As accountants and bookkeepers, you walk a tightrope. Every day you deal with engagement letters, annual reports, payslips, payroll reports and more. On one hand, you want to give your clients easy access to their data, in a clear and “on demand” fashion. On the other, you’re bound to handle this data in a compliant and secure fashion.

How can access requirements be balanced with the high levels of security and process that this confidential information demands? What are some of the best practices to observe here?

Winning Customer Service: 24/7 Access Is Everything

When it comes to documentation and data, transparency and instant access is a baseline expectation for today’s clients. The fourth industrial revolution, brought about by the rapid acceleration and evolution of technology, has meant the true digital transformation of society.

Couple this seismic societal shift with the influence of the global pandemic, which has placed a strong (and lasting) emphasis on remote working practices, and it’s easy to see why seamless digital collaboration and 24/7 access has become such an important component of a modern accountancy client experience.

Immediacy and fluidity of process are of paramount importance when it comes to online interactions. Clients increasingly expect to be able to act independently, accessing information and completing tasks at their own convenience. Getting answers to questions shouldn’t necessitate a labour-intensive string of emails and bulky attachments. Instead, there’s a growing expectation for the process to be smooth, seamless and “self service.”

Bookkeeping and accountancy are rising to meet this challenge. Increasingly, firms undergoing digital transformation are working with solutions that can facilitate these efficient new ways of working. Automation of repetitive, administrative tasks, for example, represents a huge opportunity for the industry. Not only does it help guard against human error, it also speeds up workflows, leading to happier clients and better time to revenue.

In a survey of 200 UK accountants, it was discovered that for 81%, the automation of simple tasks could save around 2 hours a day. For Scottish accountants this figure was even higher, with around 3-4 hours a day saved – equating to £120,000 in untapped revenue per year.

Managing Multiple Data Sources

Modern accountancy demands the ability to handle data (securely and compliantly) from a wider range of data sources – financial and non financial. There’s a pressing need to be able to both accept and protect this incoming data, no matter the format or presentation.

The benefits of being able to receive, gather and interpret a wider range of data are more than purely practical. The broader the range of sources shedding light on a client and their unique situation, the more insight can be gained. This enhanced intelligence can lead to better informed recommendations, better reporting and more accurate auditing.

What’s the best way to ensure reliable access to the widest range of data? Increasingly, third party integrations are paving the way when it comes to the smooth running of this processing. By carefully choosing partners with an established ecosystem of integrations, bookkeepers and accountants can ensure their systems are fully optimized in this regard.

MyDocSafe’s Zapier integration is a great example of how functionality can be added to your system in this way. It allows for seamless export of data from webforms (easily sent to clients through MyDocSafe) to any system that talks to Zapier.

With multiple data sources in the mix, it’s important to ensure the permanence of your “front-of-house” window. Your technical requirements might change, but clients still want familiarity and reassurance. In addition to ensuring that they have easy access to the answers they’re searching for, an accountancy DMS like MyDocSafe means that, even if you change your back end systems, clients will still find everything they need in the same place.

Building Trust In Accountancy

Having a dependable method of data sharing with clients is about more than simple convenience. It also represents a valuable opportunity to build trust and improve connection. Smoother, more professional sharing of data aids transparency, which forms the bedrock of all solid client relationships.

How can this be achieved, and improved upon? A smooth onboarding process offers a real chance to impress and set the tone for the way that your professional relationship will play out over time. Working with an accountancy DMS such as MyDocSafe means that the entire onboarding experience can be branded, automated and customized to perfectly meet the needs and expectations of your new clients. Your clients are empowered to work, independently, through a carefully curated flow, bringing you all of the information you require in the most efficient and secure manner possible.

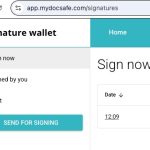

Additionally, digital signatures can be requested and captured as part of a simple, automated flow. No chasing emails, no delays to authorised business moving ahead. Automatic notifications and reminders ensure that progress is swift and professional. First impressions count, and MyDocSafe ensures a great experience.

Following on from onboarding, MyDocSafe offers your clients a branded portal, meaning that ongoing interactions feel professional, safe and familiar. Instead of being asked to navigate through a range of unknown third party software interfaces (leading them to wonder who it is they’re really working with!) they’ll stay in familiar, trustworthy territory at all times.

Best Practices For The Future

To wrap up, here are 4 essential practices to deploy when rising to meet the expectations of clients when it comes to security, 24/7 access and exemplary customer service.

- Granular access rights

Within your team, you can have client data hidden from other team members to create ‘virtual Chinese walls’ that improve confidentiality. This is especially important if your firm works for clients who may be in direct competition with each other.

- Client portals

If you’re looking to give your clients a truly personalized service, and demonstrate top level customer service, functionality and security, leveraging customized customer portals is key. By giving each client their own unique access point, account management is made much smoother internally.

- Encryption

It goes without saying that you should work with an accounting DMS that offers encryption to ensure the total security of your clients’ data. For certain clients who may need or request additional layers of security, access to private encryption keys can add an extra layer of reassurance.

- Work With Webforms

Your methods of data collection should be as secure as your methods of data storage and presentation. Look for an accounting DMS that can provide you with webform functionality, allowing for the secure collection of data directly from your clients.

An Accounting DMS With Security and 24/7 Access At Its Heart

MyDocSafe is an accountancy DMS built upon the balancing principles of instant, on-demand access and total security. From slick automated onboarding to fully branded client portals, top-level encryption to functional webforms and granular access rights – surprise, delight and reassure your clients with each interaction.

DMS = Document Management System