Overview

This article examines best practices for implementing digital signatures within legal firms, underscoring their vital role in streamlining operations and bolstering security.

Legal professionals often grapple with inefficiencies that hinder their ability to serve clients effectively.

By adopting digital signatures, firms can significantly enhance operational efficiency—reducing turnaround times and administrative costs—while simultaneously ensuring compliance with legal standards.

This strategic adoption positions firms to better serve their clients and maintain a competitive edge in an increasingly technological landscape.

The implementation of digital signatures not only addresses existing challenges but also empowers legal firms to thrive in a dynamic environment.

Introduction

In a world where digital transactions are increasingly becoming the norm, grasping the complexities of digital signatures is essential for legal professionals. These cryptographic signatures not only guarantee the authenticity and integrity of electronic documents but also possess substantial legal significance under established regulations like the ESIGN Act and UETA. As law firms progressively adopt digital solutions, the benefits of digital signatures extend well beyond mere compliance; they bolster security, streamline operations, and enhance client satisfaction.

With platforms like MyDocSafe providing advanced features such as real-time tracking and secure document management, legal firms are well-positioned to revolutionize their practices within this rapidly evolving landscape. Delving into the operational advantages, security improvements, and best practices for implementation underscores that digital signatures are not merely a passing trend but a vital element in the future of legal operations.

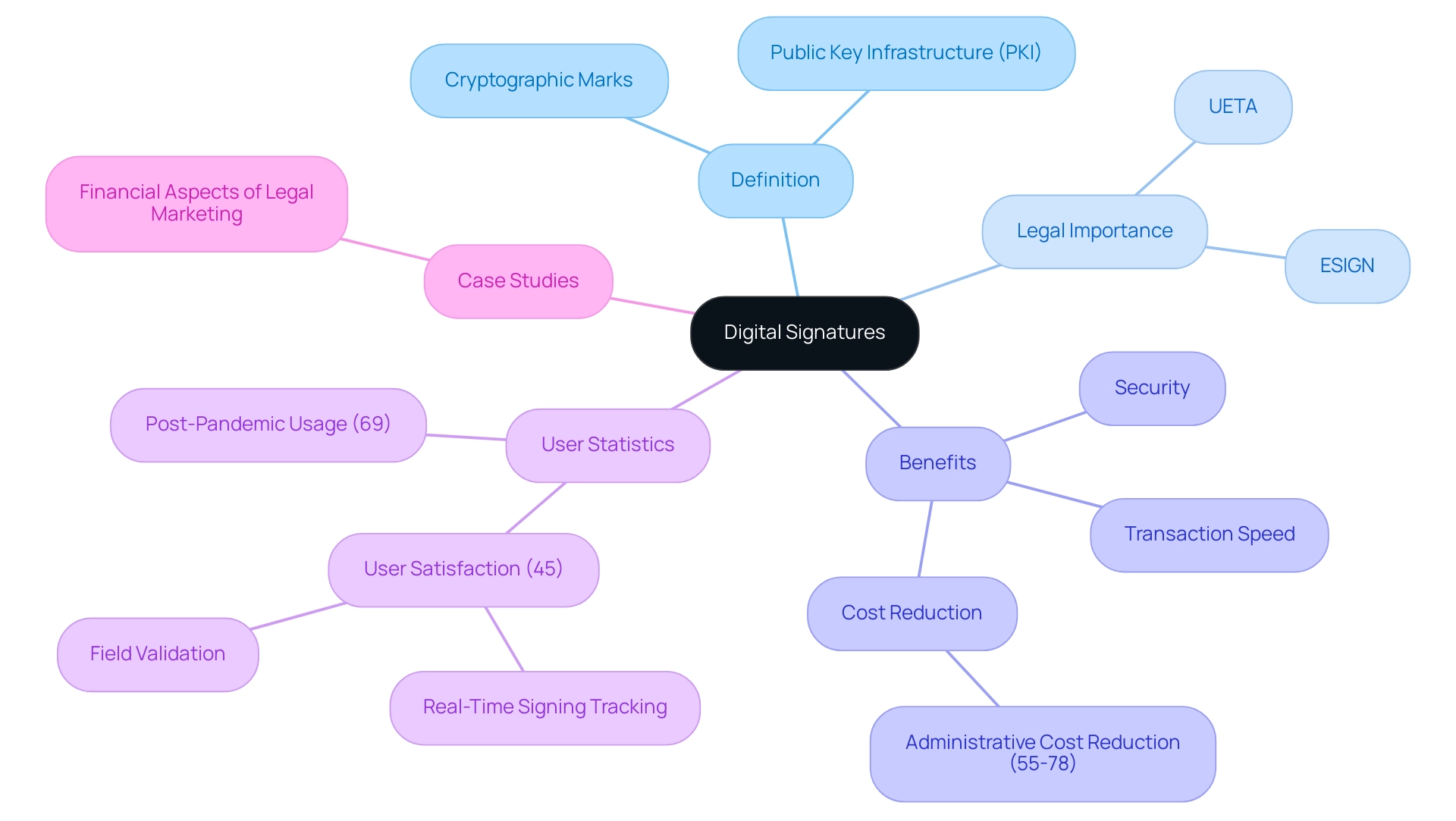

Understanding Digital Signatures: Definition and Importance in Legal Context

Digital signatures are cryptographic marks that provide a secure and verifiable method for endorsing electronic files. By utilising public key infrastructure (PKI), they ensure the authenticity and integrity of signed documents through the implementation of a digital signature. Within the judicial domain, digital signatures hold lawful significance under the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA).

