Overview

The article articulates best practices for document signing, underscoring the transition from traditional signatures to digital methods that significantly enhance efficiency and regulatory compliance within legal practices. It begins by acknowledging the challenges legal firms encounter in managing signatures, paving the way for a discussion on innovative solutions.

By detailing the advantages of platforms like MyDocSafe, it illustrates how these tools:

- Streamline the signing process

- Bolster security through advanced features

- Comply with legal standards such as the ESIGN Act and UETA

These elements collectively contribute to improved operational effectiveness and reduced costs for organizations, making a compelling case for their adoption.

Introduction

In the evolving landscape of legal documentation, the methods of signing documents are undergoing a significant transformation. As traditional wet signatures give way to the efficiency and security of electronic signatures, legal professionals face both opportunities and challenges. Platforms like MyDocSafe are at the forefront of this change, enabling firms to streamline their processes while embracing a digital-first approach that enhances compliance and client satisfaction.

This article explores the various aspects of document signing methods, examining the legal implications, best practices for security, and the critical role of training in effectively harnessing these technologies. As the legal sector adapts to this shift, understanding the nuances of electronic signatures becomes paramount for achieving success in a rapidly changing environment.

Understanding Document Signing Methods: A Legal Perspective

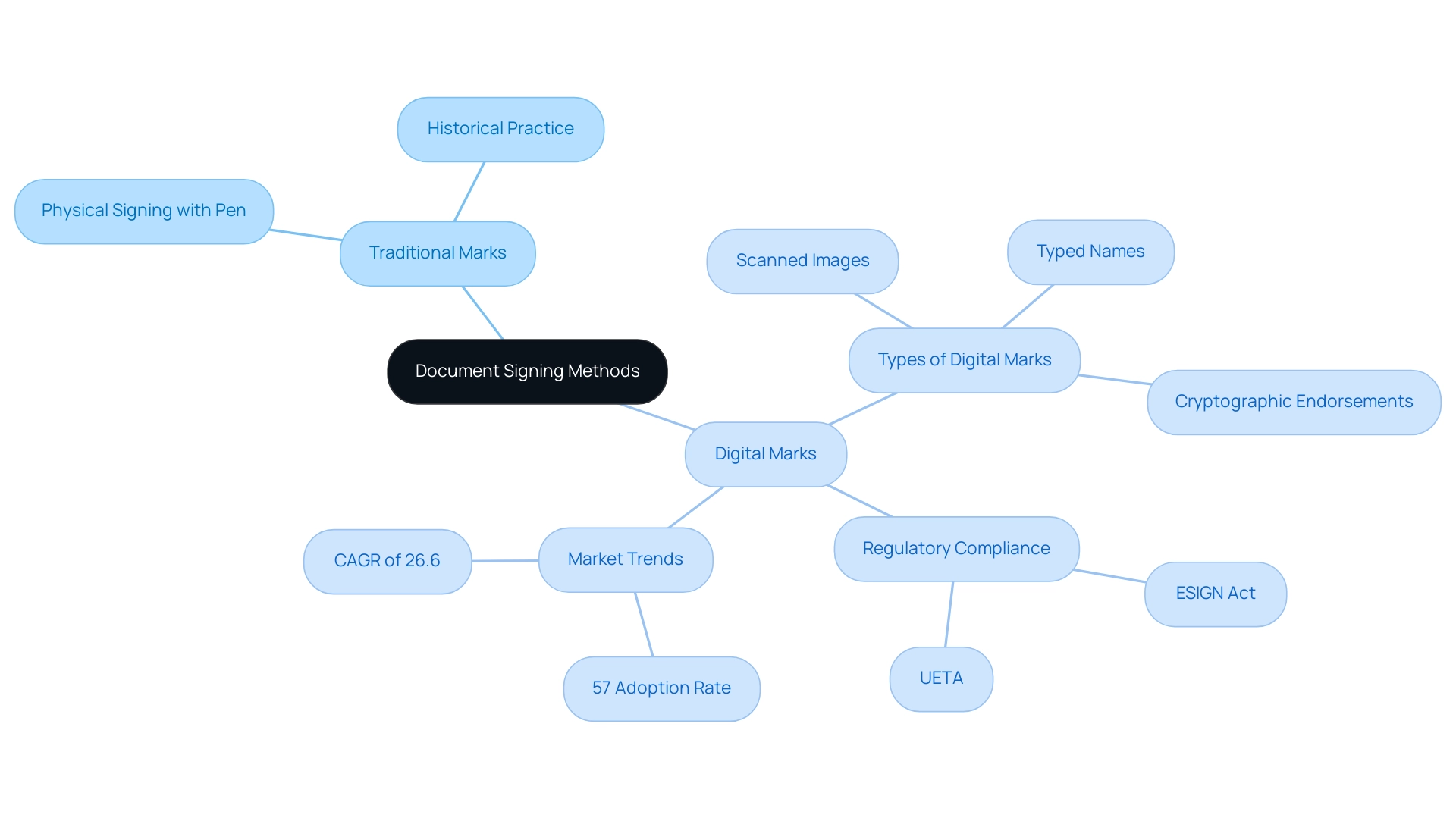

Documents signing techniques can be categorised into two primary types: traditional (wet) marks and digital marks. Traditional marks, which involve physically signing a document with a pen, have been the standard practise for centuries. However, the rise of technology has prompted a significant shift towards document signing and digital approvals, increasingly recognised for their efficiency and security, particularly through comprehensive solutions like those provided by MyDocSafe.

