Overview

A commercial lease agreement serves as a legally binding document that delineates the terms between a property owner and a business occupant. This agreement permits the latter to utilize a property for business purposes while clearly specifying obligations such as rent and maintenance responsibilities. Understanding the key terms of this agreement is crucial.

Effective negotiation is essential, and seeking legal counsel can ensure that both parties are aligned and protected. This proactive approach not only fosters positive landlord-tenant relationships but also significantly reduces the potential for disputes.

Introduction

Navigating the intricate landscape of commercial lease agreements presents a formidable challenge for both landlords and tenants. These legally binding contracts are crucial in delineating the terms of occupancy, ensuring that the rights and responsibilities of both parties are explicitly articulated.

As the commercial real estate market undergoes continual transformation, grasping the nuances of these agreements becomes increasingly essential. With forecasts suggesting that a substantial percentage of businesses will engage in commercial leases by 2025, the significance of meticulously structured contracts cannot be overstated.

From understanding the pivotal distinctions between commercial and residential leases to negotiating the essential terms, this article explores the complexities of commercial leasing, providing invaluable insights and strategies for all stakeholders involved.

Defining Commercial Lease Agreements: An Overview

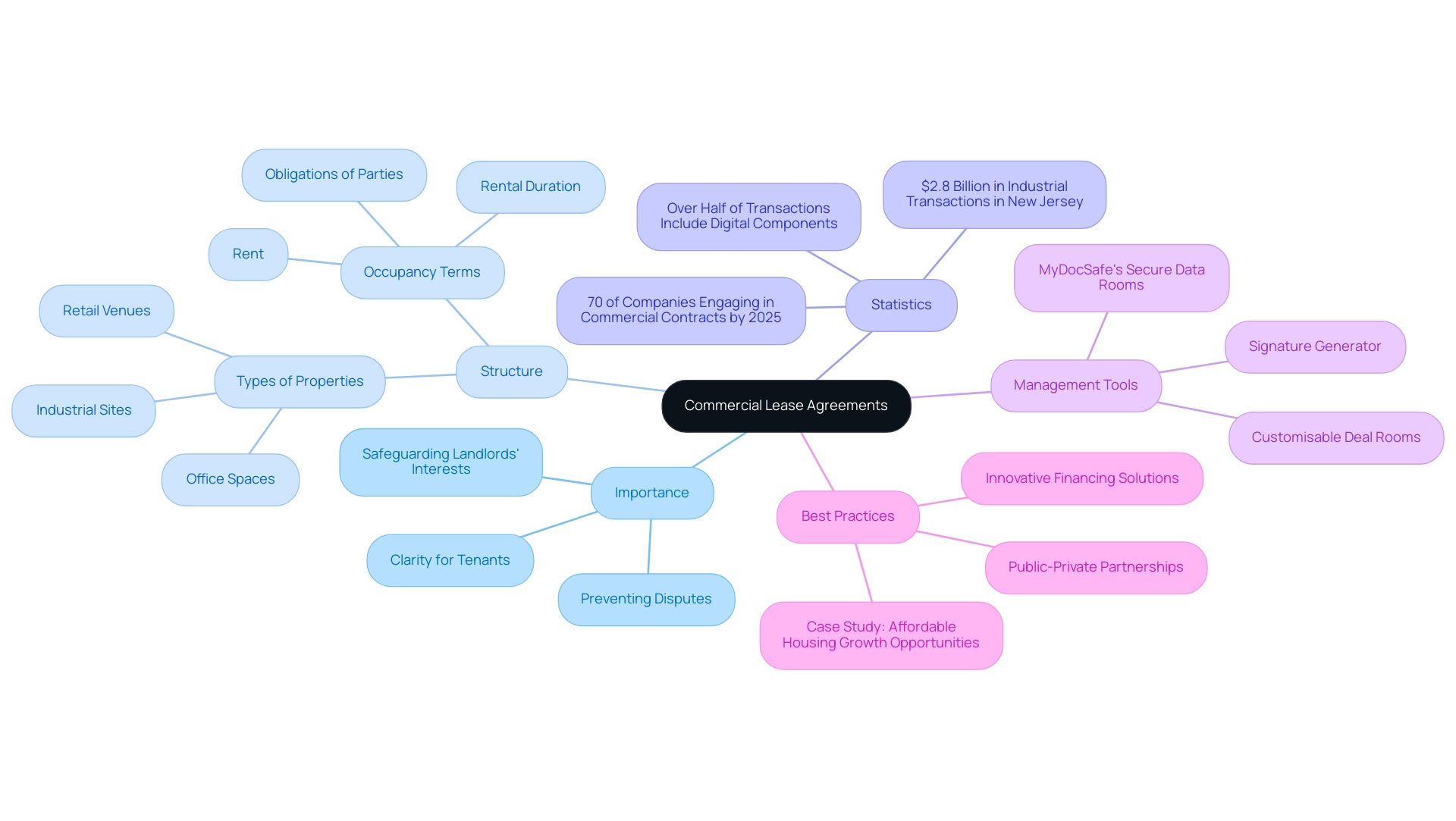

A commercial lease agreement is a legally binding document between a property owner and a business occupant, granting the occupant the right to occupy and utilise a business property for professional activities. Unlike residential contracts, which focus on living arrangements, commercial rentals are specifically designed to meet the diverse needs of enterprises, encompassing various property categories such as office spaces, retail venues, and industrial sites.

These commercial lease agreements are crucial for outlining occupancy terms, including rent, rental duration, and the obligations of both parties. In 2025, approximately 70% of companies are expected to engage in commercial contracts, underscoring the growing reliance on such arrangements within the business landscape.

Expert insights highlight the importance of well-structured commercial lease agreements. Real estate attorneys assert that these agreements not only safeguard landlords’ interests but also provide tenants with a clear understanding of their rights and obligations. For instance, Tara Kachaturoff underscores the ease of managing client contracts through effective rental agreements, illustrating their role in fostering positive landlord-tenant relationships.

