Chapter 1: Introduction to Electronic Signatures

Understanding the Basics of Electronic Signatures

In today’s fast-paced digital world, small businesses are constantly looking for ways to streamline their processes and improve efficiency. One way to achieve this is by integrating electronic signatures into customer onboarding procedures. Electronic signatures offer a convenient and secure way to sign documents without the need for physical paper or ink. In this section, we will explore the basics of electronic signatures and how they can benefit your small business.

Electronic signatures, also known as e-signatures, are a digital representation of a person’s signature. They are legally binding and can be used to sign a variety of documents, including contracts, agreements, and forms. Electronic signatures are typically created using a secure digital process that verifies the identity of the signer and ensures the integrity of the document.

One of the key benefits of electronic signatures is the convenience they offer. With electronic signatures, you can sign documents from anywhere, at any time, using any device with an internet connection. This eliminates the need for in-person meetings or physical documents, saving time and resources for both your business and your customers. Additionally, electronic signatures can help speed up the customer onboarding process, allowing you to onboard new clients more quickly and efficiently.

Security is another important aspect of electronic signatures. When using electronic signatures, you can be confident that your documents are secure and tamper-proof. Electronic signature platforms use encryption and authentication techniques to ensure the integrity of your documents and protect them from unauthorized access. This provides peace of mind for both you and your customers, knowing that their sensitive information is safe and secure.

Electronic signatures laws have been enacted in most major jurisdictions.

The European Union has eIDAS (post-brexit Britain has inherited that framework), which introduced legal definitions of ‘simple’, ‘advanced’ and ‘qualified’ electronic signatures. MyDocSafe offers advanced electronic signature ‘AES’ and, via third parties, qualified electronic signature ‘QES’. It appears that AES is fast becoming the dominant way to sign documents in Europe due to quick onboarding process and low cost.

The US has The U.S. Electronic Signatures in Global and National Commerce (ESIGN) Act of 2000 which legislated that electronic signatures are legal in every state and U.S. territory where federal law applies. Where federal law does not apply, most U.S. states have adopted the Uniform Electronic Transactions Act (UETA), which was published by the Uniform Law Commission in 1999. The net effect of these laws is that every jurisdiction in the United States has substantially the same rules for the use of electronic signatures.

In conclusion, understanding the basics of electronic signatures is essential for small businesses looking to streamline their customer onboarding procedures. By integrating electronic signatures into your processes, you can save time, resources, and improve security. Electronic signatures offer a convenient and secure way to sign documents, making it easier for both you and your customers to complete transactions quickly and efficiently. If you haven’t already, consider incorporating electronic signatures into your customer onboarding procedures to take advantage of these benefits and stay ahead of the competition.

Benefits of Implementing Electronic Signatures in Customer Onboarding

One area where electronic signatures can make a significant impact is in customer onboarding. By implementing electronic signatures into their onboarding procedures, small businesses can experience a wide range of benefits that can help them save time, reduce costs, and improve customer satisfaction.

- One of the key benefits of implementing electronic signatures in customer onboarding is the ability to streamline the entire process. With electronic signatures, small businesses can eliminate the need for paper forms, manual signatures, and physical document storage. Instead, customers can easily sign documents online using their computer, tablet, or smartphone, making the onboarding process faster and more convenient for everyone involved.

- Another benefit of using electronic signatures in customer onboarding is the improved accuracy and compliance it provides. Electronic signatures are legally binding and provide a clear audit trail of who signed each document and when. This can help small businesses ensure that all necessary forms are completed correctly and securely, reducing the risk of errors or compliance issues.

- Additionally, implementing electronic signatures in customer onboarding can help small businesses save time and reduce costs. By eliminating the need for paper forms and manual signatures, businesses can significantly reduce the amount of time spent on administrative tasks and paperwork. This can free up valuable resources that can be redirected towards more important tasks, such as serving customers or growing the business.

