Overview

Best practices for document signers underscore the critical need for secure and efficient signing processes, which are essential for safeguarding sensitive information and enhancing operational efficiency. Legal firms face significant challenges in managing these processes effectively. To address these challenges, the article delineates key strategies:

- Utilizing secure platforms equipped with advanced encryption

- Ensuring comprehensive audit trails

- Adopting automated workflows

These strategies are not merely theoretical; evidence supports their efficacy, demonstrating reduced processing errors and fostering improved client trust in electronic signatures. Implementing these practices not only mitigates risks but also streamlines operations, ultimately leading to a more trustworthy and efficient signing experience.

Introduction

In an increasingly digital world, the significance of secure document signing is paramount, especially within the legal sector where confidentiality reigns supreme. As organizations navigate the complexities of electronic signatures, the imperative for robust security measures intensifies, safeguarding sensitive information from unauthorized access and potential data breaches.

MyDocSafe emerges as a leader in this evolution, providing advanced encryption and compliance solutions that not only protect documents but also enhance operational efficiency. Statistics indicate a notable reduction in processing errors, reinforcing the critical need for organizations to understand the intricacies of secure document signing to thrive in a competitive landscape.

This article explores various methods of electronic signatures, best practices for maintaining integrity, and the technological advancements that enrich user experience, equipping firms to adeptly navigate the future of document management.