This regulatory recognition is pivotal for law firms, allowing them to streamline operations while adhering to compliance standards. A robust understanding of this framework is essential for professionals in the field who aim to utilise electronic marks efficiently.

The importance of digital signatures extends beyond mere compliance; they significantly enhance security and expedite transactions, making them indispensable in today’s fast-paced legal landscape. With MyDocSafe’s comprehensive document management and electronic signing solutions, law firms can capitalise on advanced features such as:

- real-time signing tracking

- field validation

- client onboarding

- ID verification services

Benefits that 45% of e-signing users find particularly advantageous. Furthermore, 69% of individuals indicate they will continue using electronic methods, including digital signatures, post-pandemic, underscoring the clear shift towards electronic solutions.

Electronic identifiers also provide a distinct audit trail, which is critical for legal accountability and transparency. As legal firms increasingly recognise the value of digital signatures for electronic approvals, they can expect improved operational efficiency and enhanced client satisfaction. According to Fatih Ozkan, companies can reduce their administrative costs by 55-78% by adopting electronic methods.

Case studies demonstrate that organisations employing electronic methods not only streamline their processes but also achieve significant reductions in administrative expenses, ensuring that businesses remain competitive and compliant in an evolving environment. This transition towards electronic solutions, supported by MyDocSafe’s secure file management and electronic signing capabilities, is not merely a passing trend; it represents a fundamental transformation in the delivery of services within the legal sector.