This ease of management is particularly vital in the realm of commercial lease agreements, where clarity can prevent disputes and enhance operational efficiency.

Successful commercial lease agreements often serve as benchmarks for best practices within the industry. A recent case study on affordable housing growth opportunities demonstrates how innovative financing solutions and robust public-private partnerships can yield successful outcomes in leasing, especially in sectors experiencing high demand and limited supply. These collaborations are essential for navigating the complexities of business agreements, ensuring that both property owners and occupants can achieve their objectives.

Integrating MyDocSafe’s secure data rooms into the rental process can significantly enhance document management and communication. By creating customisable deal rooms and utilising data collection forms, legal firms can securely share and manage all transaction-related documents, safeguarding sensitive information. Furthermore, MyDocSafe’s signature generator streamlines the signing process, facilitating efficient client onboarding and compliance tracking through customisable workflows.

Current statistics indicate that over half of real estate transactions now incorporate some digital component, reflecting a shift towards more streamlined and efficient leasing processes. This trend is particularly relevant to commercial lease agreements, as digital tools can facilitate negotiations, document management, and compliance monitoring. Moreover, New Jersey recently closed $2.8 billion in industrial transactions, marking a slight increase from the previous year. This statistic highlights the dynamic nature of the business rental market and the necessity for companies to stay informed about the latest trends and regulations.

In summary, a comprehensive understanding of the commercial lease agreement is essential for both property owners and occupants, ensuring that all parties are aligned and protected throughout the rental process. Leveraging MyDocSafe’s innovative solutions, with a focus on security and customisable features, can further enhance this understanding and streamline the overall management of business agreements.

Commercial vs. Residential Leases: Key Differences

Commercial contracts, such as the commercial lease agreement, exhibit significant distinctions from residential agreements—differences that are essential for businesses to understand when entering into arrangements. One of the primary distinctions lies in the duration of the agreements; business contracts typically extend over longer periods, often ranging from three to ten years, whereas residential agreements are generally shorter, often lasting one year or operating on a month-to-month basis.