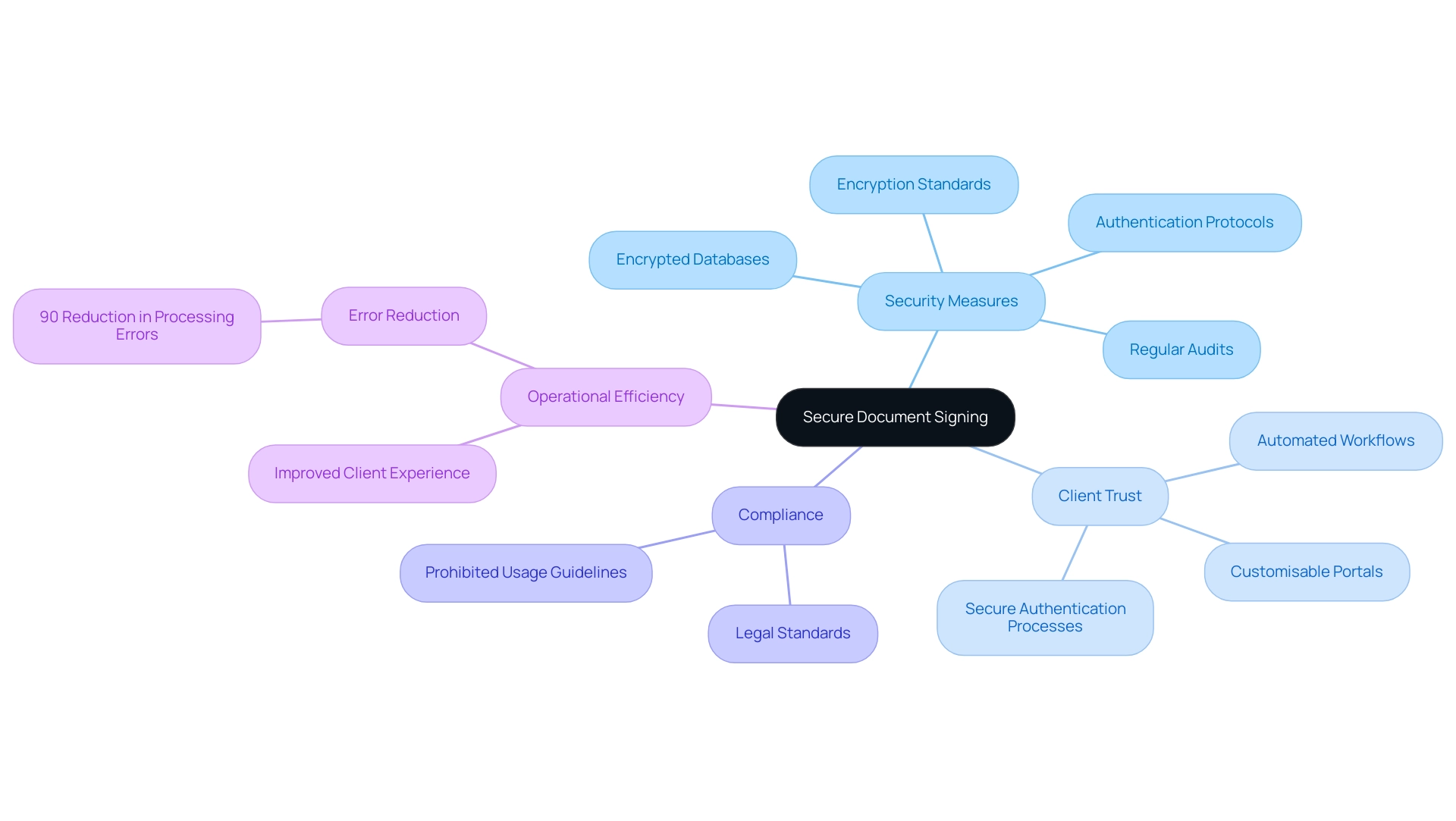

Understanding the Importance of Secure Document Signing

In today’s digital landscape, a document signer is essential for secure signing, particularly in the legal sector where sensitive information is frequently handled. This service ensures the integrity of electronic signatures provided by the document signer through advanced security measures, including top-level encryption standards used by financial institutions and robust authentication protocols. Implementing encrypted databases with controlled access is vital to prevent unauthorised access and mitigate the risk of data breaches, which are increasingly prevalent as 66% of staff resort to free file-sharing platforms.

Regular audits and compliance checks are critical in fortifying security, ensuring that all records signed by the document signer remain protected against tampering and fraud. The organisation’s commitment to compliance with legal standards further enhances the security framework, allowing document signers to confidently manage sensitive documents. A survey by MSB Docs highlights that companies utilising electronic signatures through a document signer can reduce processing errors by an impressive 90%, showcasing how these measures not only enhance security but also streamline operations. As we move into 2025, the latest trends in electronic signature security emphasise the importance of maintaining client trust.

Organisations that prioritise secure authentication processes, such as those offered by MyDocSafe, significantly bolster their reputation and legal standing as a trusted document signer. Expert opinions emphasise that secure file authentication is not merely a regulatory requirement but a cornerstone of client relationships in the legal field, particularly when involving a document signer. Staying informed about management trends is essential for enhancing efficiency, innovation, and growth in this field.

Furthermore, the effect of electronic authentication security measures on client trust is significant. By adopting best practices in secure signing, including customisable portals and automated workflows, firms can reassure clients that their sensitive information is handled with the utmost care by the document signer. This commitment to security is increasingly becoming a differentiator in a competitive market, where trust in the document signer is paramount.

As Josh Howarth observed, DocuSign’s $2.5 billion revenue in 2023, with $2.4 billion from subscription sales, reflects the increasing dependence on secure electronic signature solutions, particularly those utilised by document signers in the industry.

It is essential to follow prohibited usage guidelines to ensure the security and compliance of management. The system prohibits actions such as probing or scanning for vulnerabilities, unauthorised access to non-public areas, and the distribution of malware. By adhering to these guidelines, firms can further protect their sensitive information and maintain compliance with legal standards.

Additionally, MyDocSafe provides features for file sharing and access management, allowing users to control permissions and securely share files, which can include documents signed by a document signer, both internally and externally. This comprehensive approach to information security not only protects sensitive data but also improves the overall client experience.