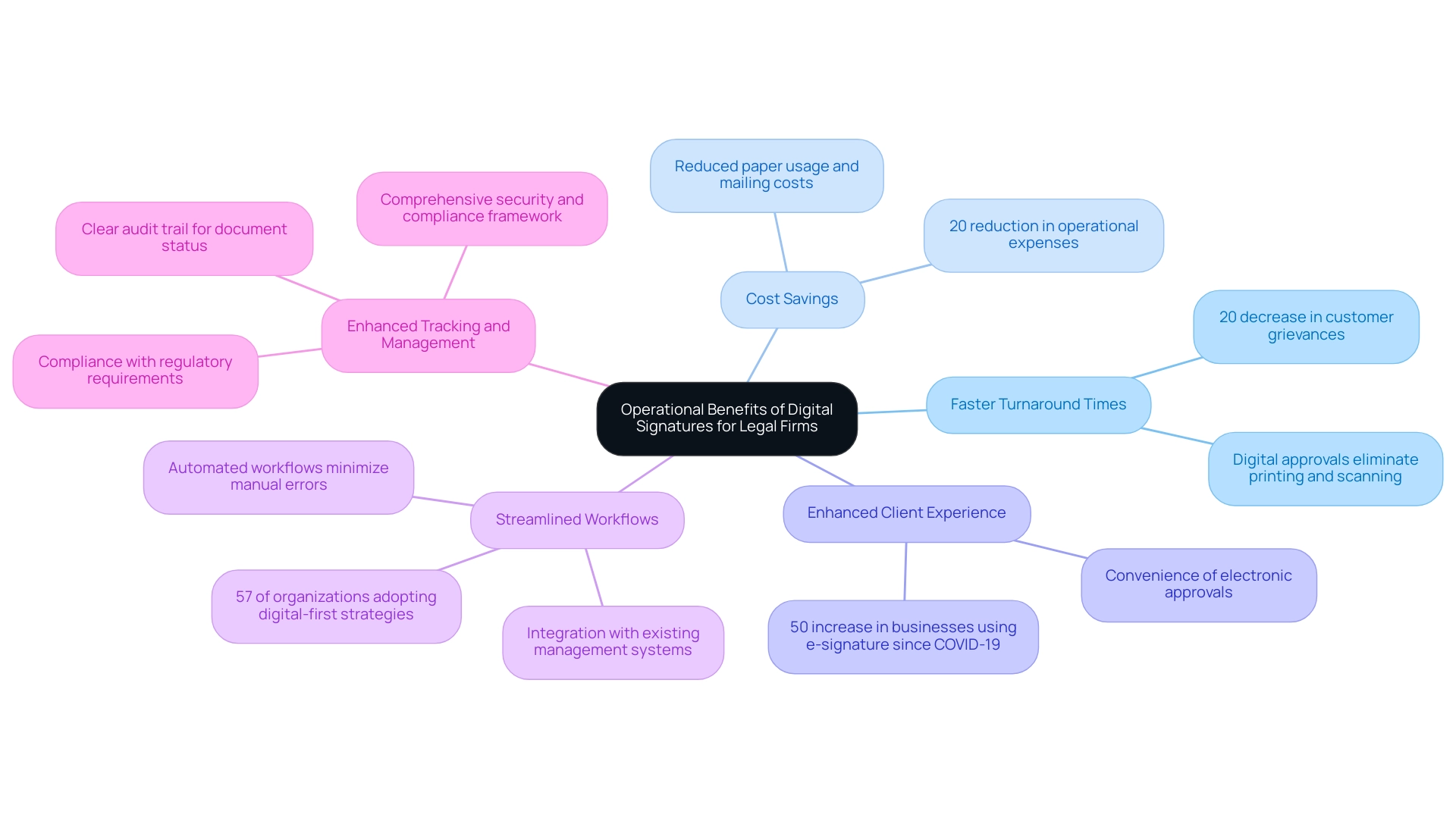

Operational Benefits of Digital Signatures for Legal Firms

Utilising electronic markers can significantly enhance operational effectiveness within legal practices, particularly through MyDocSafe’s advanced functionalities. The key benefits include:

- Faster Turnaround Times: Digital approvals employing a digital signature eradicate the cumbersome processes of printing, signing, and scanning documents. This streamlining facilitates immediate processing, leading to reduced turnaround times that can elevate client satisfaction. Indeed, the implementation of electronic endorsements has been shown to yield a 20% decrease in customer grievances, thereby enhancing overall customer satisfaction.

- Cost Savings: Legal firms can realise substantial savings by reducing paper usage and the associated costs of printing and mailing. The adoption of digital marks has demonstrated a 20% reduction in operational expenses, making it a financially prudent choice for many practices.

- Enhanced Client Experience: Clients increasingly prefer the convenience of electronic approvals, which not only simplify the signing process but also contribute to higher satisfaction and retention rates. MyDocSafe enhances this experience by offering customisable client portals that facilitate secure file sharing and signing, further improving client engagement. This shift is reflected in the growing trend, with a reported 50% increase in businesses utilising e-signature solutions since the onset of the COVID-19 pandemic, as noted by AirSlate.

- Streamlined Workflows: Digital signature technology integrates seamlessly with existing management systems, enabling automated workflows that minimise manual errors and enhance productivity. MyDocSafe’s capabilities in creating bespoke onboarding workflows and automated proposals are crucial, as 57% of organisations have adopted a digital-first strategy, indicating a broader trend toward operational efficiency. Additionally, MyDocSafe allows for the inclusion of password protection and SMS codes, ensuring enhanced security for sensitive files. The ability to send files in bulk and utilise mail merge further illustrates the operational advantages of MyDocSafe’s solutions.

- Enhanced Tracking and Management: The use of electronic marks provides a clear audit trail, simplifying the monitoring of document status and ensuring compliance with regulatory requirements. This capability is particularly beneficial in the judicial sector, where maintaining accurate records is essential. MyDocSafe’s comprehensive security and compliance framework, which includes encryption standards and the lawful validity of electronic marks, further supports this necessity.

As law firms continue to embrace digital transformation, the operational advantages of employing a digital signature become increasingly apparent. With over 10,000 companies globally recognising the significance of such solutions, including MyDocSafe, the industry is poised to witness substantial advancements in efficiency and client engagement. To explore how MyDocSafe can enhance your firm’s operations, contact our team today.

