Introduction to AML/KYC Compliance

Importance of AML/KYC regulations

Streamlining AML/KYC Compliance is crucial for accountants, lawyers, wealth managers, mortgage advisers and other “regulated professions” because they are expensive yet legally required. They were initially designed to prevent financial crimes such as money laundering, terrorist financing, and fraud. Increasingly they play an important role in fighting espionage and hybrid warfare and due to falling prices, are being adopted by smaller companies in a variety of industries. These regulations require businesses to verify the identity of their customers, assess the risk of potential money laundering activities, and report any suspicious transactions to the authorities. We are not going to list specific regulatory laws here as we assume that regulated professionals have that covered. Instead, we’ll describe why AML/KYC is important to society as a whole and how MyDocSafe can help automate and safeguard the process.

One of the key challenges faced by professionals in the regulated industries is the manual nature of AML/KYC compliance checks. With the increasing volume of transactions and the complexity of regulations, conducting thorough checks can be time-consuming and resource-intensive. This is where automating AML/KYC compliance checks with MyDocSafe can provide significant benefits. MyDocSafe is a secure platform that streamlines the verification process, making it easier for professionals to comply with regulations and protect their businesses from financial crimes.

By automating AML/KYC compliance checks with MyDocSafe, accountants, lawyers, and mortgage advisers can reduce the risk of non-compliance and potential fines. The platform uses advanced technology provided by Yoti to verify the identity of customers, assess the risk of money laundering activities, and flag any suspicious transactions. This not only saves time and resources but also enhances the accuracy and effectiveness of compliance checks.

In addition to improving efficiency, automating AML/KYC compliance checks with MyDocSafe can also help professionals stay ahead of regulatory changes. The Yoti platform is constantly updated to reflect the latest AML/KYC regulations, ensuring that businesses remain compliant at all times. This proactive approach can give professionals a competitive edge in their industries and build trust with their clients.

The limits of technology

A note of caution: automation has its limits. A recent BBC article revealed that foreign powers are infiltrating UK universities by posing as UK or European companies trying to engage with academics on innocent sounding research projects. In fact these companies were owned by entities based in hostile countries who might use this research for military purposes. Clearly, understanding who one is dealing with requires more than just ID verification. It might require a diligence process that includes asking prodding and sometimes uncomfortable questions about ultimate beneficiaries and true motivations.

This is where a well designed scorecards and a human process comes handy as it may just do the job of flagging suspicious counterparties. MyDocSafe can help with that as well through a design or digitization service of bespoke risk assessment scorecards. Armed with those, a company can automate what is easy to automate but can also add a proper “human” due diligence processes into their KYC workflows.

In conclusion, AML/KYC regulations are here to protect us all. Historically the were followed only by a handful of “regulated industries” and were rather expensive. Increasingly however, partially due to falling costs of ID tests, the technologies and tools used by those professions begin to appeal to all types of businesses who simply want to know who they are dealing with. from educational establishments to technology startups.

On an individual company level, automating compliance checks with MyDocSafe can streamline the verification process, reduce the risk of non-compliance, and help professionals stay ahead of regulatory changes. On an aggregate level, compliance professionals have a bigger role to play: help prevent societies from being infiltrated by foreign agents eager to undermine the democratic process or engaged in hybrid warfare.

Challenges faced by accountants, lawyers, and mortgage advisers in streamlining AML/KYC compliance

As professionals in the financial industry, accountants, lawyers, and mortgage advisers play a crucial role in ensuring compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. However, they often face numerous challenges in meeting these requirements, which can be time-consuming and complex.

- Sheer volume of regulations and guidelines that they must adhere to. The regulatory landscape is constantly evolving, with new laws and requirements being introduced regularly. This can make it difficult for accountants, lawyers, and mortgage advisers to stay up-to-date and ensure that they are in full compliance with all relevant regulations. Automating AML/KYC compliance checks with MyDocSafe can help to streamline this process (to a degree), by automatically checking client information against regulatory databases and flagging any potential issues.

- Need to collect and verify large amounts of client information. This can be a time-consuming and labor-intensive process, particularly when dealing with multiple clients or complex financial transactions. By using automated solutions like MyDocSafe, accountants, lawyers, and mortgage advisers can simplify this process by securely collecting, storing, and verifying client information in a centralized digital platform.