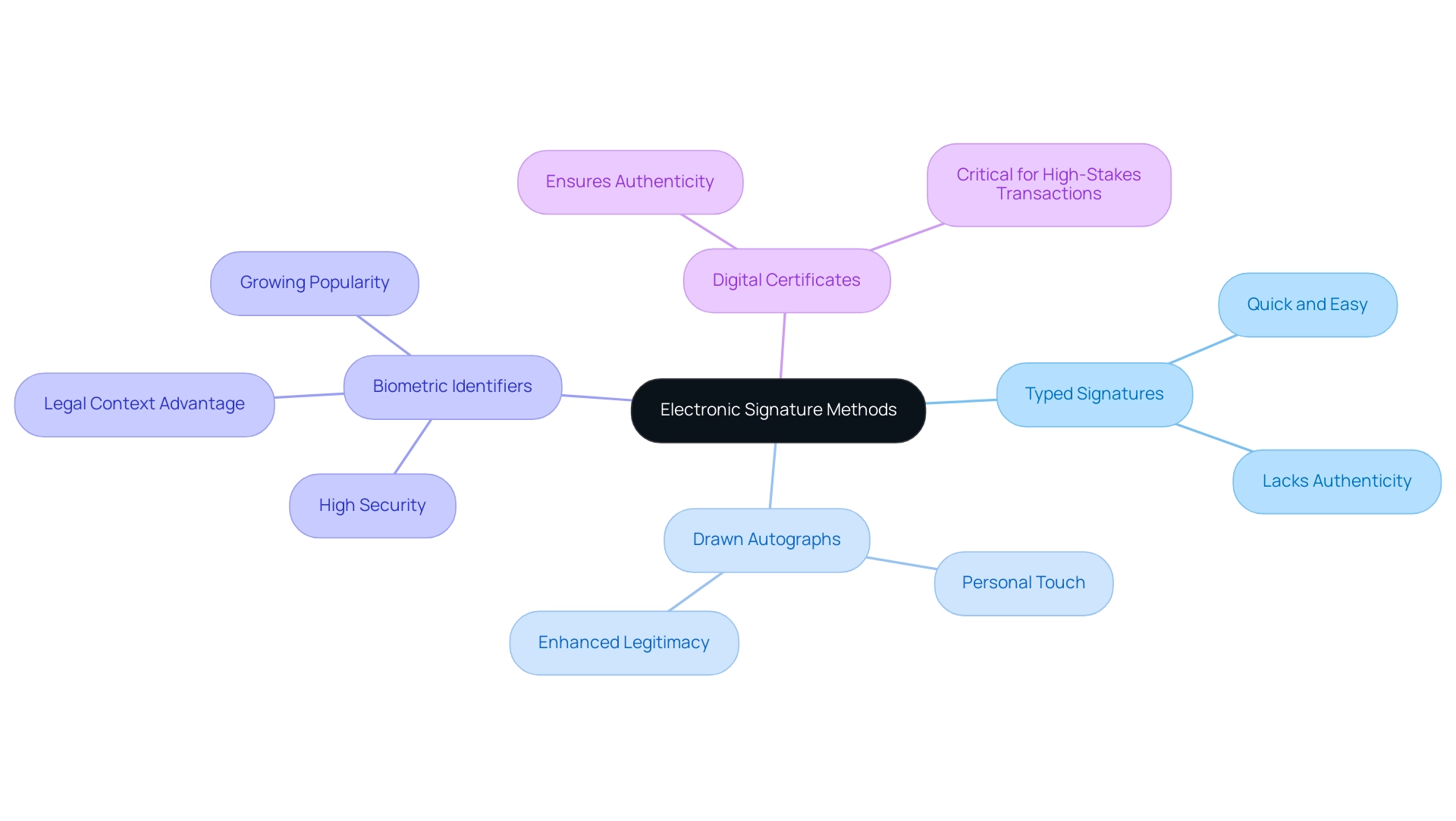

Exploring Different Methods for Electronic Signatures

In the realm of electronic authentication, various methods are available, each offering distinct advantages tailored to different organisational needs. The most common methods include:

- Typed Signatures: This straightforward approach allows users to type their names into designated fields. While it is quick and easy, it may lack the authenticity that some transactions require.

- Drawn Autographs: Users can create their autographs using a touchscreen or mouse, adding a personal touch that can enhance the perceived legitimacy of the document.

- Biometric Identifiers: Leveraging advanced technologies such as fingerprint or facial recognition, biometric identifiers provide a high level of security and verification. This method is particularly advantageous in legal contexts, where the integrity of the mark is paramount. Recent statistics suggest that biometric identifiers are gaining popularity, with a significant rise in acceptance among legal firms, reflecting a wider trend towards improved security measures in handling records. As Tara Kachaturoff noted, “Its ease of use for managing client contracts” highlights the practical benefits of adopting such technologies.

- Digital Certificates: Utilising cryptographic techniques, digital certificates ensure the authenticity and integrity of signed documents. This method is especially suitable for high-stakes transactions, where compliance and security are critical.

As organisations navigate the digital landscape, it is essential to evaluate their specific needs when selecting a document signer for electronic signing methods. Factors such as security, user experience, and the involvement of a document signer should guide this decision. Notably, a significant 45% of e-signature users report finding these features beneficial, underscoring the importance of choosing the right method to enhance operational efficiency and client trust.

Furthermore, as organisations increasingly adopt digital-first strategies—36% are planning to implement such solutions—embracing electronic signatures and facilitating the process for the document signer becomes vital for maintaining competitive advantage and ensuring customer satisfaction.