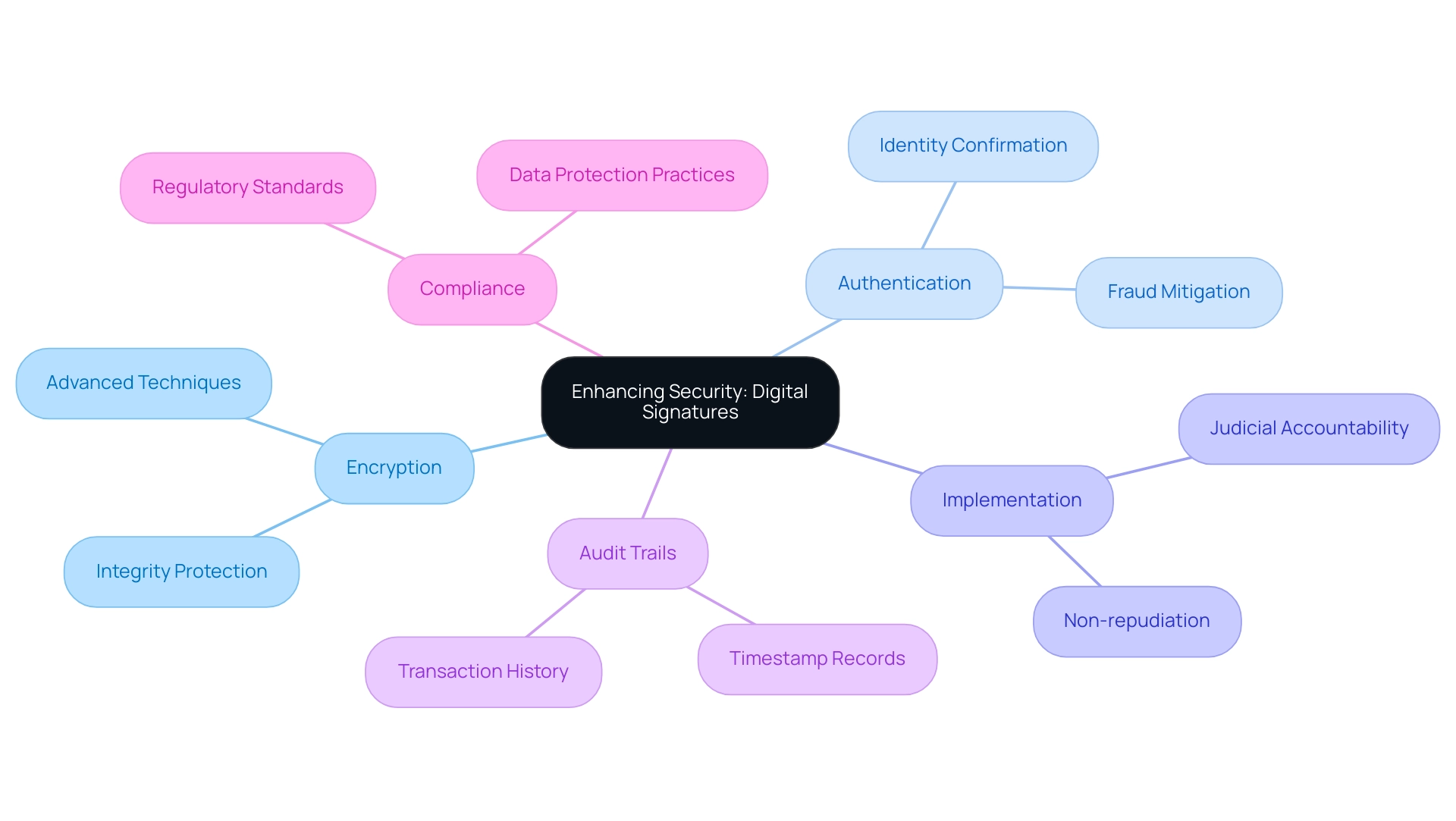

Enhancing Security: How Digital Signatures Protect Sensitive Legal Documents

Digital signatures significantly bolster the security of sensitive legal documents through a variety of mechanisms:

- Encryption: Advanced encryption techniques protect the integrity of files, ensuring that any unauthorized alterations are immediately detectable. This is crucial in a legal environment where the authenticity of records is paramount. MyDocSafe enhances this security with top-level encryption across its document management solutions, ensuring that sensitive information remains protected.

- Authentication: A digital signature confirms the identity of the signer, effectively mitigating the risks of fraud and unauthorized access to confidential information. This layer of security is increasingly vital, especially as 67% of Britons remain unaware of their country’s privacy and data protection regulations, highlighting the need for robust verification processes. MyDocSafe’s ID verification services further strengthen this aspect, providing an additional layer of trust in the signing process. As Jack Browning, Content Marketing Manager at One Legal, states, “The trend of data breaches in the industry highlights the urgent need for enhanced cybersecurity.”

- The implementation of a digital signature is essential for secure communications. Digital signatures ensure non-repudiation by providing undeniable proof of the signer’s intent, making it challenging for individuals to dispute their involvement in a transaction. This feature is essential in judicial contexts where accountability is critical.

- Audit Trails: Each signed record is accompanied by a comprehensive audit trail, including timestamps and records of the signing process. This documentation can be invaluable during disputes, providing clear evidence of the transaction history. MyDocSafe’s secure document management system ensures that these audit trails are easily accessible and well-organised.

- Compliance with Regulations: The use of a digital signature conforms to various statutory standards, such as GDPR and HIPAA, ensuring that sensitive information is managed in accordance with regulatory requirements. This compliance is increasingly important as law firms face heightened scrutiny regarding data protection practices. MyDocSafe’s solutions are created to meet these standards, offering peace of mind to professionals in the field.

The adoption of digital signatures not only improves the safety of official papers but also plays a crucial role in preventing fraud. Organisations that have embraced electronic signing solutions report a substantial decrease in document security violations, with the average expense of a data breach in the judicial sector reaching around £60 million, especially for those with fully implemented security AI and automation. By leveraging these technologies, law firms can gain a competitive edge, promoting strong cybersecurity practices that resonate with clients’ growing concerns about data safety.