MyDocSafe presents a robust platform for document signing and digital approvals, encompassing various formats such as scanned images of handwritten marks, typed names, and advanced digital endorsements that utilise cryptographic methods to confirm authenticity. Beginning in 2025, the regulatory landscape indicates a growing acceptance of digital endorsements, particularly in document signing, with a notable increase in their application across judicial practises. Recent statistics reveal that organisations employing digital approvals can reduce administrative expenses by 55-78%, while simultaneously eliminating storage costs, thereby contributing to environmental sustainability.

Professionals in the field must possess a thorough understanding of the nuances of document signing methods, especially concerning their standing under the ESIGN Act and the Uniform Electronic Transactions Act (UETA). These regulations validate the legitimacy of digital marks in document signing, provided they meet specific criteria, thus ensuring compliance with statutory standards. MyDocSafe’s solutions, featuring elements such as Kunden-Onboarding and Virtuelle Datenräume, are designed to facilitate compliance by streamlining the process for firms to navigate the complexities of digital documentation and document signing.

Indeed, a recent study indicated that 57% of organisations have embraced a digital-first approach, with an additional 36% intending to do so, highlighting the shift towards document signing and digital approvals in legal contexts. This trend is further corroborated by projections from Prescient & Strategic Intelligence, which anticipate that the global eSignature market will exhibit a compound annual growth rate (CAGR) of 26.6% from 2021 to 2030.

The choice between digital and handwritten marks often hinges on the type of paper, intent, and preferences of the signers involved in document signing. For instance, while digital marks are generally suitable for most contracts, certain documents may still necessitate handwritten marks due to regulatory requirements or the nature of the transaction. Understanding these distinctions is crucial for professionals advising clients on the most appropriate document signing method.

Furthermore, professional insights underscore the advantages of document signing and digital approvals in enhancing regulatory compliance and streamlining procedures. The case study titled ‘Adoption of Digital-First Strategies’ illustrates that organisations are increasingly recognising the strategic imperative of adopting document signing and digital approvals to maintain competitiveness in a dynamic environment. MyDocSafe’s features, including secure file management, client onboarding, and adherence to terms of service and acceptable use policies, further empower firms to effectively leverage these advantages.