The application improves these processes with features such as customisable client portals, advanced encryption standards, and automated workflows, ensuring secure management and compliance across various sectors, including legal, medical, and real estate. Unlike other e-signature solutions such as PandaDoc, Zoho Sign, and DocuSign, this platform provides customised options that emphasise security and client engagement. We encourage legal firm partners to contact us for personalised support and to discover how our solutions can fulfil their specific signing requirements.

Best Practices for Maintaining Document Integrity and Authenticity

To uphold the integrity and authenticity of signed records, organisations must implement best practices that not only address current challenges but also enhance operational efficiency.

- Utilise Secure Platforms: Trustworthy e-signature solutions are essential. Organisations should select platforms that comply with industry regulations and offer advanced security features, such as top-level encryption and blockchain solutions. MyDocSafe exemplifies this with features like client onboarding and secure document management, ensuring sensitive information is safeguarded throughout the transaction process. As Mark Fairlie, a Senior Analyst, notes, a survey by Infosecurity Europe found that 69 percent of IT decision-makers expect to increase their cybersecurity budget year over year, with cloud security recognised as a top priority.

- Establish Comprehensive Audit Trails: Maintaining meticulous logs of all authorisation activities, including timestamps and IP addresses, is crucial. This practice not only provides a transparent record of the signing process but also enhances accountability and traceability, which are critical for compliance in legal environments.

- Regularly Update Security Protocols: Keeping encryption algorithms and security measures current is vital to defend against evolving threats. Organisations that prioritise security updates can significantly reduce vulnerabilities in their management systems. The challenges organisations face in maintaining data quality underscore the importance of investing in robust e-signature solutions like MyDocSafe, which offers a comprehensive security and compliance framework for document signers, including encryption standards and blockchain solutions.

- Educate and Train Users: Thorough training for employees on the significance of record integrity and the correct usage of e-signature tools is essential. This reduces the risk of human error and promotes a culture of security awareness within the organisation, ensuring that all users understand the prohibited usage guidelines to maintain compliance.

By adhering to these best practices, organisations can significantly enhance the reliability of their signed materials, effectively mitigating risks related to fraud and data breaches. Research indicates that automating the signing process through digital signatures can improve turnaround time by over 28%, benefiting document signers by leading to quicker deal closures and increased efficiency in contract management. Furthermore, organisations like Vertikal have reported substantial cost savings, saving £20,000 annually and reducing processing time by 40% after utilising secure platforms like MyDocSafe, highlighting the importance of a reliable document signer in investing in robust e-signature solutions.

Additionally, the integration of the viaSocket feature enhances the management process, providing seamless connectivity and improved workflow efficiency.