Furthermore, openness in the application of electronic endorsements and artificial intelligence in law practices promotes client confidence. As clients increasingly seek assurance regarding the handling of their sensitive information, law firms that openly disclose their digital signature policies and reinforce the human element in their operations can enhance client satisfaction and loyalty. This method not only tackles current security challenges but also positions firms as leaders in the evolving landscape of technology in law.

Additionally, MyDocSafe’s encrypted chat features provide a secure communication channel, further ensuring that client interactions remain confidential and protected from third-party vulnerabilities. The inclusion of client access portals and virtual data rooms within MyDocSafe’s offerings enhances the overall client experience, ensuring that sensitive documents are managed securely and efficiently across various industries.

Best Practices for Implementing Digital Signatures in Legal Operations

To successfully apply electronic marks in regulatory activities, firms must adhere to these best practices:

- Choose the Right Technology: Select MyDocSafe’s digital signature solution, specifically designed to meet your firm’s unique requirements and ensure compliance with legal standards, including GDPR. Non-compliance can result in substantial fines, potentially reaching €20 million or 4% of a firm’s global annual revenue. The urgency of adopting appropriate practices cannot be overstated, particularly in a landscape where compliance is critical.

- Train Staff: Comprehensive training is crucial for staff to effectively and securely utilise MyDocSafe’s electronic signing tools, especially the digital signature feature. Current expert insights highlight that well-trained personnel are more likely to successfully adopt new technologies, thereby enhancing overall operational efficiency. As noted by Tara Kachaturoff, the simplicity of these tools significantly facilitates efficient training and execution, enabling staff to seamlessly integrate electronic marks into their workflows.

- Develop Clear Policies: Establishing clear guidelines for the use of digital signatures is essential. This includes directives for file management, security procedures, and the responsibilities of personnel overseeing electronic authentication, all supported by MyDocSafe’s robust security and compliance framework.

- Integrate with Existing Systems: Ensure that MyDocSafe’s electronic signing solution, featuring a digital signature, integrates smoothly with your current document management and case management systems. This integration streamlines workflows and enhances productivity, facilitating efficient proposal management and client onboarding.

- Monitor and Audit: Regular monitoring of electronic authentication usage and conducting evaluations are vital to ensure compliance with internal policies and regulatory standards. This practice not only safeguards sensitive information but also reinforces accountability within the organisation.

As a broader trend, 53% of CFOs plan to accelerate technological transformations by investing in automation and data analysis, underscoring the importance of digital signatures in electronic authentication for law firms. By adhering to these best practices, firms can streamline operations, bolster security, and enhance client interactions. Numerous organisations are recognising the value of electronic signing tools, with over 10,000 businesses globally utilising MyDocSafe to refine their document management and client interaction processes.

The effectiveness of electronic authentication tools in regulatory activities is significantly influenced by adequate training and application strategies, rendering these methods indispensable for success.