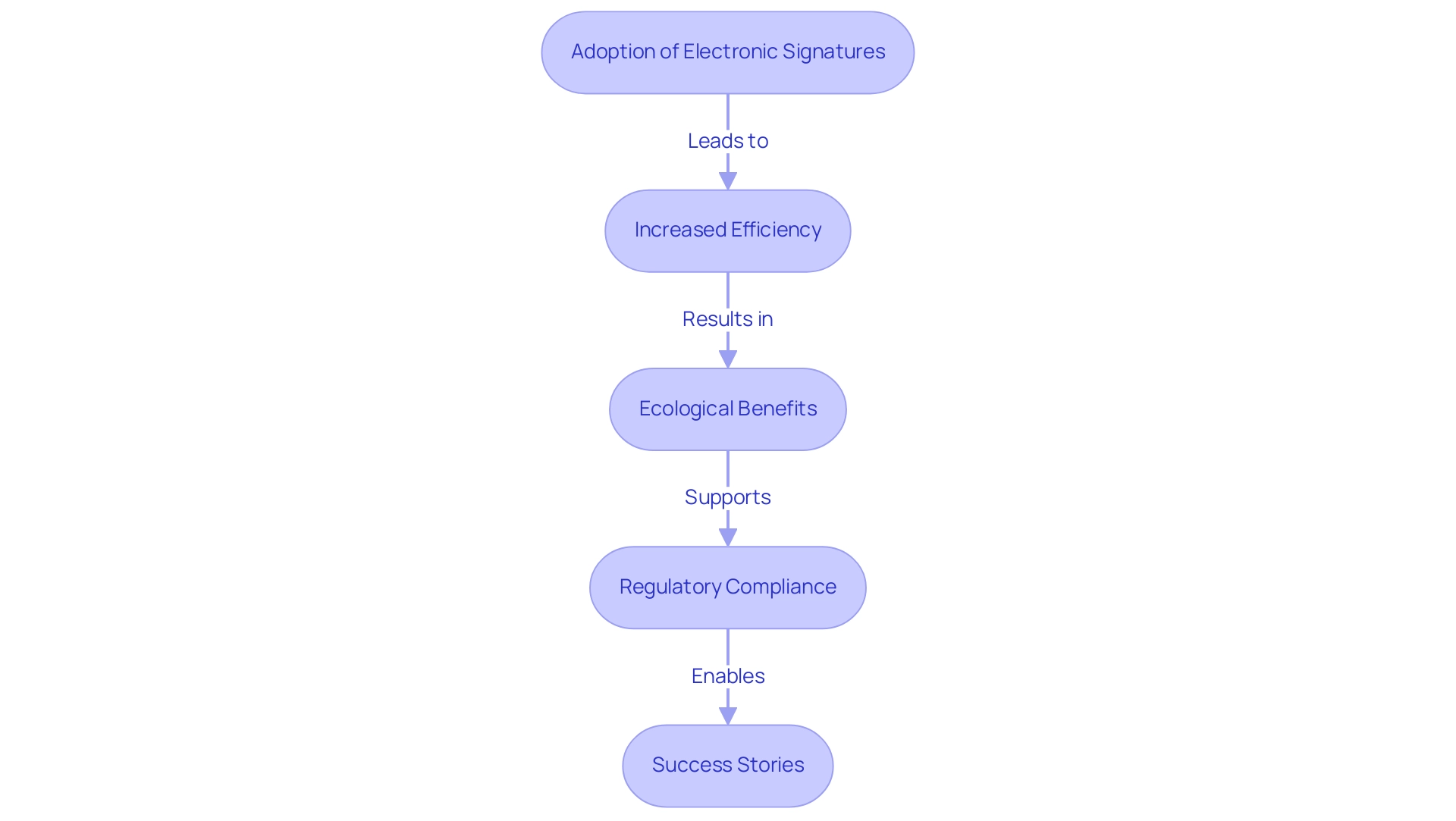

The Rise of Electronic Signatures in Legal Practices

The adoption of electronic signatures for document signing within law practices has experienced remarkable growth, particularly in 2025, as firms increasingly seek efficiency and adapt to the demand for remote services. This technological shift has transformed the document signing process, allowing files to be executed swiftly and securely from virtually any location. As a result, professionals in the field are witnessing a significant reduction in document turnaround times, especially in document signing, with many firms reporting improvements of up to 50% in processing speed.

Furthermore, the ecological advantages of digital approvals cannot be ignored. By minimising reliance on paper, practices contribute to sustainability efforts while also streamlining their operations. The incorporation of digital approvals not only improves client satisfaction through faster service provision but also aligns with the increasing focus on environmentally friendly practices in the industry.

To ensure the integrity and legitimacy of digital endorsements, it is essential for attorneys to utilise Trust Service Providers (TSPs) that are sanctioned by government bodies and comply with strict guidelines. This compliance not only enhances the reliability of digital markings but also reduces risks linked to identity theft, which impacted around 1.4 million people in 2020, as per the Federal Trade Commission. The necessity of using approved TSPs for regulatory compliance is further illustrated by the context of Trust Service Providers in document signing, emphasising their role in enhancing trust and compliance capabilities.

Success narratives from law firms that have adopted digital methods demonstrate their transformative effect. For instance, firms have reported enhanced operational efficiency and improved client engagement, with testimonials highlighting the ease of managing client contracts and document signing. As Tara Kachaturoff noted, “Its ease of use for managing client contracts” exemplifies the user-friendly experience that electronic signatures provide.

