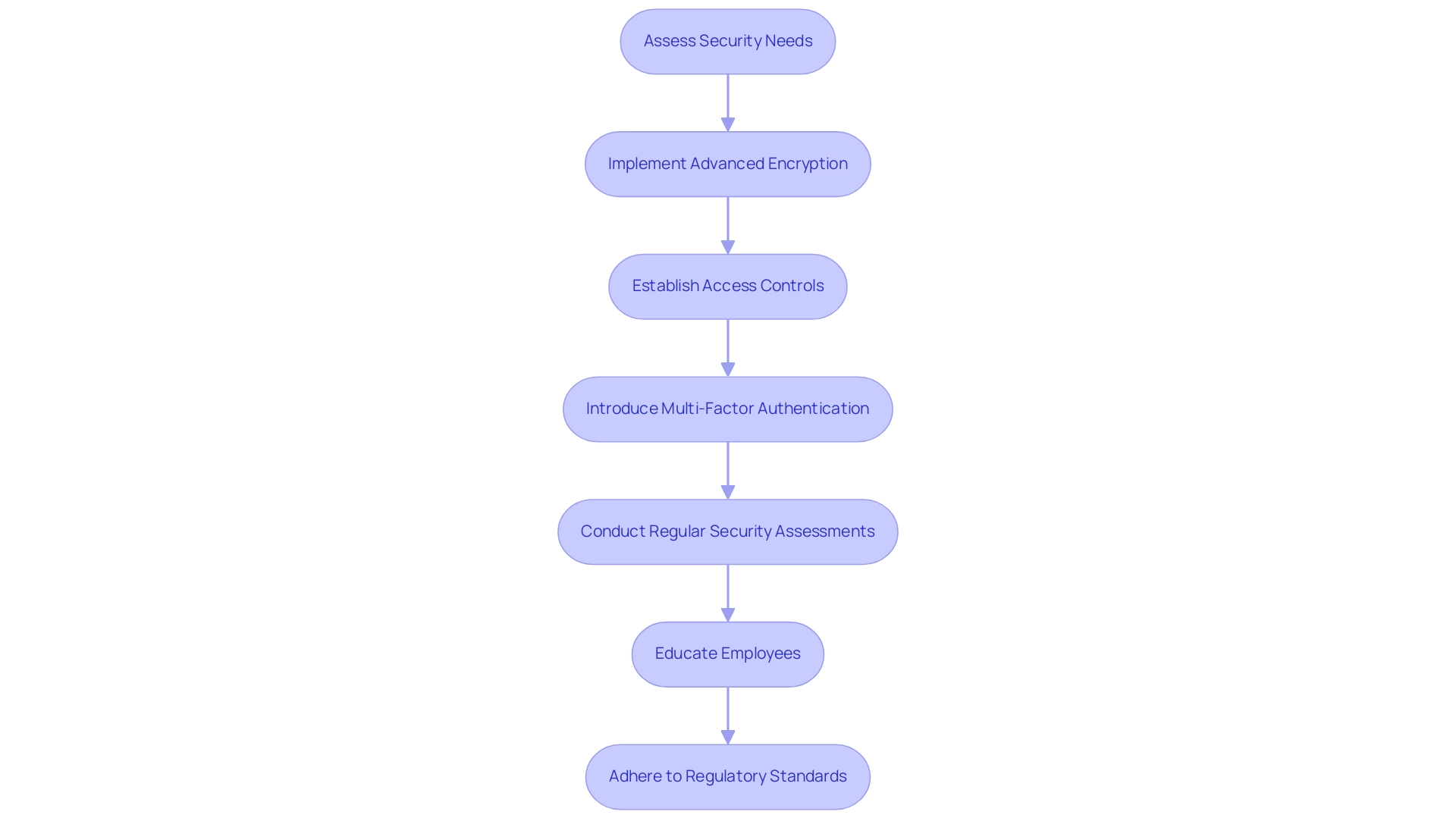

Ensuring Security in Document Signatures: Protecting Sensitive Information

In the legal and healthcare sectors, where the exchange of sensitive information is routine, ensuring the security of signatures is paramount. Organisations must adopt comprehensive security measures, including advanced encryption protocols and stringent access controls, to safeguard against unauthorized access and data breaches. MyDocSafe Document Security offers top-tier encryption, the same standard employed by financial institutions, ensuring that all sensitive files are managed securely.

Recent statistics reveal that nearly 70% of patients would contemplate switching providers following a significant data breach, highlighting the urgent need for robust security practices. Moreover, with over 10,000 companies worldwide utilising MyDocSafe’s services, it is evident that effective security solutions are in high demand.