- Furthermore, electronic signatures can also help small businesses improve customer satisfaction. By offering a more convenient and efficient onboarding process, businesses can create a positive first impression on customers and build trust and loyalty. Customers will appreciate the ease of signing documents online and the quick turnaround time, leading to a more positive overall experience with the business.

Note that MyDocSafe’s electronic signature and client onboarding platform allows users to send contracts on their own or as part of templated multi-step workflows that incorporate service selection, payments, questionnaires, marketing materials, videos and ability to add comments.

Overall, integrating electronic signatures into customer onboarding procedures can provide small businesses with a wide range of benefits, including streamlined processes, improved accuracy and compliance, time and cost savings, and increased customer satisfaction. By embracing this technology, small businesses can stay ahead of the curve and position themselves for success in today’s competitive business environment.

Chapter 2: Assessing Your Customer Onboarding Process

Evaluating Current Onboarding Procedures

As a small business owner, it is crucial to constantly evaluate and improve upon your current onboarding procedures in order to streamline the customer experience and increase efficiency. One key aspect to consider when evaluating your current onboarding procedures is the integration of electronic signatures. By incorporating electronic signatures into your onboarding process, you can save time, reduce paperwork, and improve the overall customer experience.

When evaluating your current onboarding procedures, it is important to consider the current pain points and inefficiencies in the process. Are there long wait times for customers to sign paperwork? Are there multiple steps that could be consolidated into one? By identifying these pain points, you can begin to address them and improve the overall onboarding experience for your customers. Main ones are:

- Inaccuracy in data collection, if done by email

- Time spent getting the prospect to a ‘yes’

- Lack of audit trail and automation of reminders

Another important factor to consider when evaluating your onboarding procedures is the level of security and compliance. Electronic signatures provide a secure and legally binding way to sign documents, ensuring that your business is in compliance with all necessary regulations. By incorporating electronic signatures into your onboarding process, you can rest assured that your customers’ information is safe and secure.

In addition to improving efficiency and security, integrating electronic signatures into your onboarding procedures can also help to improve the overall customer experience. By allowing customers to sign documents electronically, you can reduce the amount of time they spend filling out paperwork and waiting for approval. This can help to create a more positive experience for your customers and increase their overall satisfaction with your business.

At MyDocSafe we recommend a two step approach to client onboarding:

- First, send a quote or a business proposal that is accessible via a button in a well crated email. Your ‘prospect’ will be able to approve the quote, perhaps pay you money and sign the agreement

- Second, given that the prospect is now a client, invite the client to a secure client portal through which you can complete the onboarding process. This may include filling out multiple questionnaires that lead the client through a logic-based decision tree, helping them get to the right questions fast.

In conclusion, evaluating your current onboarding procedures and integrating electronic signatures is essential for small businesses looking to streamline their customer onboarding process. By identifying pain points, improving security and compliance, and enhancing the overall customer experience, you can create a more efficient and effective onboarding process that will benefit both your business and your customers.

Chapter 3: Choosing the Right Electronic Signature Solution

Factors to Consider When Selecting an Electronic Signature Provider

In the digital age, electronic signatures have become a crucial tool for small businesses looking to streamline their customer onboarding processes. However, with so many electronic signature providers on the market, it can be overwhelming to choose the right one for your business. In this subchapter, we will explore the factors to consider when selecting an electronic signature provider to ensure that you choose the best option for your small business.

– The first factor to consider when selecting an electronic signature provider is security. It is essential to choose a provider that offers robust security features to protect your customers’ sensitive information. Look for providers that offer encryption, multi-factor authentication, and compliance with industry standards such as GDPR and HIPAA. By prioritizing security, you can instill trust in your customers and protect their personal data.

- Another factor to consider is ease of use. The electronic signature provider you choose should have a user-friendly interface that is easy for both you and your customers to navigate. Look for providers that offer intuitive design, customization options, and integrations with other software systems you may already be using. By choosing a provider that is easy to use, you can streamline your customer onboarding processes and improve the overall customer experience.

