The Legalities of Electronic Signatures: What You Need to Know

In the digital age, the way we sign important documents is changing dramatically. With the click of a button, we can now sign contracts, agreements, and even tax forms electronically. But how legally binding are these electronic signatures? As the use of these signatures becomes more widespread, it’s important to understand the legalities surrounding them. In this article, we’ll explore everything you need to know about electronic signatures, from their legal status to the requirements for creating a valid one. So grab a cup of coffee and let’s dive in.

What is an Electronic Signature?

We cannot start by mentioning what a wet signature is. A wet signature is what some us still have to do from time to time – take a pen, maybe not a quill pen any more, but a ball pen, and sign a document on the dotted line. The ‘wet’ comes from the ink, which needs time to dry.

An electronic signature, in contrast, refers to a digital representation of a person’s signature. It is used to sign a document in electronic form and serves as evidence that the individual has signed the document. Unlike a handwritten signature, an electronic signature is created using various technologies such as a computer, mobile device, or specialized hardware.

Electronic signatures can take many forms, including:

- a typed name,

- a digitized version of a handwritten signature,

- a biometric signature,

- or a graphic image of a signature.

Essentially, any method that

- uniquely identifies the signer and

- provides evidence of their intent to sign

can be considered an electronic signature.

The use of electronic signatures is becoming increasingly popular as people move away from traditional paper-based methods. They offer convenience, speed, and efficiency when signing documents, particularly in remote or online settings. However, it is essential to understand the legalities and standards that surround electronic signatures to ensure their validity.

Types of Electronic Signatures

When it comes to electronic signatures, there are various types one should know. First, there is a simple electronic signature (SES), which is basically an electronic image of your handwritten signature. This kind of signature can be created with your computer or mobile device. An example of a SES is a squiggle you place on a hand held device when accepting a parcel delivery.

Second, there is a biometric signature. This type of signature uses unique physiological characteristics of the signer, such as fingerprints or voice recognition, to verify their identity. Another type of electronic signature is the advanced electronic signature (AES). AES requires a higher level of security and is usually used for more sensitive documents.

Lastly, there is the qualified electronic signature (QES), which is the most secure type of electronic signature. It is regulated by law, and requires a digital certificate issued by a trusted third-party. It is important to understand these different types of electronic signatures to determine which one is best suited for your needs.

Legal Framework for Electronic Signatures

Key Legislation

Key legislation refers to the laws that regulate electronic signatures. These laws establish the legal validity and enforceability of an electronic signature under certain conditions.

In the United States introduced the main law governing electronic signatures, Electronic Signatures in Global and National Commerce Act (ESIGN), in 2001. ESIGN requires that electronic signatures be given the same legal effect as traditional signatures and provides guidelines for their use in commerce.

Another important law is the Uniform Electronic Transactions Act (UETA). 47 states have already adopted it. UETA provides a framework for the use of electronic signatures and records in transactions.

Internationally, the United Nations Commission on International Trade Law (UNCITRAL) developed the Model Law on Electronic Signatures in 2001 to promote the use of electronic signatures in international trade. Many countries use international frameworks, especially that offered by the EU ready-made templates for adoption and fine tuning.

The European Union introduced SES, AES and QES concepts and definitions via the EIDAS legislation in 2014.

International Standards

International Standards refer to a set of guidelines and protocols agreed upon by various countries and organizations around the world to regulate and standardize activities across different borders, industries, and sectors. In the context of electronic signatures, international standards provide a unified approach to their use and ensure their legality across various regions and jurisdictions.

The most widely recognized standard for electronic signatures is the eIDAS Regulation, which the European Union (EU) adopted in 2014 to unify and standarize the EU market to promote cross border trade. Other international standards include the UNCITRAL Model Law on Electronic Signatures, which is commonly used in North America and in various countries around the world, and the ISO 27001, which defines the security controls necessary for ensuring the integrity and confidentiality of data in general and e-signatures in particular.

In short, International Standards for electronic signatures ensure that e-signatures are valid and enforceable in different countries and can be used for cross-border transactions without any legal hindrance. Compliance with these standards helps businesses to gain trust and confidence in their electronic signature systems, avoid legal challenges, and ensure seamless international business transactions.