Implementing multi-factor authentication (MFA) has proven to be transformative in enhancing file security. By necessitating multiple forms of verification before granting access to signed files, organisations can significantly reduce the risk of unauthorized access. This strategy not only fortifies security but also cultivates client trust, which is essential for sustaining long-term relationships.

Regular security assessments are critical for identifying vulnerabilities and ensuring that security measures remain effective against evolving threats. Furthermore, educating employees about the importance of safeguarding sensitive information and recognising potential security threats is vital. A well-informed workforce serves as the first line of defence against cyber threats.

As Steve Alder, Editor-in-Chief of The HIPAA Journal, articulates, “The minimum necessary standard requires that only the minimum necessary information is used or disclosed to achieve the purpose of the use or disclosure.” This underscores the importance of adhering to regulations in document signature processes. MyDocSafe’s comprehensive security and regulatory framework, encompassing its encryption standards and the legal validity of electronic signatures, aids organisations in fulfilling these obligations.

Additionally, recent regulatory and legislative initiatives aimed at addressing healthcare cybersecurity, including proposed revisions to the HIPAA Security Rule, emphasize the necessity for organisations to remain cognizant of their obligations. Covered entities and business associates bear distinct HIPAA adherence responsibilities based on their activities, a critical consideration for legal and healthcare professionals.

By prioritising these security measures within the document signature process, organisations can ensure compliance with data protection regulations while enhancing operational efficiency and client satisfaction. Moreover, leveraging MyDocSafe’s encrypted chat features over third-party applications can further secure client communications. MyDocSafe also provides customisable workflows and a fully paperless proposal process, streamlining client onboarding and minimizing administrative delays.

Automated distribution of materials, reminders, and notifications further enrich the onboarding experience, enabling organisations to close deals more swiftly while maintaining compliance. As the landscape of cybersecurity continues to evolve, staying ahead of potential risks will be crucial to preserving the integrity of sensitive information.