- Cost is also an important factor to consider when selecting an electronic signature provider. While it is important to choose a provider that offers competitive pricing, it is equally important to consider the value you are getting for your money. Look for providers that offer transparent pricing plans with no hidden fees, and consider factors such as the number of users, documents, and signatures included in the plan. By choosing a provider that offers a balance of affordability and value, you can maximize the return on your investment.

- Integration capabilities are another important factor to consider when selecting an electronic signature provider. Look for providers that offer seamless integrations with other software systems you may already be using, such as CRM or document management systems. By choosing a provider with strong integration capabilities, you can streamline your workflows, reduce manual data entry, and improve the efficiency of your customer onboarding processes.

In conclusion, selecting the right electronic signature provider is crucial for small businesses looking to streamline their customer onboarding processes. By considering factors such as security, ease of use, cost, and integration capabilities, you can choose a provider that meets your business’s specific needs and helps you achieve your customer onboarding goals. By taking the time to research and evaluate different providers, you can make an informed decision that will benefit your business in the long run.

Comparing Different Electronic Signature Platforms

Electronic signature platforms have become increasingly popular among small businesses looking to streamline their customer onboarding procedures. With so many options available, it can be overwhelming for small business owners to choose the right platform that suits their needs. In this subchapter, we will compare different electronic signature platforms to help small business owners make an informed decision.

One of the most popular electronic signature platforms is DocuSign. DocuSign offers a user-friendly interface that makes it easy for both businesses and customers to sign documents electronically. It also integrates seamlessly with a variety of other business tools, making it a versatile option for small businesses looking to streamline their onboarding processes.

Another popular option is Adobe Sign, which offers a range of features that cater to small businesses. Adobe Sign allows users to create custom templates, track the status of documents, and integrate with popular business tools such as Microsoft Office and Salesforce. Small business owners looking for a platform that offers advanced features and customization options may find Adobe Sign to be a good fit.

For small businesses on a budget, HelloSign is an option that still offers a range of features. HelloSign allows users to create unlimited templates, track document status, and integrate with popular business tools such as Google Drive and Dropbox. Small business owners looking for a simple yet effective electronic signature platform may find HelloSign to be a good choice.

SignNow is another electronic signature platform that offers a range of features tailored to small businesses. SignNow allows users to create custom templates, track document status, and integrate with popular business tools such as Salesforce and Google Drive. Small business owners looking for a platform that offers flexibility and ease of use may find SignNow to be a good fit for their needs.

MyDocSafe is arguably the most cost effective option of them all. It offers not just esign, but powerful business tools such as business proposals and client portals that require separate subscriptions if you use one of its competitors.

Ultimately, the best electronic signature platform for your small business will depend on your specific needs and budget. By comparing the features and pricing of different platforms, small business owners can make an informed decision that will help streamline their customer onboarding processes and improve overall efficiency.

Chapter 4: Integrating Electronic Signatures into Your Onboarding Process

Implementing Electronic Signatures in Customer Forms

As a small business owner, implementing electronic signatures in customer forms can greatly streamline your customer onboarding process. Electronic signatures make it easy for customers to sign important documents digitally, saving time and resources for both you and your customers. In this subchapter, we will discuss the benefits of using electronic signatures in customer forms and provide tips on how to successfully integrate this technology into your onboarding procedures.

The first step in implementing electronic signatures in customer forms is to choose a reliable electronic signature software that meets the needs of your business. There are many options available on the market, so it’s important to do your research and select a software that is user-friendly, secure, and compliant with legal regulations. Look for features such as customizable templates, document tracking, and secure storage to ensure a smooth onboarding process for your customers.

Note that most companies offer free trial periods that usually range from 7 to 30 days. MyDocSafe offers 30 days, no commitment, no credit card required option. Once the trial ends, you will be able to continue using the same account if you subscribe.

Once you have selected an electronic signature software, the next step is to update your customer forms to include electronic signature fields. You can easily create digital forms using the software’s drag-and-drop editor, or you can upload existing paper forms and convert them into electronic documents. Make sure to clearly label where customers need to sign and provide instructions on how to complete the electronic signature process to avoid any confusion.