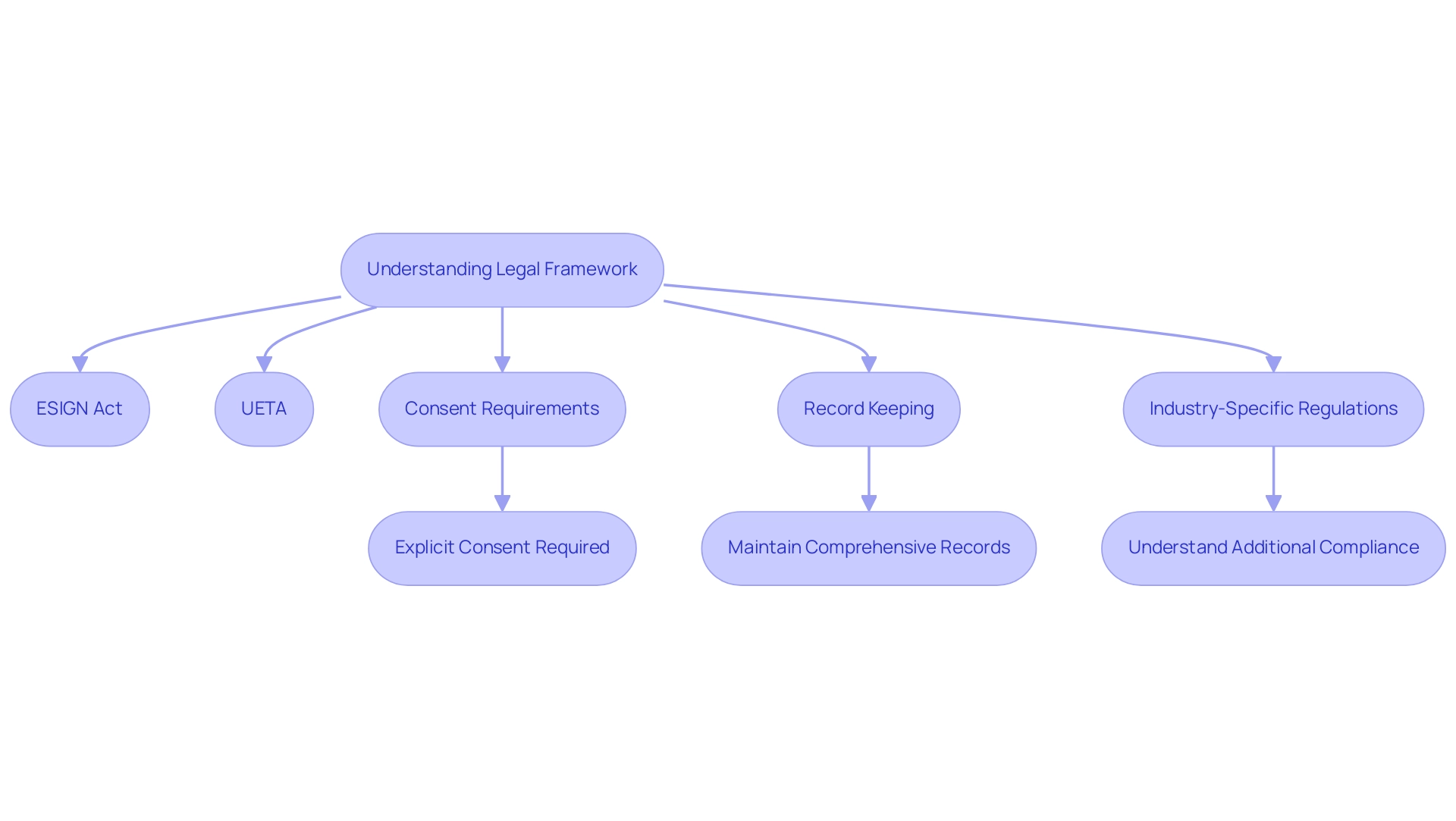

Navigating Legal Compliance in Document Signing

Navigating legal compliance in document execution necessitates a comprehensive understanding of the regulations governing electronic approvals by the document signer. Key considerations include:

- Familiarity with the ESIGN Act and UETA: These pivotal laws affirm the legal validity of electronic marks in the U.K., ensuring they carry the same legal weight as traditional marks. As of 2025, legal firms must be well-versed in these regulations to effectively implement electronic signing processes.

- Consent and Intent: It is essential that all parties involved give explicit consent to use electronic methods, clearly demonstrating their intent to sign digitally. This mutual agreement is foundational to the enforceability of e-signatures.

- Record Keeping: Organisations are required to maintain comprehensive records of signed documents, including audit trails that can substantiate compliance and assist in dispute resolution. This practice not only safeguards against legal challenges but also enhances the transparency of the document signer.

- Industry-Specific Regulations: Various sectors, particularly finance and healthcare, impose additional compliance requirements that organisations must navigate. Understanding these nuances is essential for legal firms to ensure adherence to all applicable laws.

The platform emphasises a comprehensive security and compliance framework, incorporating advanced encryption standards and blockchain solutions to enhance the integrity of electronic documents for every document signer. This framework ensures that a document signer can use electronic signatures that are not only legally valid but also secure, addressing the growing concerns around data protection and compliance with regulations such as GDPR. Additionally, MyDocSafe’s terms of service and acceptable use policy provide clear guidelines for users, reinforcing the importance of compliance in electronic signing processes.

Recent statistics indicate that 36% of companies are planning to expand their digital solutions, while 35% are set to implement new options, highlighting a significant shift towards digital-first strategies. This trend underscores the necessity for legal firms to adapt to evolving compliance landscapes. Notably, the Middle East & Africa has the 5th highest market share in electronic signatures, accounting for 3%, which reflects the growing global interest in secure digital solutions.

Moreover, the biometric system market, which plays a crucial role in verifying the authenticity of documents signed by a document signer electronically, was valued at $36.6 million in 2020 and is projected to reach $68.6 billion by 2025. This growth reflects the increasing importance of secure electronic signing processes.

Real-world examples demonstrate the effect of the ESIGN Act on electronic mark adoption. Organisations that have embraced these regulations report improved productivity and enhanced customer experiences, with many recognising the imperative to adapt to remain competitive. As Saisuman Revankar observes, “Middle East & Africa has the 5th highest market share with 3%,” highlighting the region’s importance in the electronic document landscape.

As the landscape of electronic signatures continues to evolve, legal compliance remains a cornerstone for building credibility and trust in the marketplace.