Platforms like MyDocSafe further enhance this experience by offering customisable client portals that allow firms to securely share and facilitate document signing, run ID checks, and request necessary data. Additionally, features such as password protection, SMS codes, and bulk sending streamline processes from onboarding to payment setup, ensuring that professionals can engage prospects and close deals faster. As the adoption of document signing through electronic signatures continues to rise, professionals in the field must leverage this technology to enhance their workflows, ensuring they remain competitive in an evolving landscape.

We would love to hear about your requirements. Speak with a member of our team today at (863) 270 9779 (5 am – noon EDT) to discover how MyDocSafe can assist your practice.

Ensuring Security in Document Signing: Best Practices

To ensure robust security in document signing agreements, professionals in the field must adopt a series of best practices tailored to the unique challenges they face. First and foremost, selecting a trustworthy digital signing platform, such as MyDocSafe, which complies with industry standards for data protection, is essential. MyDocSafe’s new viaSocket integration not only enhances security but also ensures compliance with regulations such as GDPR, providing advanced e-signature solutions with verifiable security features.

The viaSocket integration enables seamless management of files and enhances the user experience by automating compliance and onboarding processes, making it an indispensable tool for legal firms.

Implementing multi-factor authentication (MFA) is another critical step. MFA significantly reduces the risk of unauthorized access by requiring multiple forms of verification from signers. This practice is increasingly recognised as a fundamental component of electronic signature security, especially in light of rising cyber threats.

In fact, statistics indicate that organisations employing MFA can mitigate the risk of security breaches by up to 99%. Legal firms that have successfully integrated MFA into their signing processes report enhanced confidence in their security measures, further supported by MyDocSafe’s comprehensive security framework.

Maintaining detailed audit trails is vital for transparency and accountability. MyDocSafe provides robust logging features that capture every action taken on a file, offering a clear record that can be invaluable in case of disputes or audits. Regularly updating security protocols is equally important; firms should stay informed about the latest threats and adapt their strategies accordingly.

Training personnel to identify phishing attempts and other security threats is a proactive step that can greatly decrease vulnerabilities.

The significance of these practices is underscored by recent statistics on security breaches in signing. In 2025, the cost of a data breach is projected to reach an average of £1.81 million, with lost business costs being the most significant contributor. This emphasises the necessity for law firms to prioritise security in their document signing procedures.

As noted in the Data Breach Investigations Report by Verizon, the majority of cyberattacks are triggered by various external and internal actors, highlighting the need for robust security measures.

Real-world examples further illustrate the consequences of security failures. The Revolut data breach, which exposed personal information of tens of thousands of clients, raised significant concerns about the security of sensitive information in digital banking. Furthermore, the Red Cross’s data breach impacted over 515,000 at-risk individuals, underscoring the extent of possible weaknesses and the importance of strong security measures in signing agreements.

By adopting these best practices, including the use of MyDocSafe’s customisable workflows, password managers, and thorough employee training, professionals can enhance document signing, protect sensitive information, boost client trust, and maintain their reputations in an ever-evolving digital environment. Moreover, MyDocSafe’s dedication to encryption standards and blockchain solutions guarantees that all files are secured with the utmost level of protection, reinforcing the platform’s reliability in judicial contexts.