Note that MyDocSafe form editor can automatically convert a form into a PDF and add electronic signature fields to it (in you chosen places). In that way you get the best of both world: exportable data that was provided in the questionnaire and an immutable signed PDF version.

After updating your customer forms, it’s important to communicate the changes to your customers and provide them with the necessary information to complete the electronic signature process. Consider sending out an email or posting a notice on your website explaining the benefits of electronic signatures and providing instructions on how to sign documents digitally. You may also want to offer customer support for those who may have questions or need assistance with the new process.

Finally, once you have successfully implemented electronic signatures in your customer forms, be sure to regularly review and update your procedures to ensure they are meeting the needs of your business and customers. Monitor the efficiency of your onboarding process, gather feedback from customers, and make any necessary adjustments to improve the overall experience. By integrating electronic signatures into your customer onboarding procedures, you can save time, reduce paper waste, and create a more seamless experience for your customers.

Implementing Electronic Signatures in business proposals

As a small business owner, incorporating electronic signatures into your business proposals can streamline your customer onboarding process and improve efficiency. Electronic signatures are a secure and legally binding way to obtain signatures on important documents without the need for printing, scanning, or mailing. By implementing electronic signatures, you can save time, reduce paperwork, and provide a more convenient experience for your customers.

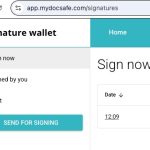

When sending out business proposals that require signatures, be sure to clearly communicate the process for electronic signatures to your customers. Provide instructions on how to sign the document electronically, including any verification steps that may be required. Make it easy for customers to access and sign the document by sending it via email or providing a secure link for them to review and sign online.

By implementing electronic signatures in your business proposals, you can improve the efficiency of your customer onboarding process and enhance the overall experience for your customers. Electronic signatures offer a secure and convenient way to obtain signatures on important documents, reducing the need for paperwork and manual processes. Take the time to research and choose the right electronic signature platform for your small business, customize templates for your business proposals, and communicate the process clearly to your customers to streamline your customer onboarding procedures.

Training Staff on Using Electronic Signature Software

Training staff on using electronic signature software is a crucial step in successfully integrating this technology into your customer onboarding procedures. By providing thorough and effective training, you can ensure that your employees are comfortable and confident in using the software, which will ultimately improve the overall customer experience.

The first step in training staff on using electronic signature software is to familiarize them with the basic functionality and features of the software. This may include teaching them how to create and send electronic documents for signature, how to track the status of documents, and how to verify the authenticity of electronic signatures. By providing hands-on training and allowing employees to practice using the software in a controlled environment, you can help them feel more comfortable and confident in using it in their day-to-day tasks.

In addition to teaching employees how to use the software, it is also important to educate them on the legal implications of electronic signatures. This may include explaining the laws and regulations governing electronic signatures, as well as the security measures in place to protect the integrity of electronic documents. By ensuring that your staff understands the legal and security implications of using electronic signatures, you can help prevent any potential issues or misunderstandings that may arise during the onboarding process.

Another important aspect of training staff on using electronic signature software is to provide ongoing support and resources for employees as they continue to use the software. This may include creating user guides or training materials that employees can reference when they have questions or issues, as well as offering regular training sessions or workshops to help employees stay up-to-date on the latest features and updates to the software. By providing ongoing support and resources, you can help ensure that your staff remains confident and proficient in using the software.

At MyDocSafe we believe that the time of reading manuals and tutorials related to consumer facing software is coming to the end. That is why we aim at making all of the above steps redundant as we offer a suite of training videos that dramatically simplify your employee onboarding time.

Overall, training staff on using electronic signature software is a critical component of successfully integrating this technology into your customer onboarding procedures. By providing thorough and effective training, educating employees on the legal implications of electronic signatures, and offering ongoing support and resources, you can help ensure that your staff is well-equipped to use the software confidently and effectively, ultimately improving the overall customer experience for your small business.