Furthermore, a commercial lease agreement is usually more negotiable, allowing tenants to tailor conditions to meet their specific operational needs. This flexibility is crucial, particularly as the real estate sector transitions from defensive to proactive strategies in 2025, reflecting an increasing emphasis on adaptability and tenant requirements. The demand for industrial real estate in the U.S. is projected to rise by 850 million square feet in 2023, indicating a robust market that necessitates strategic rental negotiations.

Moreover, commercial lease agreements frequently encompass provisions related to operations, such as permitted usage and maintenance responsibilities, which are less common in residential contracts. For instance, a commercial lease agreement may delineate the types of businesses allowed on the premises or specify maintenance obligations, ensuring that both parties have a clear understanding of their responsibilities.

Statistics indicate that the average rental duration for business properties is significantly longer than that of residential properties, with many companies opting for stability in their operational locations. Additionally, approximately 70% of commercial lease agreements are negotiable, underscoring the importance of negotiation skills in securing favorable terms. As AI adoption in business real estate enhances decision-making efficiency, it is imperative for companies to leverage technology in their rental negotiations.

As the commercial real estate landscape evolves, grasping these differences in commercial lease agreements is vital for businesses to ensure they are adequately protected and informed. Engaging with real estate specialists can provide valuable insights into current trends and best practices in rental negotiations, ultimately leading to more favorable outcomes. The sector’s need to align values with younger professionals, as highlighted in a recent case study on talent acquisition, may also influence rental negotiations and tenant expectations.

As Tara Kachaturoff noted, “Its ease of use for managing client contracts” underscores the importance of effective tools in navigating these complex arrangements.

Essential Terms in Commercial Lease Agreements

Key terms in a commercial lease agreement are essential for establishing a clear understanding between property owners and renters. These terms include:

- Rent: This encompasses the total amount due, the payment schedule, and any escalation clauses that may apply over the rental period. In 2025, average rent prices for commercial properties have shown variability, reflecting market conditions and location specifics.

- Term: The lease duration is critical, detailing both the start and end dates. This term can significantly affect the lessee’s business planning and financial forecasting.

- Use Clause: This clause specifies the permitted uses of the property, ensuring that occupants operate within the agreed parameters. It is essential for landlords to protect their investment by limiting activities that could lead to property damage or zoning issues.

- Maintenance Responsibilities: This section outlines who is responsible for repairs and upkeep of the property. Common maintenance duties often fall on the renter, but landlords may retain obligations for structural repairs. Comprehending these responsibilities can avert conflicts and guarantee the property stays in good shape.

- Security Deposit: Usually necessary to secure the rental agreement, this amount may be refundable at the end of the term, depending on the property’s condition. The management of security deposits is frequently a source of disagreement, making it essential for both parties to concur on terms beforehand.

- Termination Clause: This clause outlines the conditions under which the contract can be ended early, offering both parties a clear exit strategy if situations shift.

Understanding these terms is critical for both property owners and renters to prevent conflicts and ensure adherence to the commercial lease agreement. For instance, in Bridgeport, New Jersey, the industrial market has shown a low vacancy rate of 4.2%, emphasizing the significance of well-structured rental agreements in competitive markets. This low vacancy rate suggests a strong demand for industrial space, which can influence lease terms favourably for landlords.

Furthermore, the real estate sector shows promise for growth and innovation, despite existing challenges, as evidenced by the decline in Boston’s office construction pipeline from 14.5 million square feet to 7.3 million in January 2025. As Victor Calanog notes, there are suburban office markets showing signs of cap rate flatness or even declines, indicating that stakeholders must stay informed about these key terms to navigate their agreements effectively.

Exploring Different Types of Commercial Leases

In the realm of commercial rentals, understanding the various types of commercial lease agreements is crucial for making informed decisions. Here are the main rental types, each with distinctive features:

- Gross Agreement: In this arrangement, the occupant pays a flat rental fee that includes all operating expenses, such as utilities, maintenance, and property taxes. This kind of agreement streamlines budgeting for occupants, as they are not accountable for varying expenses linked to property management.