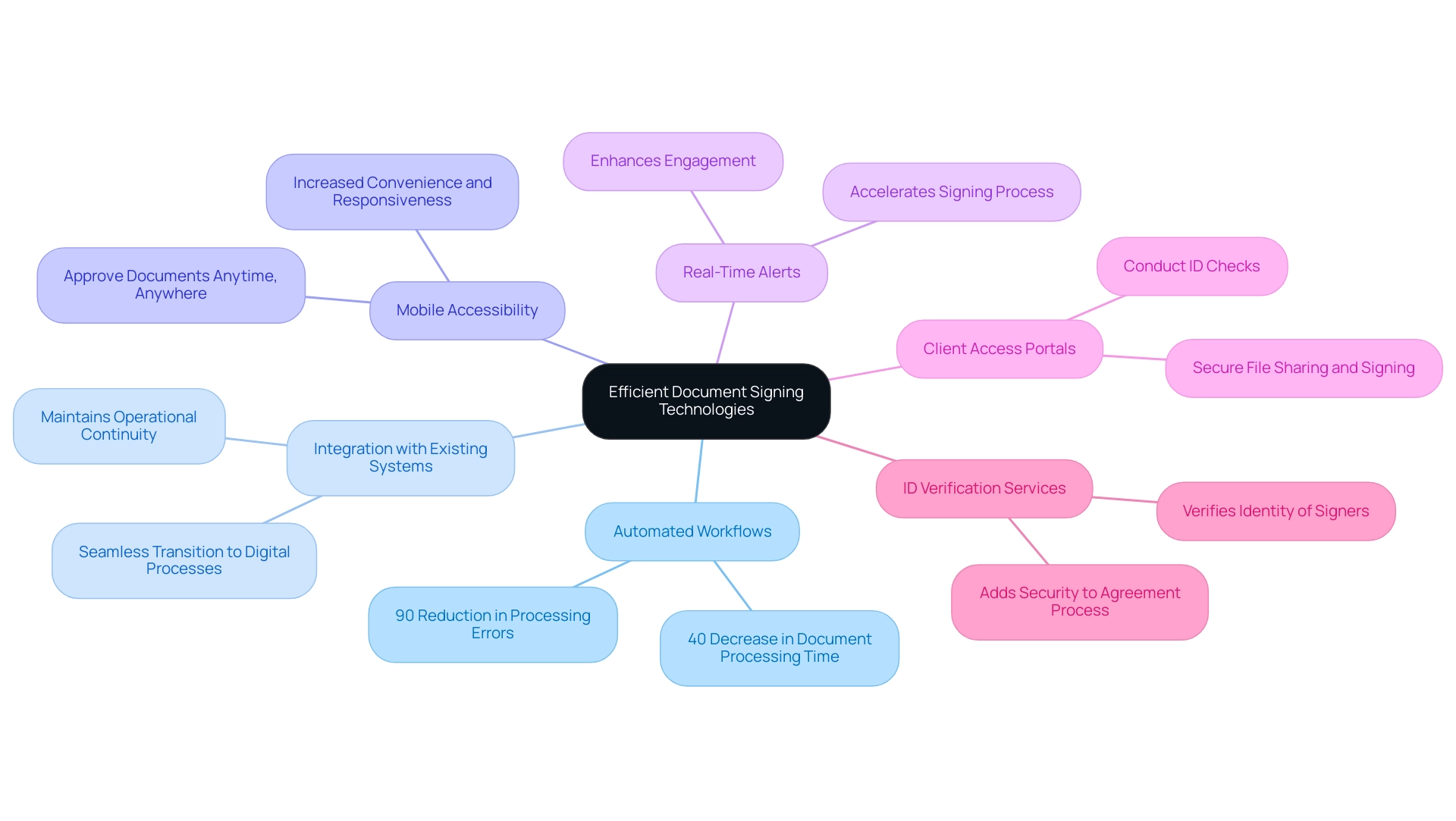

Leveraging Technology for Efficient Document Signing

Technology is revolutionising the efficiency of document signer processes, empowering organisations to streamline operations and enhance client interactions. This service provides a suite of features designed to optimise these processes, including:

- Automated Workflows: Implementing automated workflows within this platform can drastically reduce the time needed to prepare, send, and sign documents. This efficiency not only accelerates transaction completion but also minimises the risk of errors, with electronic signatures reducing processing errors by up to 90%. By automating proposals and onboarding workflows, the platform significantly enhances the overall client experience.