Chapter 5: Ensuring Compliance and Security

Understanding Legal Requirements for Electronic Signatures

In today’s digital age, electronic signatures have become a convenient and efficient way for small businesses to streamline their customer onboarding processes. However, it is important for small business owners to understand the legal requirements surrounding electronic signatures in order to ensure compliance and protect their business interests. This subchapter will provide a detailed overview of the legal requirements for electronic signatures, helping small business owners navigate this increasingly important aspect of customer onboarding.

First and foremost, it is crucial for small business owners to understand that electronic signatures are legally binding in most jurisdictions. The Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) provide the legal framework for electronic signatures in the United States, establishing that electronic signatures are equivalent to traditional pen-and-ink signatures. By complying with these laws, small businesses can ensure that their electronic signatures are legally valid and enforceable.

In addition to understanding the legal framework for electronic signatures, small business owners must also ensure that their electronic signature processes meet certain requirements to be considered valid. For example, electronic signatures must be linked to the signatory and must be capable of verifying the identity of the signer. Small businesses should also maintain records of electronic signature transactions to demonstrate compliance with legal requirements in the event of a dispute.

Furthermore, small business owners should be aware that certain types of documents may not be suitable for electronic signatures due to legal restrictions or industry-specific regulations. For example, documents requiring notarization or certain types of contracts may still require physical signatures in some jurisdictions. By understanding these limitations, small businesses can avoid potential legal pitfalls and ensure that their electronic signature processes are both efficient and legally compliant.

Overall, understanding the legal requirements for electronic signatures is essential for small businesses looking to integrate electronic signatures into their customer onboarding procedures. By complying with relevant laws and regulations, small business owners can streamline their onboarding processes, improve efficiency, and provide a seamless experience for their customers. With the right knowledge and tools, small businesses can leverage electronic signatures to enhance their operations and stay ahead in today’s competitive business landscape.

Implementing Security Measures to Protect Customer Data

In today’s digital age, small businesses are increasingly relying on electronic signatures to streamline their customer onboarding processes. However, with the convenience of electronic signatures comes the responsibility of safeguarding sensitive customer data. Implementing security measures to protect customer data is crucial in order to build trust with your customers and maintain compliance with data protection regulations.

The first step in implementing security measures to protect customer data is to choose a reputable electronic signature provider. Look for a provider that offers robust encryption protocols, secure data storage, and regular security audits. It’s important to thoroughly vet your electronic signature provider to ensure that they have the necessary safeguards in place to protect your customers’ personal information.

Once you have selected a secure electronic signature provider, it’s essential to educate your employees on best practices for handling customer data. Train your team on the importance of keeping customer information confidential, using secure passwords, and following proper data protection protocols. Regularly review your security policies and procedures to ensure that your team is up to date on the latest security measures.

In addition to educating your team, it’s crucial to implement access controls to limit who has access to sensitive customer data. Use role-based access controls to restrict employees to only the data they need to perform their job duties. Regularly review and update access controls to ensure that only authorized personnel have access to customer data.

Lastly, regularly monitor and audit your electronic signature system to identify and address any potential security vulnerabilities. Conduct regular security assessments, penetration testing, and audits to ensure that your customer data is secure. By taking proactive measures to protect customer data, you can build trust with your customers and demonstrate your commitment to data security.

MyDocSafe is ISO27001 certified and offers secure client portals which store encrypted versions of signed documents. This minimises any house-keeping or document sharing tasks as we do most of the heavy lifting.

Chapter 6: Streamlining Customer Onboarding with Electronic Signatures

Improving Efficiency in the Onboarding Process

Improving efficiency in the onboarding process is crucial for small businesses looking to streamline their operations and provide a seamless experience for new customers. One effective way to enhance the onboarding process is by integrating electronic signatures into the customer onboarding procedures. Electronic signatures allow businesses to digitize the paperwork involved in onboarding, reducing the time and resources required to onboard new customers. By eliminating the need for physical paperwork and manual signatures, businesses can expedite the onboarding process and improve overall efficiency.