Navigating Compliance: Legal Standards for Document Signing

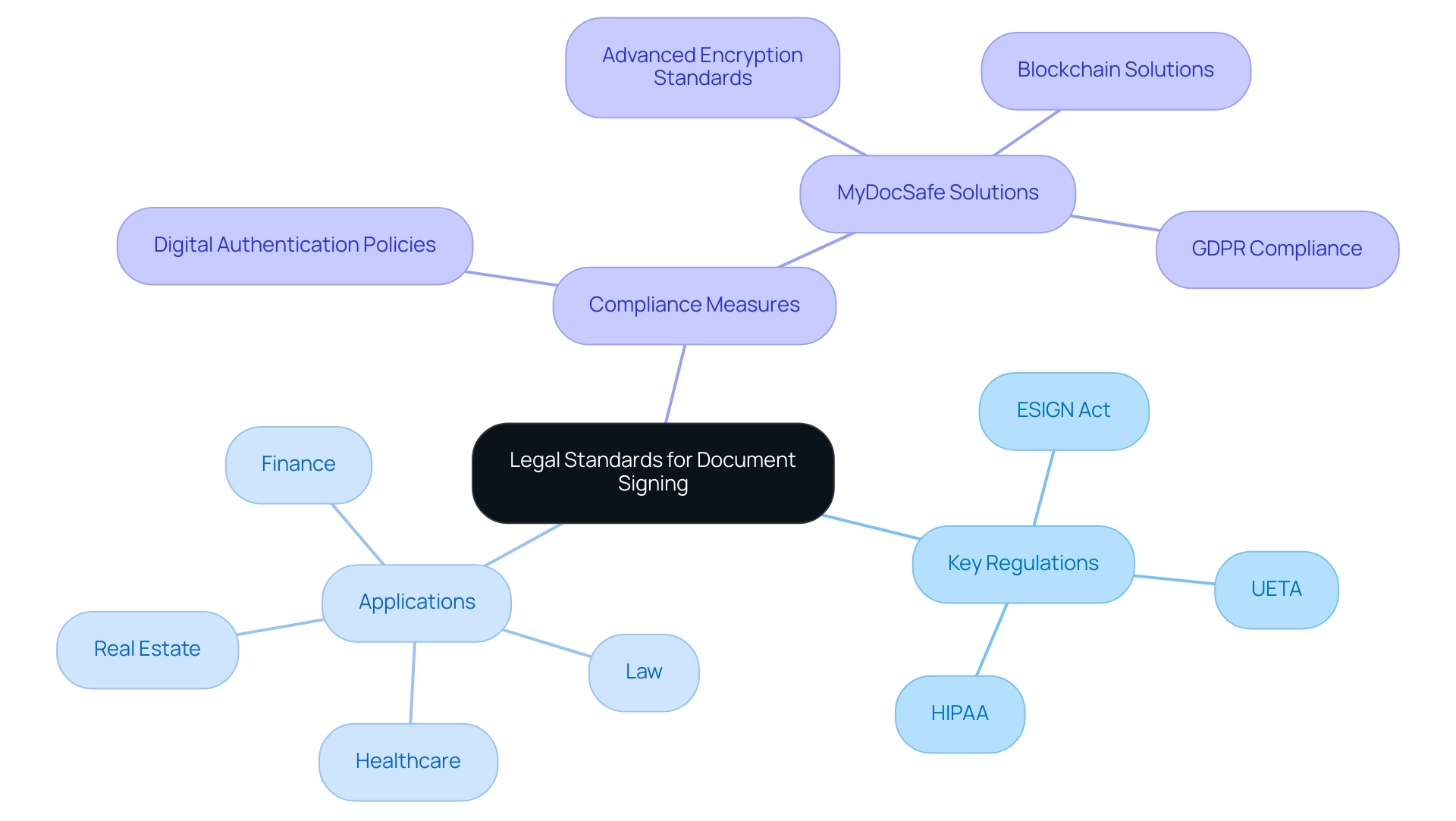

Adhering to regulatory standards is essential in the field of document endorsement, particularly for attorneys navigating the complexities of document signing. The ESIGN Act and UETA establish that digital marks hold the same judicial significance as traditional signatures, a notable advancement that streamlines procedures and enhances efficiency. As we approach 2025, it is imperative for law firms to remain vigilant regarding specific regulations relevant to their practice areas.

For instance, healthcare-related records must comply with HIPAA regulations, which impose stringent requirements for managing sensitive patient information.

To ensure compliance, law firms should implement robust policies regarding digital authentication. This necessitates obtaining clear approval from all parties involved in the signing process, thereby safeguarding the integrity of contracts. Recent statistics indicate that a significant number of law firms remain unaware of HIPAA regulations concerning digital marks, highlighting a critical area for improvement in legal practices.

Moreover, adherence to the ESIGN Act and UETA requires that digital marks meet specific criteria, such as demonstrating intent to sign and ensuring that the signer has access to the completed document. The Information Technology Act 2000 lays the regulatory groundwork for eSignatures in India, further underscoring the global relevance of these standards.

MyDocSafe emerges as a comprehensive solution in this domain, offering robust file management features and document signing capabilities that ensure secure client interactions and compliance. With advanced encryption standards, encryption key management services, and blockchain solutions, MyDocSafe guarantees the validity of electronic signatures, addressing the critical need for security in document handling. Additionally, MyDocSafe’s terms of service, acceptable use policy, and GDPR guide further bolster its compliance framework, ensuring that all aspects of document management are thoroughly addressed.

