Wealth management is booming – but should the industry be resting on its laurels, or keeping a close eye on the impending issues which threaten to rock this seemingly stable boat?

In the first of two articles, we’ll explore the soft underbelly of the wealth management industry – investigating the potential pitfalls which promise to disrupt those who haven’t prepared for coming change…

Wealth Management: Maining An Upward Trajectory…

According to a recent report published by Research Dive, in the period spanning 2021-2028, the global wealth management market is expected to generate a revenue of $850.90 billion and grow at a healthy CAGR of 7.1%.

What’s driving this expansion? Many attribute the acceleration of the wealth management market to the emergence of improved digital technologies, able to optimise performance and enhance results obtained for clients. From the leverage of AI through to ChatBots and secure document management, the digital transformation of the wealth management industry has brought untold improvements to communication and general leverage of data, meaning more bandwidth and more predictable positive outcomes.

Within the sector, the human advisory sub-segment still reigns in terms of market share, and is estimated to generate a revenue of $516.67 billion across the 2021-2028 forecast period. As this service revolves so closely around interpersonal skills, flexible customisation, absolute discretion, trust and transparency, there’s a real opportunity for intersection of digital opportunity and professional relationship building to unlock huge growth opportunities.

The Evolution of The Wealth Management Audience

What could get in the way of this growth? We’d argue that more attention needs to be paid to the evolving expectations of a new generation of clients – tomorrow’s customers. These young, digitally native individuals will be approaching the wealth management industry with a completely different set of expectations, requirements and attitudes.

The wealth managers who are ill-prepared to meet these expectations (or worse, who haven’t taken time to understand them in the first instance) will rapidly find themselves outperformed by those who have evolved their offering and operations to accommodate this client base.

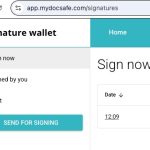

What exactly do the next generation of wealth management clients expect? For a start, a fully digitised experience. From intuitive “self service” interfaces that unlock instant insight through to smooth workflows, that give them the chance to access a full range of management or advisory functionality from any device (especially mobile.) This new breed of clients will be seeking efficiency, curated digital experiences and sleek, frustration-free onboarding journeys.

Security practices will also be thrust into the spotlight. These clients will seek for industry-leading best practices to be implemented and evident – but will also expect these processes to be unobtrusive, fully digital and swift to action. Modern biometric practices and kyc authentication will become increasingly commonplace in terms of expectations.

Wealth Management: An Industry Dragging Its Heels

A new generation of intelligent, proactive clients with high expectations and a great working knowledge of the digital tools that wealth managers can leverage to help them – surely this represents an exciting, overwhelmingly positive opportunity? Yes and no. While technology and expectations are advancing, there’s a third element that also needs to fall into place to complete the equation and unlock the situation’s full potential – implementation.

The technology to improve provision is ready. A new generation of savvy clients are eager to work with these tools, and the wealth managers who leverage them. The gap: adoption. Too many wealth management organisations are dragging their heels when it comes to digital transformation.

What’s the root cause of this reluctance to update and move into the modern digital age? For many, it will be a simple matter of complacency. When workflows and processes have always been carried out in a certain way, the impetus to evolve is reduced. Whatever the reasons for this lag, the end result will start to feel increasingly off putting to a younger, more dynamic clientbase.

An aging customer base is likely to remain loyal simply as a result of inertia, but as a new generation of clients starts to replace this older vanguard, expectations will shift and the need to move from retention to an acquisition model will rapidly accelerate.

Wealth Management: The Enemy On The Horizon

New, smaller, more agile wealth management organisations are currently flying underneath the radar, courting and working with this new generation of tech-savvy clients. They’re making an impression, building relationships and loyalty and finessing their offering as they learn more about tomorrow’s customer and the best ways to serve them.

By the time some of the more established wealth management companies wake up to the need for digital transformation, the damage will have been done. They represent bigger ships to turn – slower to react to this clear gap in the market, slower to embrace change. At the point that they realise their model needs to evolve, this new target audience will already be well-established in the care of the younger businesses that have been serving them with streamlined, digital experience from the start of the relationship.

Turning The Ship Around: Digital Transformation And The Wealth Management Sector

The good news is that when it comes to digital transformation within the wealth management industry, two parts of the puzzle are already in place. Great technology, that’s easy to implement and cost-effective to run, is readily available and already proven to be driving ROI and making a difference within the sector. Similarly, client expectations are rising, and with them, the willingness to embrace new digital tools within the wealth management process.

Digital transformation doesn’t have to happen overnight – incremental improvements to workflows all add up, and start to enhance client experience right away. Onboarding is a great area to focus on here – making a strong first impression and taking away the common pain points of personal data collection and security checks.

or contact us at sales@mydocsafehq.com.