Integrating electronic signatures into the onboarding process can also help small businesses enhance security and compliance. Electronic signatures provide a secure and legally binding way to capture customer consent and agreement, reducing the risk of fraud and ensuring compliance with regulations. By leveraging electronic signatures, small businesses can streamline their onboarding procedures while maintaining the necessary security and compliance standards.

In addition to improving efficiency and enhancing security, integrating electronic signatures into the onboarding process can also enhance the customer experience. Electronic signatures allow customers to sign documents digitally from anywhere, at any time, making the onboarding process more convenient and user-friendly. By providing customers with a seamless and efficient onboarding experience, small businesses can differentiate themselves from competitors and build stronger relationships with customers.

Furthermore, integrating electronic signatures into the onboarding process can help small businesses reduce costs associated with printing, storing, and managing paper documents. By digitizing the onboarding process, businesses can eliminate the need for physical paperwork and manual processes, saving time and resources. Additionally, electronic signatures can help businesses reduce errors and improve accuracy in the onboarding process, leading to greater overall efficiency and cost savings.

Overall, integrating electronic signatures into the customer onboarding procedures can help small businesses improve efficiency, enhance security and compliance, enhance the customer experience, and reduce costs. By leveraging electronic signatures, small businesses can streamline their onboarding processes and position themselves for success in an increasingly digital world.

Enhancing the Customer Experience through Electronic Signatures

In today’s fast-paced digital age, small businesses are constantly looking for ways to streamline their operations and enhance the overall customer experience. One way to achieve this is by integrating electronic signatures into customer onboarding procedures. Electronic signatures offer a convenient and efficient way for businesses to collect signatures from customers without the hassle of printing, signing, and scanning documents.

By incorporating electronic signatures into the customer onboarding process, small businesses can significantly reduce the time it takes to onboard new customers. With electronic signatures, customers can easily sign documents from anywhere at any time, eliminating the need for in-person meetings or mailing physical documents. This not only saves time for both the business and the customer, but it also helps to create a more seamless and convenient onboarding experience.

Additionally, electronic signatures help to enhance the security of customer data. By using encrypted technology to collect and store electronic signatures, businesses can ensure that sensitive customer information is protected from unauthorized access. This added layer of security not only helps to build trust with customers but also ensures compliance with data protection regulations.

Furthermore, electronic signatures can help small businesses save money on paper, printing, and storage costs. By moving to a paperless system, businesses can reduce their environmental impact while also cutting down on overhead expenses. This cost-effective solution allows small businesses to allocate their resources more efficiently and focus on growing their business.

Overall, integrating electronic signatures into customer onboarding procedures is a win-win for both small businesses and their customers. By streamlining the onboarding process, enhancing security, and saving money, businesses can improve the overall customer experience and set themselves apart from the competition. With electronic signatures, small businesses can take their customer onboarding procedures to the next level and create a more efficient and user-friendly experience for their customers.

Chapter 7: Case Studies

Success Stories of Small Businesses Implementing Electronic Signatures

In the competitive world of small business, finding ways to streamline operations and improve efficiency can be the key to success. One area where many small businesses are seeing significant benefits is in the implementation of electronic signatures for customer onboarding procedures. By digitizing the process of obtaining signatures from new customers, businesses are able to save time, reduce errors, and provide a more seamless experience for their clients.

One success story comes from a boutique accounting firm that implemented electronic signatures as part of their VAT submission service. By requiring customers to sign VAT reports via email, the firm was able to drastically reduce the amount of time spent on paperwork and administrative tasks. This not only saved them time and money, but also improved the overall customer experience by making the process quick and easy.

Another success story comes from a small law firm that integrated electronic signatures into their client intake process. By using an electronic signature platform, the firm was able to securely collect signatures from clients on legal documents without the need for in-person meetings. This not only saved the firm time and resources, but also allowed them to provide a more convenient and efficient service to their clients.