Typical applications for eSignatures include patient consent forms in healthcare, contracts in law, loan applications in finance, and property sales agreements in real estate. As professionals in the field adapt to the evolving landscape of electronic signatures, understanding and implementing compliance standards will be paramount for success in 2025 and beyond. The evolution of eSignature solutions, such as those offered by MyDocSafe, simplifies the document signing process and accelerates workflows, maximizing convenience and productivity, thus becoming an invaluable asset for legal practices.

Leveraging Automation for Efficient Document Signing

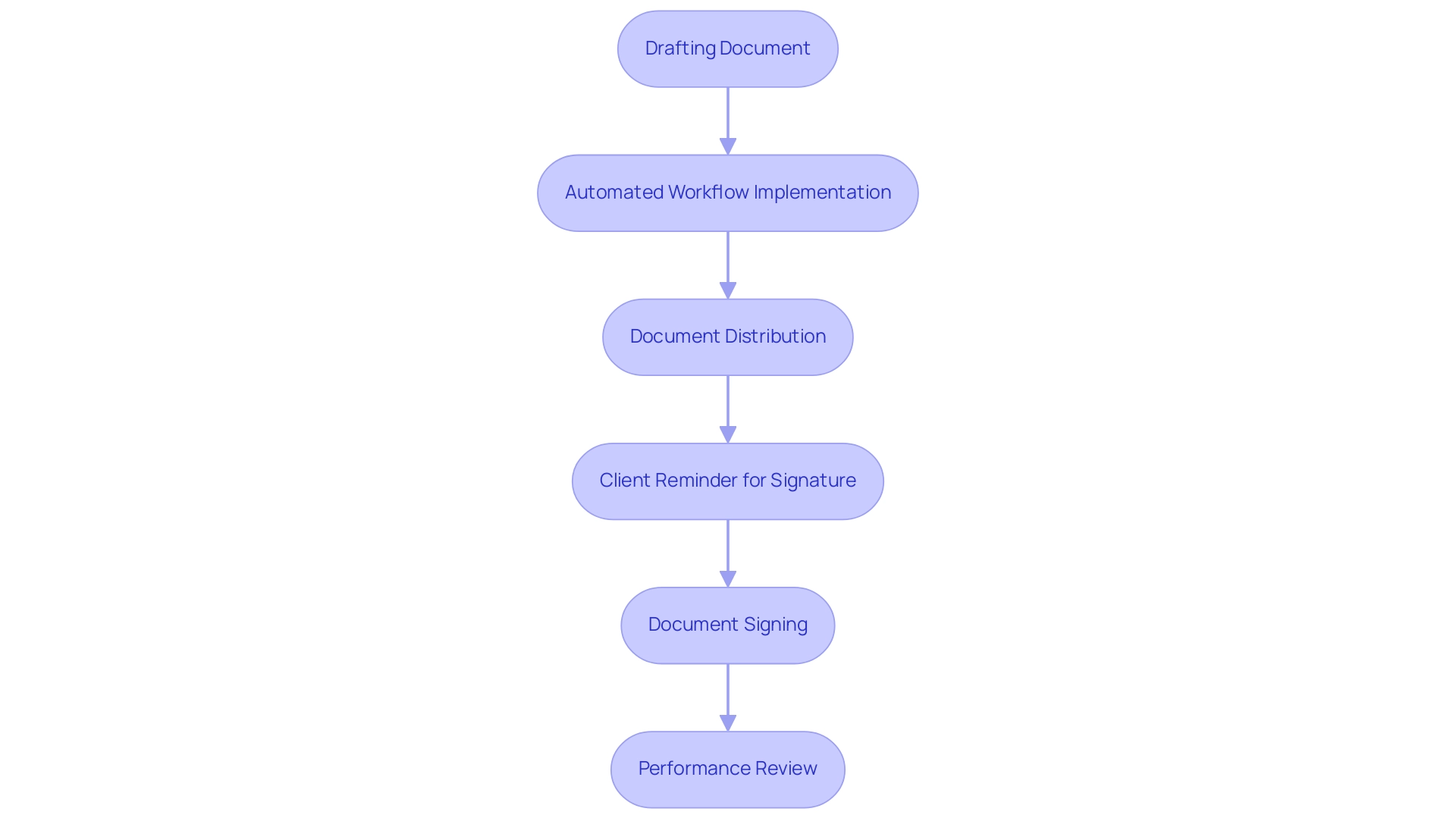

Automation is essential in transforming the efficiency of document signing processes within legal firms. By implementing automated workflows, firms can significantly enhance the creation, distribution, and signing of documents. For instance, MyDocSafe’s comprehensive management software, which incorporates electronic signature capabilities, facilitates a seamless transition from drafting to signing, ensuring that all steps are interconnected and efficient.