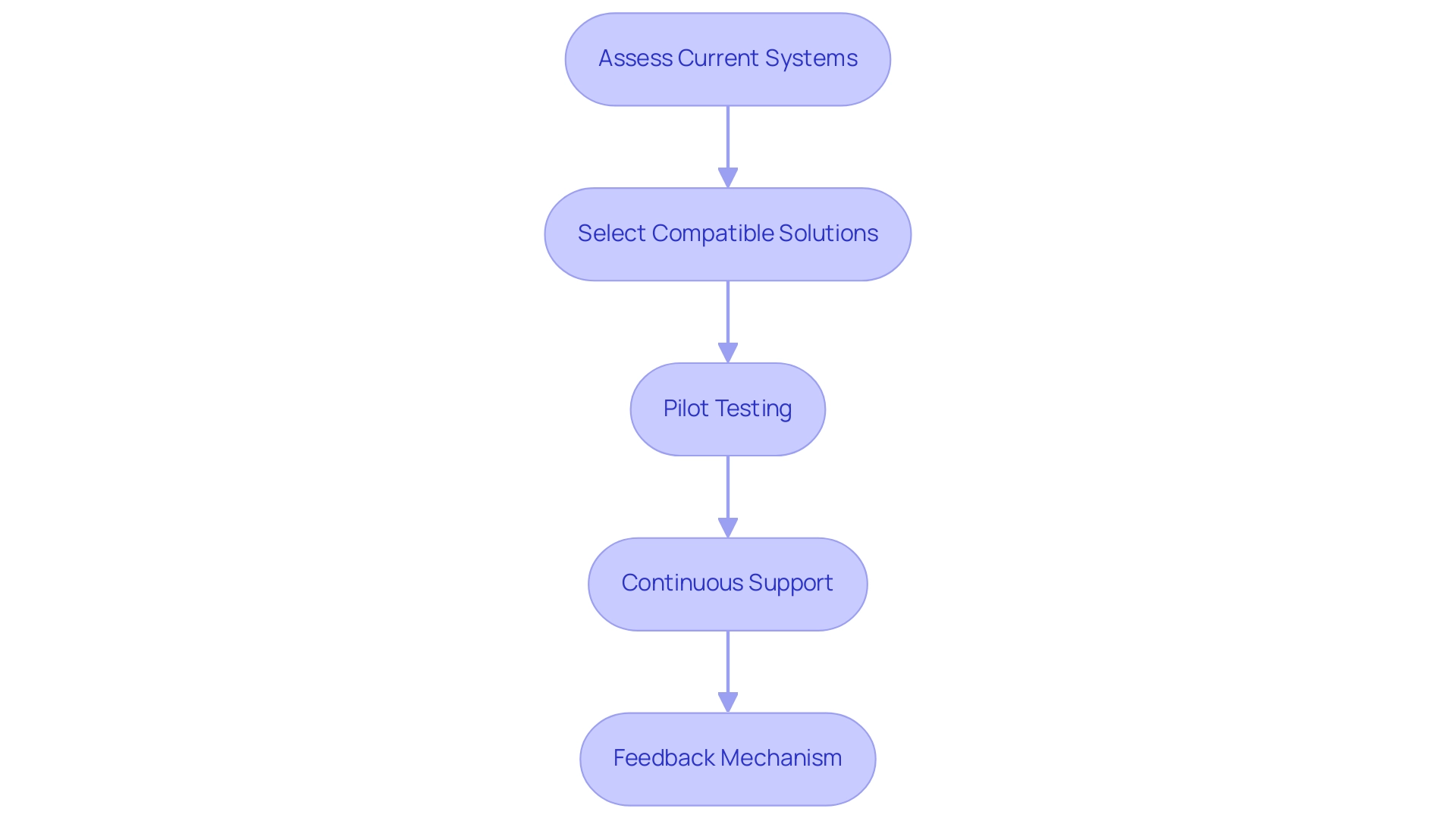

Integrating Digital Signatures with Legal Technology: A Seamless Transition

Incorporating electronic marks with current legal technology is crucial for optimising their advantages and facilitating a seamless transition. To facilitate this process, consider the following strategies:

- Assess Current Systems: Begin by evaluating your existing document management and case management systems. Identifying integration points for electronic approvals will streamline workflows and enhance efficiency.

- Select Compatible Solutions: Choose electronic signing solutions, such as those provided by MyDocSafe, that seamlessly integrate with your current technology stack. MyDocSafe offers customisable client portals that improve security and engagement, featuring password protection, SMS codes, and the capability to send files in bulk. Ensuring compatibility is essential to avoid disruptions and maintain a cohesive operational environment.

- Pilot Testing: Implement pilot tests with a select group of users to uncover potential issues and gather valuable feedback. Research indicates that firms engaging in pilot testing experience higher success rates in adopting new technologies, allowing for adjustments before a full rollout. According to the case study ‘Trends in Technology Adoption,’ firms that embrace innovation, including electronic signing methods, are better positioned for success in the evolving judicial landscape.

- Continuous Support: Provide ongoing support and resources for staff throughout the integration process. This support is vital for addressing challenges and ensuring that team members feel confident in using the new system. MyDocSafe’s automated workflows and advanced features significantly aid this process, equipping users to manage their document needs, including running ID checks and requesting documents.

- Feedback Mechanism: Establish a robust feedback mechanism to continuously refine the integration process based on user experiences. This iterative method boosts user satisfaction and cultivates a culture of enhancement within the company. As firms increasingly adopt technology, including digital methods of authentication, they are better positioned to optimise costs and improve operational efficiency. Statistics indicate that companies focusing on technology investments, especially in AI and cybersecurity, are more successful in navigating the changing regulatory environment. Furthermore, the eIDAS regulation in the European Union establishes standards for electronic identifiers, underscoring the importance of security in these transactions.

By following these strategies, professionals can ensure a successful transition to digital signatures, ultimately enhancing client interactions and improving document management. As Julie Feller, Vice President of Marketing at U.K. Legal Support, observes, ‘With a proven track record in the industry, integrating cutting-edge technology platforms is essential for professionals in this field.’ Additionally, eSignatures are increasingly utilised by real estate agents and clients for property sales contracts and lease agreements, illustrating their practical applications in the legal context.

The offerings from MyDocSafe, including customised client portals and secure document sharing, further underscore the importance of digital signatures in improving operational efficiency. For tailored solutions, we encourage you to talk to a member of the MyDocSafe team today at (863) 270 9779 (5 am – noon EDT).