- Integration with Existing Systems: Choosing e-signature solutions that seamlessly connect with current management systems is crucial. The system’s capabilities allow for smooth integration for the document signer, maintaining operational continuity and reducing the likelihood of disruptions, thus facilitating a smoother transition to digital processes.

- Mobile Accessibility: This service enables users with mobile-friendly options, allowing documents to be approved anytime and anywhere. This significant increase in convenience and responsiveness is essential in today’s fast-paced business environment, where timely decision-making is critical.

- Real-Time Alerts: Utilising the platform’s real-time notifications to inform signers when files are ready for review can accelerate the signing process. This proactive communication enhances engagement and ensures that materials are processed without unnecessary delays.

- Client Access Portals: The service offers customisable client access portals that enable organisations to securely share and sign files, conduct ID checks, and request essential materials and data, enhancing the overall client experience.

- ID Verification Services: The inclusion of ID verification services within MyDocSafe ensures that organisations can verify the identity of each document signer, adding an extra layer of security to the agreement process.

The adoption of digital-first strategies is on the rise, with 57% of organisations already implementing such approaches and an additional 36% planning to do so. This trend highlights the significance of utilising technology to enhance efficiency in agreements. For instance, companies have reported significant savings and reduced processing times after adopting automated workflows.

Moreover, the number of businesses using e-signatures, which often require a document signer, has increased by 50% since the start of the COVID-19 pandemic, underscoring the growing trend of e-signature adoption. Furthermore, 45% of e-signature users consider features such as field validation and real-time signature tracking beneficial, further emphasising the advantages of these solutions.

By adopting these technological advancements through this platform, organisations can establish a more efficient and user-friendly experience, ultimately resulting in increased client satisfaction and enhanced operational performance.

We invite you to share your requirements. Contact a member of our team today at (863) 270 9779 (5 am – noon EDT) to discover how our service can improve your file management and approval processes.