Automated reminders can be programmed within MyDocSafe to prompt clients to sign documents, effectively reducing delays and improving turnaround times. This proactive approach not only accelerates the signing process but also minimises the administrative burdens typically associated with manual follow-ups. In fact, organisations utilising intelligent processing platforms have reported remarkable efficiency gains, with some firms saving up to £20,000 annually and reducing processing time by 40%.

This aligns with the trend that nearly 80% of firms plan to leverage generative AI within the next five years, underscoring the growing significance of automation in the industry.

The incorporation of automation in document signing procedures streamlines operations and boosts overall productivity. Legal professionals can focus more on strategic tasks rather than getting bogged down by administrative duties. As highlighted by industry expert Tara Kachaturoff, “The ease of use for managing client agreements is a crucial aspect that should be emphasised during training, ensuring that staff are not only trained but also confident in utilising the new systems.”

Moreover, MyDocSafe’s features, such as secure client access portals, encrypted email, ID verification services, and Virtual Data Rooms, further enhance file security and e-signature management. Case studies demonstrate that regular performance reviews and user feedback are vital for refining automated agreement oversight systems. By adopting proactive strategies for monitoring and enhancement, law firms can ensure their automation processes remain effective and aligned with evolving business goals.

This commitment to ongoing enhancement enables companies to utilise MyDocSafe’s automation as a crucial factor in efficiency and client satisfaction in their document signing workflows.