- Risk of human error. Manual processes are inherently prone to mistakes, which can have serious consequences for both the individual professional and their clients. By automating AML/KYC compliance checks with MyDocSafe, accountants, lawyers, and mortgage advisers can reduce the risk of errors and ensure that they are meeting all regulatory requirements accurately and efficiently. Nothing will replace a properly structured “SOP” or “Standard Operating Procedure”. It’s a documente AML/KYC process that serves as a tutorial and a cheat sheet that is reviewed and updated regularly. MyDocSafe can’t help with that as each industry needs its own SOP. We are, however, able to take your SOP and digitize and automate a large part of it.

- Balancing regulatory requirements with the need to provide a seamless and efficient service to their clients. Clients expect their professional adivers to be able to quickly and accurately verify their identity and financial information, without causing unnecessary delays or inconvenience. By using automated solutions like MyDocSafe, accountants, lawyers, and mortgage advisers can meet these expectations by streamlining the AML/KYC compliance process and providing a more efficient and user-friendly experience for their clients.

We offer the following solutions to these challenges:

- Identity verification and address verification service

- Ability to embed that service inside pre-sale, post-sale or complex client portal workflows

- Pay-as-you-go without any commitment fees

Manual vs. automated AML/KYC compliance checks

Manual AML/KYC compliance checks involve reviewing documents, verifying identities, and conducting background checks by hand. This is how it used to be: you go to high street during your lunch break and pop into the office of your accountant/lawyer/wealth manager and show them your passport with your council tax bill. Or at least this is how I imagine it was. Today, with remote working and advisers being located in another county or sity, face-to-face checks are increasingly not practical.

Clearly, automated AML/KYC compliance checks using tools like MyDocSafe offer a more efficient and accurate solution. With automation, documents can be uploaded, verified, and processed in a fraction of the time it would take to do so manually. This not only saves time and resources but also reduces the likelihood of errors and improves overall compliance.

The results of an automated test still need to be reviewed an approved by a compliance officer. If manual scoring is employed, the compliance officer will have to review answers to “risk-relevant” questions and make a decision. Sometimes the decision is not straightforward and needs to be escalated. In most cases, decisions can be made quickly directly by the relevant office. And who did all the legwork? It was the client, at his or her convenience. The benefits are therefore clear:

- save time and resources. By automating these processes, professionals can eliminate the need for manual data entry and verification, allowing them to focus on more strategic tasks and pass on some of the savings to the clients.

- enhanced accuracy and consistency of the results.

- access to real-time monitoring and reporting capabilities.

Streamlining AML/KYC compliance with MyDocSafe

Types of checks available:

Identity verification

The basic principle of running ID verification checks by Yoti through MyDocSafe is that it is your client who does the pre-work. The experience looks like this:

- upload an identity document

- take a liveness test through the camera (if the computer does not have a camera, the test can be done on a mobile phone – the workflow transitions seamlessly from the computer to the mobile phone and then back)

- submit all the data with a click

- the system will

- extract the data from the document and compare it with data available in public registers

- verify document authenticity

- compare the picture in the document with the image taken thorugh the camera

- The results will be reported via a pass/fail/consider traffic light sytem

Data verification results are not shown to the client.

Proof of address checks

If proof-of-address test is also required, the system will request an appropriate document as the first step in the identity verification workflow. Once uploaded, the system will perform similar checks a above, extracting the data and comparing it with public registrars.