Compliance and Regulatory Considerations for Digital Signatures in Legal Firms

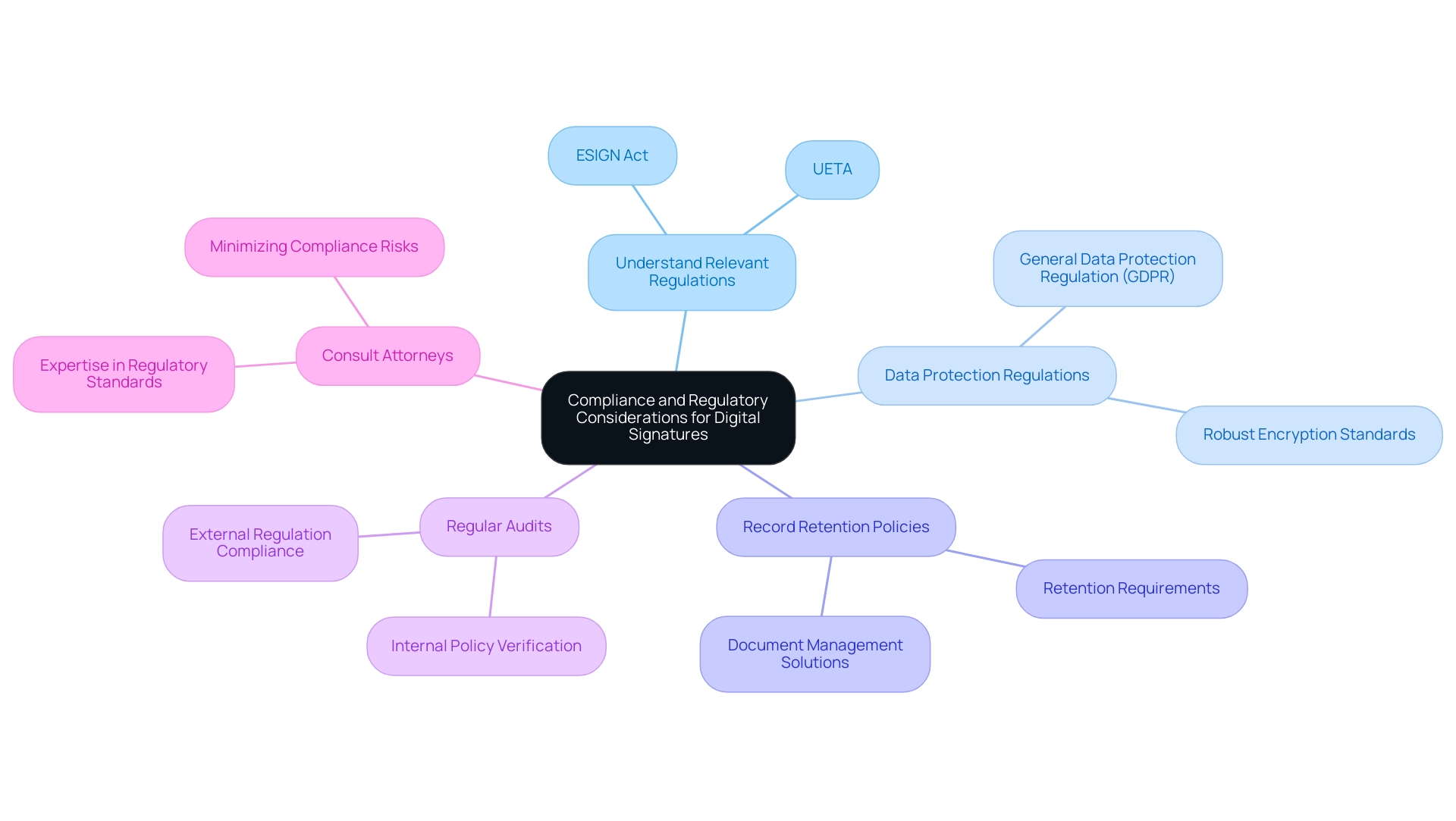

Legal firms navigate a complex landscape of compliance and regulatory considerations when implementing digital markers. To effectively address these challenges, firms should focus on several key areas:

- Understand Relevant Regulations: Familiarising yourself with laws such as the ESIGN Act and UETA is crucial, as they establish the framework for electronic agreements. These regulations ensure that digital signatures hold the same official weight as traditional marks, provided certain conditions are met. MyDocSafe’s solutions are meticulously designed to comply with regulatory standards, guaranteeing that your digital signatures are valid and enforceable.

- Data Protection Regulations: Compliance with data protection regulations, particularly the General Data Protection Regulation (GDPR), is essential for safeguarding client information. MyDocSafe implements robust encryption standards and blockchain solutions to protect sensitive data, as non-compliance can lead to significant penalties and damage to reputation. For detailed guidance, refer to MyDocSafe’s GDPR guide and terms of service.

- Record Retention Policies: Establishing clear policies for the retention and storage of records signed electronically with a digital signature is vital. Regulatory requirements dictate how long records must be retained, and companies should ensure their practices align with these mandates to avoid judicial consequences. MyDocSafe’s document management solutions facilitate compliance with these retention policies, providing a secure and organised way to manage documents.

- Regular Audits: Conducting regular audits is necessary to verify compliance with both internal policies and external regulations. These audits help identify potential weaknesses and ensure that the company’s electronic signing methods, including digital signature processes, remain current with evolving regulatory requirements. MyDocSafe offers tools that assist in maintaining compliance and conducting thorough security analyses.