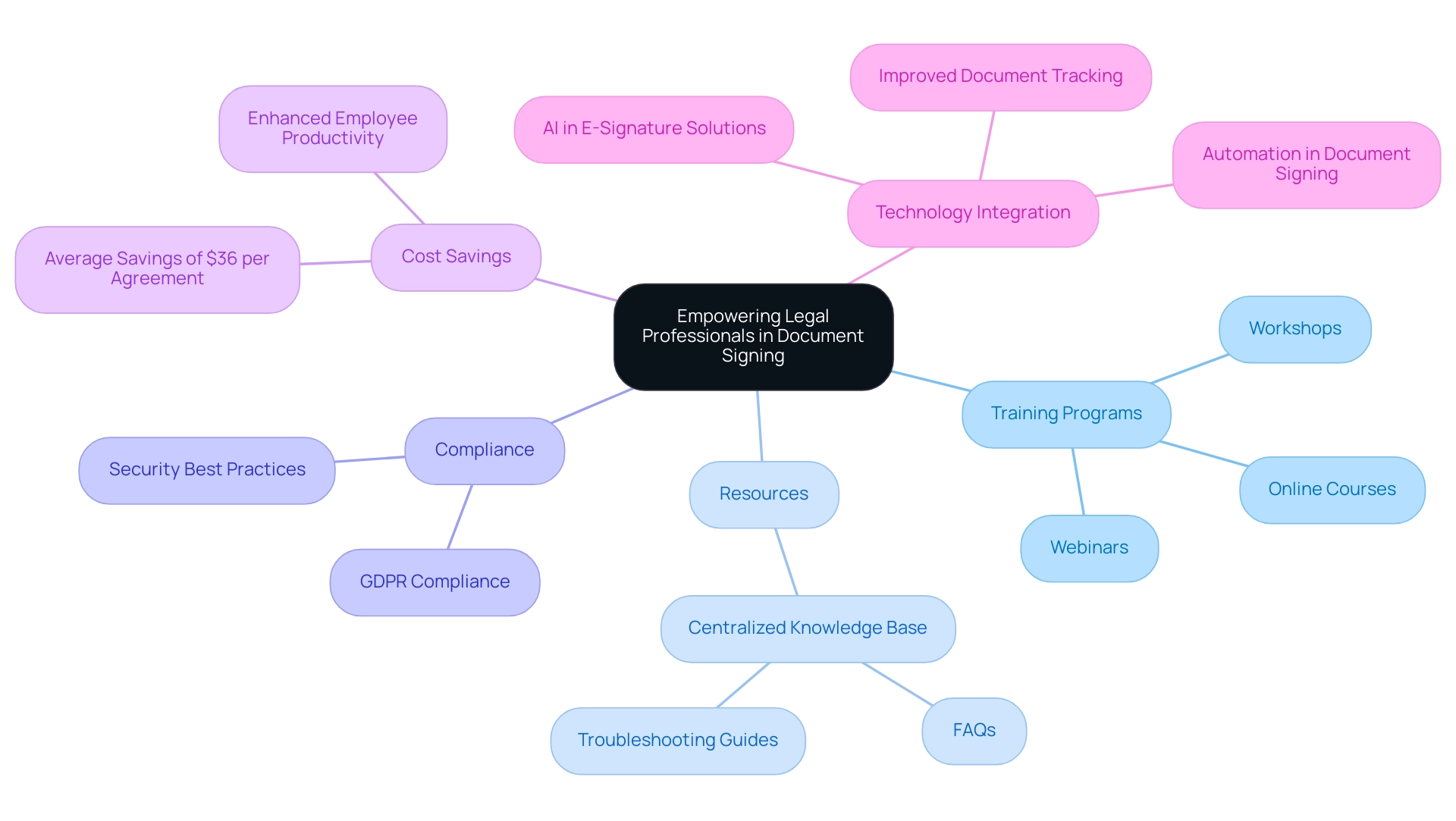

Training and Resources: Empowering Legal Professionals in Document Signing

To empower professionals in contract signing, it is essential for firms to invest in comprehensive training programmes that encompass the use of digital signing tools, compliance requirements, and security best practices. Such training not only elevates staff capabilities but also guarantees adherence to evolving regulations. Resources like webinars, workshops, and online courses offer valuable insights into the latest trends and technologies in information management, particularly as artificial intelligence and automation increasingly refine signing processes.

Establishing a centralised knowledge base that includes FAQs and troubleshooting guides can further support staff in overcoming common challenges associated with digital approvals. This strategy cultivates a culture of continuous learning, enabling teams to adeptly navigate the complexities of document signing.

Statistics reveal that e-signatures can save an average of £36 per agreement by minimising hard costs and enhancing employee productivity. As law practices embrace cloud technology and innovative solutions, the importance of training on document signing tools becomes increasingly apparent. By 2025, the success of legal experts will hinge on their ability to leverage these technologies to enhance compliance and operational efficiency.

As Tara Kachaturoff highlights, the simplicity of managing client contracts is a significant advantage of digital signing tools. MyDocSafe amplifies this experience by providing reminders for crucial actions such as requests for digital approvals, completing questionnaires, and accepting invitations to portals, thereby fostering improved client engagement. Moreover, MyDocSafe’s robust security framework includes key management and GDPR compliance, ensuring that sensitive information remains protected throughout the signing process.

Case studies demonstrate that companies implementing training programmes for electronic signatures have witnessed substantial improvements in management processes. For example, the integration of AI and automation in e-signature solutions has streamlined document signing and enhanced document tracking, rendering e-signatures more efficient and reliable.

By prioritising training and resources, legal firms can not only bolster their document signing capabilities but also ensure compliance and elevate overall productivity, aligning with MyDocSafe’s comprehensive security framework and document management solutions that address these critical needs.

Conclusion

The transition from traditional wet signatures to electronic signatures signifies a pivotal shift in the legal landscape, offering substantial benefits in efficiency, security, and compliance. Platforms like MyDocSafe are at the forefront of this transformation, providing tools that streamline document signing processes and enhance client satisfaction and operational effectiveness. Legal professionals are now equipped with advanced technologies that facilitate swift and secure transactions while adhering to legal standards such as the ESIGN Act and UETA.

Understanding the nuances of electronic signatures is crucial for legal firms navigating this evolving terrain. The importance of compliance, security best practices, and effective training cannot be overstated. By implementing robust security measures, leveraging automation, and investing in comprehensive training programmes, legal professionals can significantly mitigate risks associated with document signing while ensuring they remain competitive in a rapidly changing environment.

Ultimately, embracing electronic signatures is not merely a trend but a strategic imperative for legal practices aiming for sustainability and operational excellence. As the adoption of these technologies continues to rise, firms that prioritise understanding, compliance, and security will be well-positioned to thrive in the future, maximizing both efficiency and client trust. The time to adapt is now; with the right tools and practices in place, the legal sector can fully harness the potential of electronic signatures for greater success.