- Net Agreement: This arrangement necessitates the occupant to pay a base rent along with a share of the property’s operating costs. These expenses typically include property taxes, insurance, and maintenance costs. Net agreements can be further classified into single, double, and triple net arrangements, based on the level of the occupant’s financial obligations. Current trends indicate a growing preference for net arrangements among businesses, with approximately 60% of companies opting for this structure due to its potential for lower base rents and predictable expense management. This statistic is backed by a survey of over 880 C-level executives from major business real estate firms, emphasizing the change in rental preferences.

- Modified Gross Agreement: A hybrid between gross and net agreements, the modified gross agreement allows occupants to pay a base rent plus some operating expenses, but not all. This arrangement offers adaptability and can be customised to meet the particular requirements of both property owners and renters.

- Percentage Agreement: Mainly utilised in retail environments, this type of agreement involves the renter paying a base rent plus a portion of their sales income. This structure aligns the interests of landlords and tenants, as both parties benefit from the tenant’s business success.

Additionally, case studies reveal that organisations are adapting their leasing strategies to attract and retain talent, particularly in light of the impending retirement of 40% of the workforce in real estate. By aligning rental structures with the values of younger professionals—such as work/life balance and mental health—companies can enhance their appeal in a competitive market. This adjustment is vital as the business property environment changes.

Furthermore, the incorporation of AI is altering how property organisations utilise technology for enhanced operations, making it necessary for companies to remain informed about current trends in business renting. Comprehending these rental types is critical for companies to choose the most financially advantageous option, ensuring that their commercial lease agreements align with their operational objectives and financial plans. As Tara Kachaturoff observed, the simplicity of handling client contracts is a crucial element in the effectiveness of these rental types, highlighting the significance of efficient administration in business renting.

Insights from Deloitte’s report on the global real estate forecast for 2024 and 2025 further contextualise the discussion on business agreements, offering timely information for stakeholders in the industry.

Negotiating Your Commercial Lease: Tips and Strategies

Negotiating a commercial lease agreement is a critical factor that can significantly influence a business’s financial health. To navigate this complex landscape effectively, consider the following essential tips and strategies:

- Conduct Thorough Market Research: Familiarize yourself with local market rates for comparable properties. This knowledge empowers you to negotiate from a position of strength, ensuring you secure an agreement that reflects fair market value.

- Engage Legal Expertise: Collaborating with a real estate attorney can be invaluable. Their expertise helps navigate complex rental terms and safeguards your interests, providing peace of mind during negotiations.

- Be Prepared to Walk Away: If the proposed terms do not meet your business needs, be ready to explore alternative options. This mindset can strengthen your negotiating position and lead to more favourable outcomes.

- Negotiate for Rent-Free Periods: Requesting a rent-free period can offer significant financial relief during the initial stages of your business operations, allowing you to allocate resources more effectively.

- Clarify Maintenance Responsibilities: Ensure that the agreement explicitly defines who is responsible for repairs and maintenance. Clear delineation of these responsibilities within the commercial lease agreement can prevent disputes and safeguard your investment.

Effective negotiation strategies can lead to a commercial lease agreement that aligns with your business goals. A study by Huthwaite International highlights that companies lacking formal negotiation processes experience a staggering 63.3% decrease in net income. This statistic underscores the importance of adopting structured negotiation strategies to improve profitability.

Furthermore, collaborating with real estate brokers and attorneys provides valuable insights and legal safeguards during the negotiation process. As Tara Kachaturoff noted, the ease of managing client contracts is crucial; leveraging expert advice can streamline negotiations. Additionally, it is noteworthy that over 200 procurement teams have been upskilled by Marijn Overvest, emphasizing the significance of preparation and expertise in negotiations.