Embedding AML/KYC into pre-sale workflows

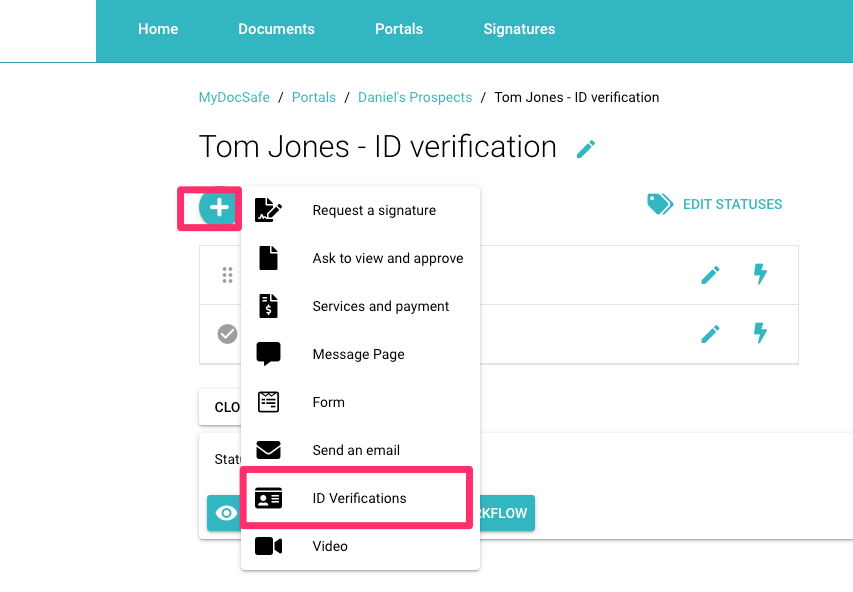

It is very easy to deploy the above checks in a workflow that can be sent out to a prospect by email. The recipient will not need to set up a login, all actions can be performed via a link in an email. To enable ID tests go to Portals and select one of the Prospect Groups. Then create a new Proposal and add the “identity verification” widget into your workflow template or a one-off workflow.

You can also send email notifications to your team members to alert them when the ID test has begun or once it has completed.

The recipient will receive an email with a link to the worklflow. You can adjust the logo, colour schema, welcome message and even the label on the button that leads to the online workflow.

The worklow will automatically load into the default browser after the recipient clicks on the button in the invitation message:

The recipient will then be able to upload documents, a selfie, conduct a ‘liveness’ test via the camera or tranfer the process to a mobile phone if required. Clearly, the workflow does not need to end there – the pre-sale process can involve display of marketing materials and videos, contract signing, approval of a quote, processing of a payment via Stripe and filling out of questionnaires.

Embedding AML/KYC into post-sale workflows

There are circumstances when it is more appropriate to limit the pre-sale workflow to basic data collection and quote approval. The full client onboarding process may require a secure client access portal to complete. MyDocSafe allows you to do just that: you can assemble the onboarding workflow and publish it in a portal. The process of doing so is very similar to the one described above. Client experience is similar but is proceeded with a portal invitation which requires the recipient to set up their login details and potentially set up a second factor authentication mechanism.

Streamlining AML/KYC compliance in multi user portals – M&A deal rooms, insolvency portals, real estate transactions

Some of our clients use portals for multi-party transactions, be it company mergers or acquisitions, insolvency proceedings or real estate transactions. Access to such portals is sometimes shared with company directors or partners, as the case may be. Yet, each involved person needs to go through the AML/KYC process. It may be impractical for the professional to chase each invididual involved to submit the required documents. Instead, it may be more appropriate to designate a company officer, such as company secretary or a non-executive director, to co-ordinate the process of inviting appropriate invidiuals into the portal. The professional invites only one person to the portal. That person invites all the others.

Each person with access to the client portal will then be able to run their own AML/KYC tests. To enable that funcationality, all you need to do is turn on the setting in the workflow template:

Note that in this case, all users with access to a particular portal will be able to see ID verification data submitted by all the others (but not the test results).

Future Trends in AML/KYC Compliance and MyDocSafe

Emerging technologies for AML/KYC compliance

Emerging technologies such as AI and ML have already entered the world of AML/KYC tools. Their aim is to verify certain attributes of an individual such as their identity, residential address, right to work, political exposure or presense of criminal records. They do not check for certain claims the person may be making such as professional track records, qualifications, achievements etc. Checking those is still a very expensive, labour intensive and error-prone process. Not surprisingly we see innovation happening in this area, which is also an area of interest of MyDocSafe. So…watch this space.

Final thoughts on leveraging MyDocSafe for efficient AML/KYC checks

We believe that using MyDocSafe for streamlining AML/KYC compliance carries with it a number of compelling benefits, which we would like to summarize here:

- flexibility of the platform which enables you to add the tests to pre-sale workflows or client portals and enable multi-party ID verification workflows

- pay-as-you-go pricing model where you are charged ONLY for what you used, monthly in arrears. So no ‘buying of credits which expire’.

- ability to keep client experience in one place – AML/KYC is just one element of a much more complex web of client interactions. Asking your new clients to switch between platforms increases deal abort risk. That is why we aim to embed third party tools such as Yoti inside our workflows for a seamless experience

Are you ready to start streamlining AML/KYC compliance with MyDocSafe? Try us for free for 30 days to see what that experience can look like (no free ID tests included though, for obvious reasons).