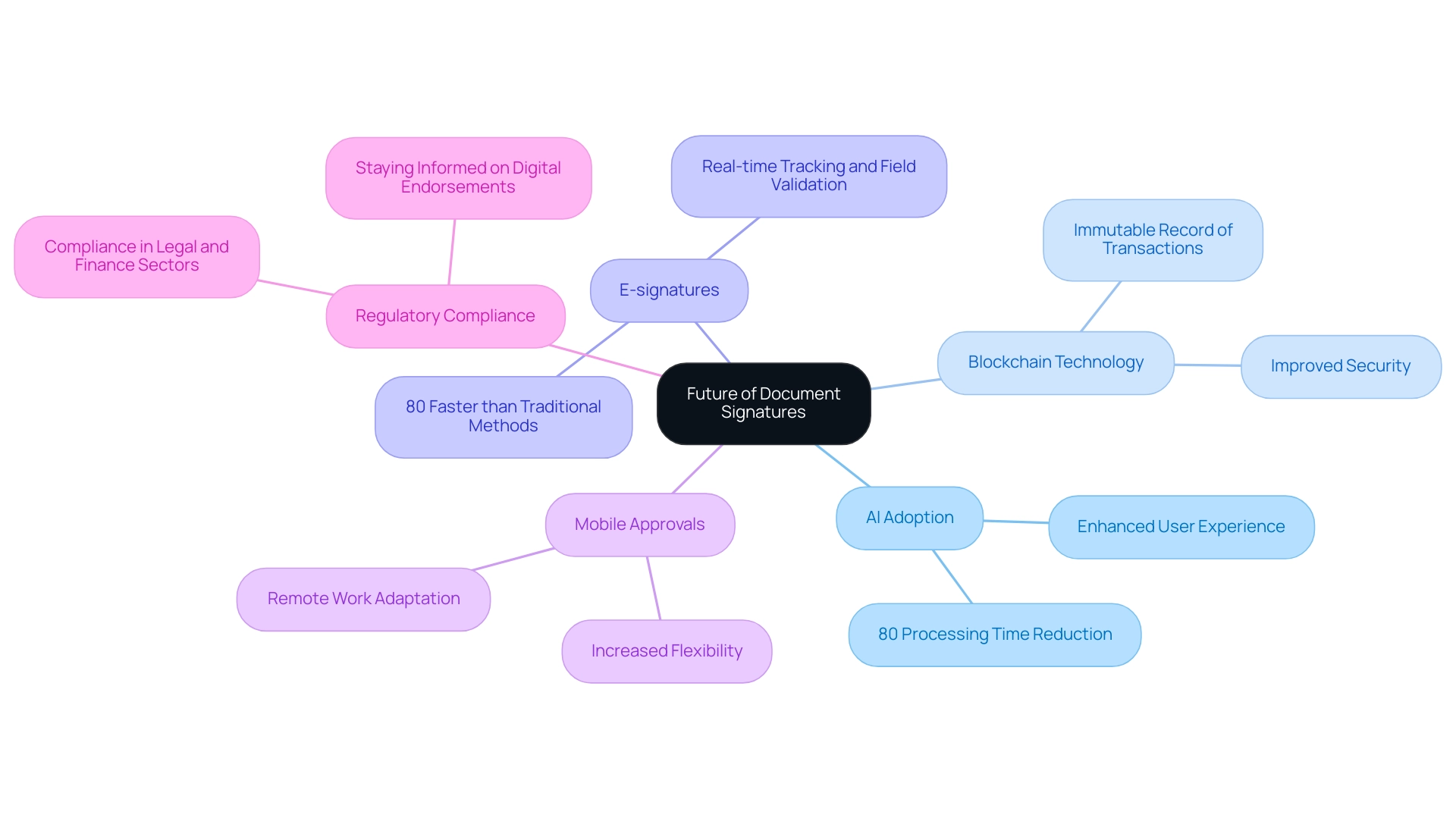

The Future of Document Signatures: Trends and Innovations

The future of document authentication, particularly regarding document signatures, is poised for a transformative shift, heavily influenced by technological advancements and evolving regulatory frameworks. A notable trend is the increasing adoption of artificial intelligence (AI) to enhance authentication processes, projected to significantly streamline operations. By 2025, statistics indicate that organizations utilizing AI in their digital signing workflows can anticipate a processing time reduction of up to 80%, thereby improving overall efficiency.

Moreover, obtaining a document signature through e-signatures can be 80% faster than traditional methods when seeking client approval, reinforcing claims about efficiency improvements. Additionally, the integration of blockchain technology is emerging as a critical factor in enhancing security and traceability within electronic agreements. This decentralized approach not only fortifies the integrity of document signatures but also provides an immutable record of transactions, essential for compliance in sectors such as legal and finance.

MyDocSafe’s advanced security framework, including encryption standards such as AES-256 and key management services, empowers organizations to confidently navigate these complexities while maintaining compliance.

As organizations face the challenges of remote work, the acceptance of mobile approvals is also rising, reflecting a shift toward more flexible and accessible signing solutions. To remain compliant, businesses must stay informed about the changing rules regarding digital endorsements. The landscape is evolving, with 36% of companies planning to expand their digital solutions and 35% intending to implement new technologies in the near future.

This proactive approach to adopting innovative signing processes will likely confer a competitive advantage in their respective markets.

As these trends continue to develop, the impact of AI and blockchain on electronic authentication will be profound. Case studies reveal that organizations utilizing AI for verifying agreements report enhanced user experiences, reduced errors, and improved transaction efficiency. For instance, 45% of users of e-signature solutions, such as those provided by MyDocSafe, find features like real-time tracking and field validation particularly beneficial.

Additionally, Tara Kachaturoff commends the simplicity of handling client agreements, emphasizing the intuitive nature of these solutions.

In conclusion, the future of paperwork approvals is defined by the convergence of AI, blockchain, and mobile technology, all poised to transform how organizations manage their signing procedures. Embracing these innovations will be crucial for businesses aiming to enhance compliance and operational efficiency in an increasingly digital landscape. MyDocSafe, with its comprehensive document management and document signature capabilities tailored for industries such as legal, finance, and healthcare, is well-positioned to lead in this evolving environment.

Conclusion

The landscape of document signatures is rapidly evolving, propelled by advancements in technology and an increasing emphasis on security and compliance. For organisations aiming to enhance efficiency while maintaining legal integrity in their signing processes, understanding the distinctions between wet, electronic, and digital signatures is essential. The adoption of electronic signatures not only streamlines workflows but also improves accuracy, as evidenced by significant reductions in processing errors.

Moreover, ensuring compliance with regulations such as the ESIGN Act and UETA is critical for upholding the legitimacy of electronic signatures. Organisations must establish robust processes that encompass:

- Obtaining explicit consent

- Demonstrating intent

- Verifying the identity of signers

The significance of maintaining an audit trail cannot be overstated, particularly in industries where compliance is of utmost importance.

As technology continues to advance, the integration of features such as AI and blockchain into electronic signature solutions will further bolster security and efficiency. These innovations are poised to redefine how organisations manage document signing, making it imperative for businesses to stay ahead of the curve. By adopting best practices and leveraging advanced platforms like MyDocSafe, organisations can enhance their operational efficiency while ensuring compliance with evolving legal standards.

In conclusion, the future of document signatures is promising, with the potential for enhanced efficiency, security, and compliance at the forefront. Embracing these changes will position organisations to thrive in an increasingly digital landscape, ultimately leading to improved client satisfaction and operational success.