- Consult Attorneys: Engaging attorneys to examine your electronic authentication methods can provide invaluable insights. Their expertise ensures that your processes align with current regulatory standards and best practices, incorporating a digital signature to minimise compliance risks. MyDocSafe’s team is ready to assist firms in managing these challenges.

As the use of digital endorsements continues to rise—69% of individuals indicate they will maintain their usage post-pandemic—firms must prioritise these compliance factors. The shift towards digital-first strategies is not merely a trend; it signifies a broader movement towards efficiency and security in information management. By understanding and applying these best practices, firms can enhance their operational efficiency while ensuring adherence to necessary regulations, all while leveraging MyDocSafe’s leading document management solutions that incorporate a digital signature for electronic signing.

The Future of Digital Signatures in the Legal Industry: Trends and Innovations

The future of electronic authentication in the judicial sector is set to undergo substantial enhancements, driven by emerging technologies and evolving regulatory landscapes. Key trends and innovations shaping this future include:

- The adoption of biometric data, such as fingerprints and facial recognition, is anticipated to significantly strengthen the security of digital signatures. This technology not only enhances verification processes but also meets the growing demands for robust security measures in transactions.

- Blockchain Technology: Leveraging blockchain can create immutable records of signed agreements, thereby improving both security and trust. This decentralised approach ensures that once a file is signed, it remains unchanged, providing a reliable audit trail essential for legal compliance. MyDocSafe integrates blockchain solutions to further bolster the integrity of electronic documents, guaranteeing that all transactions are securely recorded and verifiable.

- AI and Machine Learning: The incorporation of artificial intelligence can streamline the review process by identifying potential issues prior to the application of signatures. This proactive strategy reduces errors and accelerates workflow, allowing legal professionals to concentrate on more complex tasks. MyDocSafe’s automated workflows exemplify this trend, enhancing efficiency in client onboarding and file management.

- Increased mobile accessibility is being driven by advancements in mobile technology, rendering digital signatures more accessible than ever. Legal professionals can now sign documents on-the-go, enhancing flexibility and responsiveness in client interactions. MyDocSafe’s customisable client portals facilitate this accessibility, enabling secure document sharing and signing from any location.

- Regulatory Evolution: As the use of electronic signatures becomes increasingly prevalent, regulatory frameworks will continue to evolve. Legal firms must remain vigilant of these changes to ensure ongoing compliance, particularly as new standards emerge to govern electronic transactions. MyDocSafe’s solutions are designed to meet these compliance requirements, ensuring that validity and operational guidelines are upheld.

These trends signify a notable shift towards more secure, efficient, and user-friendly electronic authentication solutions in the legal sector. Notably, 45% of e-signature users find its features beneficial, underscoring the rising adoption of these technologies. As Tara Kachaturoff noted, the simplicity of managing client contracts illustrates the practical advantages of electronic endorsements.

Furthermore, with over 10,000 companies globally utilising MyDocSafe, it is recognised as an invaluable tool for enhancing document management and client engagement.

Moreover, a case study titled “Error Reduction with E-Signatures” reveals that companies employing electronic methods can decrease processing errors by an average of 90%, demonstrating the tangible advantages of electronic approvals in legal processes. Additionally, 42% of e-signature users value field validation capabilities, while 45% find real-time signature tracking straightforward, further showcasing the benefits of digital signature solutions in enhancing operational efficiency.

As firms embrace these innovations, they will not only elevate their operational efficiency but also foster client trust and satisfaction, leveraging MyDocSafe’s comprehensive features for secure document management, including ID verification services and encrypted email, alongside client onboarding across various industries.

Conclusion

Digital signatures signify a transformative leap in the legal industry, providing a secure and efficient method for managing electronic documents. Their legal recognition under the ESIGN Act and UETA affirms that these signatures possess the same validity as traditional signatures, delivering vital compliance and operational advantages for law firms. Enhanced security measures, including encryption and authentication, protect sensitive information, while audit trails foster transparency and accountability.

The operational benefits of digital signatures are considerable. By streamlining workflows, reducing turnaround times, and cutting administrative costs, firms can significantly boost client satisfaction and retention. The integration of digital signatures with existing legal technology further enhances these advantages, equipping firms to navigate a rapidly evolving landscape. As firms increasingly adopt digital transformation, best practices in implementation—such as staff training and compliance monitoring—are essential for maximizing the potential of these solutions.

Looking to the future, the prospects for digital signatures are promising, propelled by innovations like biometric authentication, blockchain technology, and AI integration. These advancements not only aim to bolster security and efficiency but also mirror a broader shift towards digital-first strategies within the legal sector. By embracing these technologies, law firms can enhance operational efficiency while reinforcing client trust and satisfaction. In an era where digital transactions dominate, investing in digital signatures transcends mere choice; it emerges as a strategic necessity for legal professionals striving to excel in the digital age.