By implementing these strategies and utilising tools like MyDocSafe, which is trusted by over 10,000 companies worldwide for effective document management and electronic signatures, businesses can secure more favourable contract terms and improve their overall financial outcomes. MyDocSafe enhances client onboarding through features such as customisable workflows and automated document distribution, ensuring compliance with industry standards and streamlining processes. This makes MyDocSafe a crucial ally in managing the intricacies of commercial lease agreements.

Legal Considerations in Commercial Lease Agreements

Legal factors in business rental contracts are intricate, encompassing adherence to local zoning laws, building codes, and various regulations governing rental properties. As we approach 2025, it is essential for both landlords and renters to ensure that their lease agreements comply with applicable laws, thereby mitigating the risk of legal disputes. Recent legislation has significantly expanded certain rights for small commercial occupants, including mandated notice periods for rent increases and terminations, highlighting the evolving landscape of compliance in commercial leasing.

Understanding the rental laws in California for 2025, especially concerning eviction procedures and tenant protections, is vital for landlords. Consulting a legal expert to scrutinise rental contracts is a prudent step that can help identify potential legal issues, such as ambiguous terms or provisions that may be deemed inequitable. This legal oversight is crucial not only for safeguarding the interests of both parties but also for ensuring that the rental agreement is enforceable under current laws. Grasping the rights and obligations of renters is essential, as these elements can significantly influence a business’s operations and financial stability.

Moreover, statistics indicate that compliance challenges remain a prevalent source of disputes in business rental agreements, underscoring the necessity for thorough legal examination. Legal experts assert that proactive measures in contract drafting and negotiation can avert misunderstandings and foster a more equitable relationship between landlords and tenants. By prioritising adherence and transparency in rental agreements, businesses can navigate the complexities of business renting with enhanced confidence and security.

Utilising reliable document management solutions, such as MyDocSafe, can further streamline the rental management process. MyDocSafe provides secure electronic signature solutions and comprehensive document management tools that bolster compliance and client onboarding across various industries. With over 10,000 companies globally leveraging its services, MyDocSafe equips legal professionals and businesses with the resources necessary to manage client contracts efficiently.

As noted by Tara Kachaturoff, the platform’s user-friendly interface for managing client contracts renders it an invaluable resource. Additionally, the case study titled “Rights for Small Business Occupants” illustrates how new legislation enhances protections for small enterprises, emphasising the importance of compliance and occupant rights in business leasing.

It is also imperative to address frequently asked questions regarding the legality of electronic signatures in business rental agreements. MyDocSafe complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA), ensuring that electronic signatures are legally valid and enforceable. By utilising MyDocSafe’s solutions, landlords and renters can confidently navigate the legal landscape of electronic signatures, ensuring compliance with relevant laws and regulations.

Common Pitfalls in Commercial Leasing: What to Avoid

When engaging in a commercial lease agreement, occupants must navigate several common pitfalls that can significantly affect their financial and operational stability. Key areas of concern include:

- Failing to Negotiate Key Terms: Accepting the initial offer without negotiation can result in unfavourable conditions. A significant percentage of renters overlook this step in their commercial lease agreement, potentially leading to higher costs and less favourable lease terms. As noted by Robert C. Nicholas, Esq., occupants should consider inserting a maximum upper limit on Common Area Maintenance (CAM) charges to protect against unforeseen expenses.

- Overlooking Hidden Costs: It is crucial to account for additional expenses such as maintenance fees, property taxes, and utilities. These costs can accumulate and affect the overall budget, making it essential to clarify them upfront. Furthermore, occupants should clarify the disposition of unused landlord allowances and remedies for delays caused by the landlord to avoid unexpected financial burdens.

- Not Conducting Due Diligence: Researching the property and its history is essential to avoid potential issues. Understanding the previous use of the space and any existing liabilities can prevent future complications. With over 10,000 companies worldwide utilising MyDocSafe’s services, effective document management becomes crucial in navigating these complexities.

- Assuming Rental Terms are Standard: Each agreement is unique; occupants should not presume that conditions are consistent across contracts. This misconception can lead to unfavourable obligations that could have been avoided through careful negotiation.