Validity of Electronic Signatures

Legal Recognition

Legal recognition refers to the extent to which electronic signatures are treated as legally valid and enforceable. Here’s what you need to know:

- Countries around the world have varying legal frameworks for electronic signatures.

- Some countries have specific legislation that recognizes electronic signatures as equivalent to handwritten signatures. Other countries may not have explicit legislation but still accept electronic signatures under certain conditions.

- Electronic signatures must meet certain criteria to be legally recognized, such as being capable of identifying the signer and indicating their intent.

- Electronic signature standards like the eIDAS Regulation in the EU and the Uniform Electronic Transactions Act in the US provide a legal framework for electronic signatures and can help ensure their legal recognition.

- Legal recognition of electronic signatures can provide cost savings and efficiency in business transactions, but it’s important to understand the legal landscape and ensure compliance with regulations and laws.

Authenticity and Integrity

Authenticity refers to ensuring that the signature was indeed made by the person claiming to have made it, and not by someone else. It involves measures such as verifying the identity of the signatory, ensuring that they have the necessary authority to sign a document, and keeping a record of the signature.

On the other hand, integrity refers to ensuring that no one tempered with the signed document or altered in any way after signing. This involves implementing security measures such as encryption, digital certificates, and secure signing devices to prevent unauthorized changes to the document.

Both authenticity and integrity are critical in ensuring that electronic signatures are legally valid and can be relied upon as evidence in court. It is important for organizations to implement measures to safeguard the authenticity and integrity of electronic signatures in order to protect themselves and their customers from fraud and other malicious activities.

Acceptance and Use of Electronic Signatures

Organizations’ Obligations

Organizations have obligations when it comes to accepting and using electronic signatures, including:

- Ensuring that electronic signatures are legally valid based on the applicable laws and regulations.

- Implementing appropriate security measures to prevent unauthorized access to electronic signature systems and to protect confidential information.

- Providing clear information to users about the use of electronic signatures and how they can be used to sign documents.

- Ensuring that electronic signatures are properly authenticated and that the signatory is authorized to sign the document.

- Keeping records of electronic signature transactions and ensuring that they are stored securely.

- Establishing procedures for resolving disputes related to electronic signatures, including issues of non-repudiation, authenticity, and integrity.

- Conducting periodic audits and assessments of electronic signature systems to ensure that they are functioning properly and in compliance with all relevant laws and regulations.

Overall, organizations must take a proactive approach to electronic signature management, ensuring that they are using the technology in a legally compliant and secure manner that meets the needs of their users.

Role of Government

The role of government in electronic signatures is crucial. Here are some key points to keep in mind:

- Governments around the world have created laws and regulations that specify how electronic signatures can be used.

- Government agencies often issue guidelines and best practices to help businesses and consumers understand how to use electronic signatures safely and effectively.

- Some governments have created specialized agencies to oversee electronic signature technologies and enforce laws related to their use.

- In many cases, government agencies themselves use electronic signatures extensively, which helps to establish credibility and promote wider adoption among the public and private sectors.

- Governments can play a key role in ensuring that electronic signatures are secure and reliable by setting standards and requiring audits of electronic signature providers.

- Finally, governments can help to promote trust in electronic signatures and provide legal clarity around their use by establishing clear rules for when and how electronic signatures can be used in legal, financial, and other sensitive transactions.

Consumer Preferences

Consumer preferences refer to the choices made by individuals or groups of consumers when it comes to electronic signatures. Some consumers may prefer using electronic signatures for convenience, while others may prefer traditional paper signatures due to trust issues or personal preferences.

What consumers want can also be influenced by factors such as accessibility and affordability. For example, some consumers may prefer electronic signatures because they are readily available and easy to use. Others may prefer traditional signatures because they do not require access to technology or expensive software.

Organizations should consider consumer preferences when implementing electronic signature systems, as it can impact consumer satisfaction and adoption rates. It is crucial to educate consumers on the benefits and security of electronic signatures to increase their acceptance and usage.