Enhancing User Experience in Document Signing

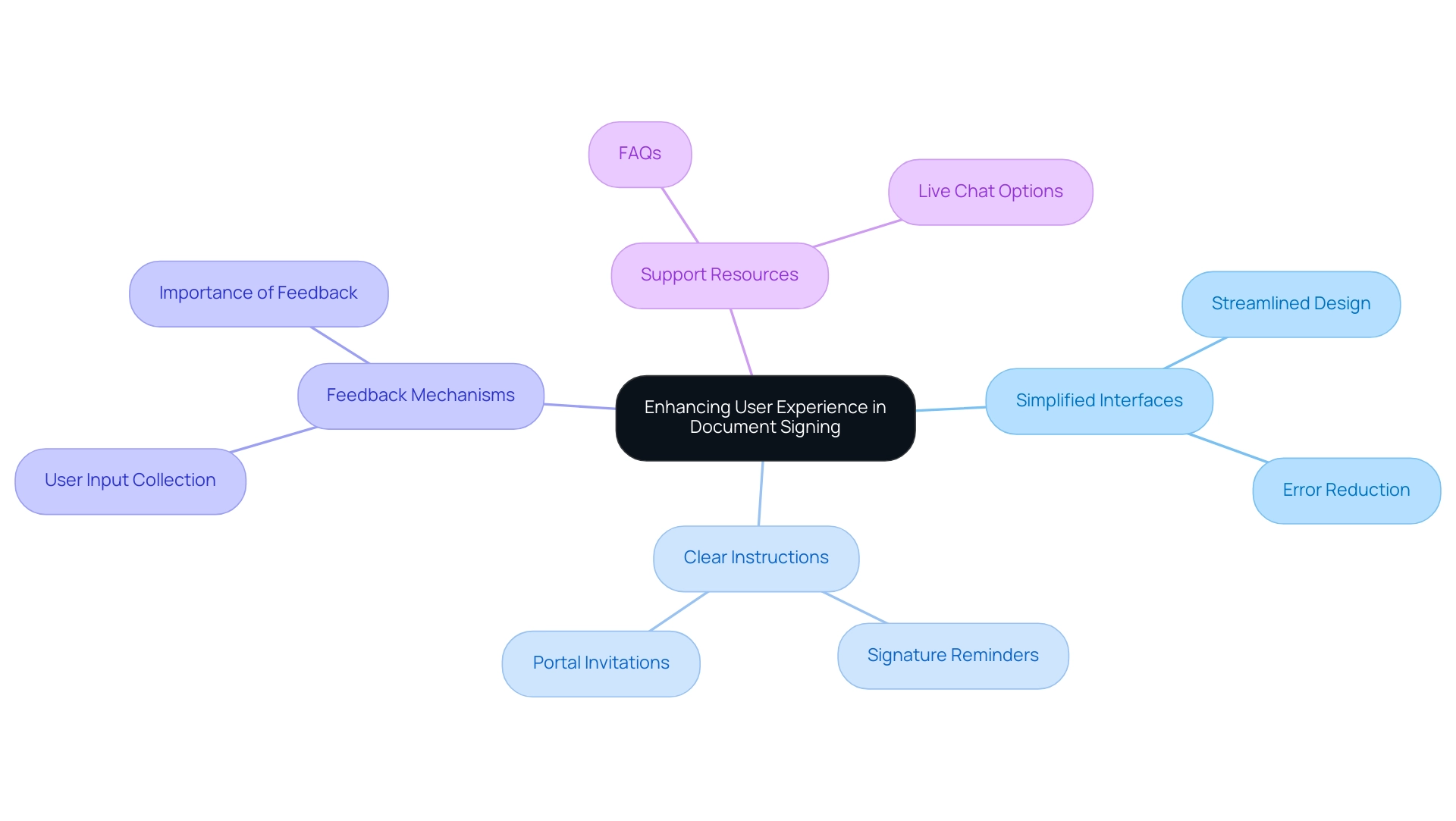

Improving user experience in file approval is essential for establishing a streamlined and user-friendly process for clients. Key strategies to achieve this include:

- Simplified Interfaces: Developing user-friendly interfaces that minimise complexity is crucial. MyDocSafe provides a streamlined design that guides document signers through the signing process step-by-step, significantly reducing the likelihood of errors and frustration. This intuitive platform enhances client engagement and ensures secure file management, featuring options like password protection and SMS codes for added security.

- Providing clear and concise instructions on how to electronically sign documents is vital for the document signer. The application enhances clarity by offering reminders for signature requests and invitations to portals, ensuring users can complete their tasks efficiently without confusion.

- Feedback Mechanisms: Implementing feedback mechanisms allows organisations to gather user input on the experience. This feedback is invaluable for continuous improvement, enabling businesses to adapt and enhance their processes based on real user experiences. Notably, 91% of unhappy clients who do not complain simply disappear without providing feedback, highlighting the critical need for effective feedback channels.

- Support Resources: Offering readily accessible support resources, such as FAQs and live chat options, empowers users to resolve any questions or issues they may encounter quickly. The platform’s commitment to customer support not only enhances user satisfaction but also builds trust.

Focusing on user experience in agreement execution for the document signer can result in enhanced client satisfaction, promote repeat business, and cultivate long-term relationships. Research indicates that a well-designed user experience can significantly impact completion rates, with simplified interfaces contributing to higher engagement and efficiency. In fact, organisations that invest in user-friendly e-signature solutions from a document signer, such as those available from other providers, often see a marked improvement in client retention and overall satisfaction.

As Annemarie Bufe, Content Manager, states, “Investing in UX design is essential for companies because it can have a significant impact on the success of their products.” Furthermore, the integration of AI in enhancing customer relationships demonstrates how technology can personalise experiences and improve user engagement. By concentrating on these strategies, legal firms can guarantee that their signing processes are not only secure but also efficient and user-centric.

To experience these benefits firsthand, consider starting a 30-day free trial with MyDocSafe, where you can explore features like bulk sending and customisable workflows that enhance your document management processes.

Conclusion

Secure document signing has emerged as an essential component in today’s digital landscape, particularly within the legal sector, where confidentiality and integrity are paramount. This article has highlighted the multifaceted advantages of advanced electronic signature solutions, such as those provided by MyDocSafe. By implementing robust security measures and compliance frameworks, and integrating innovative technologies and best practices, organizations are better equipped to protect sensitive information while streamlining operations.

Understanding the various methods of electronic signatures and adhering to industry-specific regulations is critical for maintaining legal compliance and fostering client trust. Organizations that prioritize secure document signing not only mitigate risks but also enhance their operational efficiency and client relationships. The statistics presented underscore the tangible benefits of adopting these technologies, revealing significant reductions in processing errors and improved turnaround times.

As organizations navigate an increasingly digital-first environment, the commitment to secure document management will continue to be a key differentiator in a competitive market. By leveraging advanced features and prioritizing user experience, firms can ensure that their signing processes are efficient, secure, and user-friendly. Ultimately, embracing these practices is not merely about compliance; it’s about building trust and paving the way for future growth in an evolving landscape.