Thoroughly reading the commercial lease agreement is vital to understanding all terms and conditions, so it’s important not to ignore the fine print. Many residents have faced unexpected challenges due to overlooked clauses in their commercial lease agreement that could have been negotiated or clarified. A case study titled “Understanding Crucial Contract Provisions” highlights how a clear understanding of terms regarding duration, rent calculations, and responsibilities for improvements can help occupants avoid unexpected costs and obligations.

By being vigilant and informed, tenants can sidestep these common pitfalls and secure a commercial lease agreement that meets their business needs. Expert advice from real estate professionals emphasises the importance of negotiating terms and actively engaging in the leasing process to enhance their chances of achieving favourable outcomes.

The Role of Legal Counsel in Commercial Lease Agreements

Engaging legal counsel during the negotiation of a commercial lease is essential for several compelling reasons:

- Expertise in Lease Terms: Legal professionals possess the knowledge to interpret complex legal language, ensuring that lease terms are transparent and equitable. This expertise is especially valuable in navigating the intricacies of commercial agreements, where misunderstandings can lead to significant financial repercussions.

- Protection of Interests: A lawyer acts as an advocate for the renter, negotiating terms that are tailored to meet specific business needs. This advocacy is crucial, especially in a competitive real estate market where landlords may have the upper hand.

- Compliance Assurance: Legal counsel ensures that the agreement adheres to all applicable laws and regulations, thereby minimizing the risk of future legal complications. This compliance is vital in avoiding costly mistakes that could arise from overlooked legal requirements. Seeking advice from a commercial real estate lawyer prior to signing a rental contract can ultimately save funds in the long term by recognising possible issues and ensuring that the agreement is equitable and supportive of the renter’s best interests.

- Dispute Resolution: In the event of a disagreement, having legal representation can streamline the resolution process and protect the individual’s rights. Effective legal counsel can help navigate disputes efficiently, potentially saving significant legal fees and time.

The significance of legal counsel is emphasised by recent statistics showing that over 60% of tenants obtain legal representation during rental negotiations. This trend reflects a growing recognition of the value that legal expertise brings to the table. Furthermore, case studies illustrate how effective negotiation strategies, such as those discussed in ‘Negotiation Strategies for Commercial Leases,’ can result in arrangements that not only meet the lessee’s needs but also address potential disruptors such as credit requirements and upfront payments.

As highlighted by specialists from SBEMP, “Their knowledge can prevent you from making expensive errors and guarantee that your rental contract is just and in your best interest.” This highlights that having a lawyer involved in commercial leases is not just a precaution; it is a strategic move that can enhance the overall leasing experience and lead to more favourable outcomes.

Conclusion

Navigating the complexities of commercial lease agreements is essential for both landlords and tenants as the commercial real estate landscape continues to evolve. Understanding the key distinctions between commercial and residential leases, along with the various types of commercial leases, empowers businesses to make informed decisions that align with their operational needs. The importance of critical lease terms—such as rent, maintenance responsibilities, and termination clauses—cannot be overstated; they form the foundation of effective landlord-tenant relationships.

Moreover, effective negotiation strategies can significantly influence the financial health of a business. Engaging legal counsel during this process is crucial, ensuring compliance with laws and protecting the interests of all parties involved. By being aware of common pitfalls—such as overlooking hidden costs or failing to negotiate terms—tenants can avoid significant financial setbacks and secure leases that best serve their needs.

As the commercial leasing market continues to grow, with projections indicating that a significant percentage of businesses will engage in these agreements by 2025, leveraging innovative tools and expert advice becomes increasingly vital. The integration of digital solutions, like MyDocSafe, facilitates better document management and enhances communication, ultimately streamlining the leasing process.

In summary, a comprehensive understanding of commercial lease agreements, coupled with effective negotiation and legal support, is essential for navigating this intricate landscape. Both landlords and tenants must prioritise clarity and compliance to foster beneficial relationships and achieve their respective goals in an ever-changing market. By staying informed and proactive, stakeholders can leverage commercial leases to their advantage, paving the way for successful business operations.