A third success story comes from a local real estate agency that adopted electronic signatures for their rental agreements and lease documents. By allowing tenants to sign documents electronically from their smartphones or computers, the agency was able to eliminate the need for printing, scanning, and mailing physical documents. This not only saved the agency time and paper, but also reduced the risk of errors and delays in the rental process.

Overall, these success stories highlight the many benefits that small businesses can experience by integrating electronic signatures into their customer onboarding procedures. By embracing digital solutions, businesses can streamline operations, save time and money, and provide a more convenient and efficient experience for their clients. As technology continues to evolve, small businesses that adapt and innovate will be better positioned to succeed in the ever-changing marketplace.

Chapter 7: Conclusion

Recap of Key Points

In this subchapter, we will recap some of the key points discussed throughout the book on streamlining customer onboarding with electronic signatures. As a small business owner looking to integrate electronic signatures into your customer onboarding procedures, it is important to understand the benefits and best practices associated with this technology.

First and foremost, electronic signatures can greatly improve the efficiency of your customer onboarding process. By allowing customers to sign documents digitally, you can eliminate the need for physical paperwork and manual processing, saving time and reducing the risk of errors. This streamlined approach can help your small business operate more smoothly and provide a better experience for your customers.

Additionally, electronic signatures offer enhanced security and compliance capabilities. With advanced encryption and authentication features, you can ensure that your customers’ sensitive information is protected and that your business remains in compliance with relevant regulations. This added layer of security can help build trust with your customers and protect your business from potential legal issues.

Furthermore, electronic signatures can also help you save money by reducing paper and printing costs. By going digital, you can eliminate the need for physical storage space and reduce the amount of time and resources spent on managing paperwork. This cost-effective solution can help your small business operate more efficiently and allocate resources to other areas of your business that need attention.

In conclusion, integrating electronic signatures into your customer onboarding procedures can provide numerous benefits for your small business. From improved efficiency and security to cost savings and compliance advantages, this technology can help your business thrive in today’s digital age. By understanding and implementing the key points discussed in this book, you can successfully streamline your customer onboarding process and create a better experience for both your business and your customers.

Next Steps for Implementing Electronic Signatures in Your Business

Now that you have a better understanding of how electronic signatures can streamline your customer onboarding processes, it’s time to take the next steps in implementing this technology into your business. In this subchapter, we will discuss the key actions you need to take to successfully integrate electronic signatures into your customer onboarding procedures.

The first step is to choose the right electronic signature solution for your business. There are many different options available, so it’s important to do your research and find a solution that meets your specific needs. Look for a solution that is user-friendly, secure, and compliant with relevant regulations. Consider factors such as pricing, customer support, and integration capabilities when making your decision.

Once you have selected an electronic signature solution, it’s time to start the implementation process. Work closely with your chosen provider to set up the software and train your staff on how to use it effectively. Make sure to communicate the benefits of electronic signatures to your team so they understand the value this technology can bring to your business.

Next, update your customer onboarding procedures to include electronic signatures. This may require making changes to your existing processes and forms, so be prepared to invest some time and resources into this transition. Make sure to communicate these changes to your customers so they are aware of the new procedures and understand how to use electronic signatures.

Finally, monitor the performance of your electronic signature implementation and make adjustments as needed. Keep track of key metrics such as completion rates, turnaround times, and customer satisfaction levels to ensure that the technology is delivering the expected results. Stay informed about new developments in electronic signature technology and be open to making changes to further enhance your customer onboarding processes. By following these steps, you can successfully integrate electronic signatures into your business and streamline your customer onboarding procedures for greater efficiency and customer satisfaction.

Lastly, feel free to take MyDocSafe for a free spin or write to sales@mydocsafehq.com if you would like to find out more.

About MyDocSafe

MyDocSafe is a client engagement platform for professional services firms. Through MyDocSafe companies automate pre-sale and post-sale workflows (quotes, business proposals, client onboarding) and then secure and automate the deal/transaction processes through encrypted client portals (document approval, document exchange). The system also includes a proprietary electronic signing, eform and workflow automation engine, making the system industry agnostic and highly customisable.