Benefits and Drawbacks of Electronic Signatures

Advantages

The advantages of electronic signatures are numerous. Firstly, they offer convenience as they can be applied from anywhere in the world at any time. Secondly, they reduce paperwork and bureaucracy, which saves time, effort, and money. Electronic signatures also eliminate the need for physical storage and transportation of paper documents.

Moreover, electronic signatures are more secure than traditional signatures as they are tamper-evident, and the signer’s identity can be verified through multi-factor authentication. They also provide a clear audit trail, ensuring that the signature’s authenticity can be verified at any time.

Additionally, electronic signatures can accelerate the signing process, which can expedite business transactions and improve workflow. They also reduce the risk of errors and inaccuracies, as they can be programmed to contain specific requirements and validation criteria.

Lastly, electronic signatures can contribute to environmentally friendly practices by

- reducing paper usage,

- reducing printer usage,

- leading to a positive impact on the environment in terms of conservation, resource use, and waste reduction.

Disadvantages

While electronic signatures provide many advantages, such as speed, convenience, and cost-effectiveness, they also have their drawbacks. These can include concerns about security, privacy, and reliability.

One disadvantage of electronic signatures is the risk of identity theft or fraud. If someone gains access to a person’s signature, they could use it to sign documents without the person’s permission. This can lead to legal disputes and financial loss.

Another potential disadvantage is the lack of universal acceptance of electronic signatures. Some organizations may not accept them as legally binding, which can create complications in conducting business.

Additionally, some people may feel uncomfortable with the idea of electronic signatures and prefer to sign documents in person. This can lead to resistance from some consumers or employees, resulting in slower adoption of electronic signatures.

Finally, electronic signatures can be challenging for individuals who are not tech-savvy or do not have access to the necessary technology. This can create barriers to entry for certain groups, such as the elderly or those in developing countries.

While electronic signatures are becoming increasingly prevalent and widely accepted, it is important to consider the potential drawbacks when deciding whether to use them. By addressing these concerns and implementing best practices, we can ensure that electronic signatures are a safe and effective way to conduct business in the digital age.

Over to you

Electronic signatures are becoming increasingly popular in the business world due to their convenience and efficiency. However, it’s essential to understand the legalities surrounding these signatures before using them. Electronic signatures are legal and binding in most countries, including the United States and the European Union. To be considered legally binding, electronic signatures must meet specific requirements outlined in laws and regulations. The two major ones are the Electronic Signatures in Global and National Commerce Act in the US and the eIDAS Regulation in the EU. These requirements include

- identifying and authenticating signers,

- providing a clear indication of intent to sign,

- and maintaining the integrity of signed documents.

The use of electronic signatures can also help businesses save time and money, streamline workflows, and enhance security. However, it’s crucial to choose a reputable electronic signature service provider and follow best practices such as

- keeping a record of signed documents,

- ensuring that all parties understand the terms of the agreement,

- and using an appropriate type of signature for the right purpose

Understanding the legalities of electronic signatures is crucial for any business looking to digitize its operations while ensuring compliance with laws and regulations.

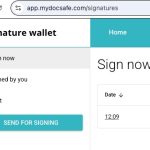

How do we do it?

At MyDocSafe we offer AES and QES flavors. Each signed document

- is appended with a certificate that records the document journey,

- its fingerprint,

- signers details such as name and email address,

- time stamps,

- IP addresses

- and other security elements used in the transaction (SMS verification, Knowledge Based Authentication, or QES).

We maintain the integrity of signed documents by creating a PDF version of the signed document and recording its fingerprint on our servers. We record and store the fingerprint of the original document and place it on our certificate. Any changes in the resultant PDF will change its fingerprint which can be easily verified through our publically available signature verification service. To verify QES, make sure the QES stamp is visible in the bottom left corner of MyDocSafe certificate. Then open the document in Adobe document viewer and lookup the signature through it.

Last but not least, we embed our esign technology in our client portal platform, which is password protected and offers 2-factor-authentication, empowering you to design and launch easy-to-use client registration workflows.