The surprising topic dominating the conversation at this year’s Global WealthTech Summit 2021

Recently, MyDocSafe had the pleasure of speaking at the Global WealthTech Summit 2021, one of Europe’s leading WealthTech events.

With a reputation for high quality content spanning the past twenty years, The Global WealthTech Summit is hosted by AltAssets and FinTech Global, and is strengthened by long-standing relations to leading financial institutions, investors and businesses worldwide. The Summit provides a platform for many key figures representing these categories, and attracts an international audience.

In keeping with the transition back towards in-person events, the Summit was executed as a hybrid event, with a virtual and in-person component. Based in bustling Central London, we appreciated the opportunity to attend the event in person. As we adjust to the post-pandemic landscape, it reminds us how much we’ve missed this kind of interaction and engagement.

This Year’s Hot Topic: Client Onboarding and Registration

The attendees of Global WealthTech Summit represented an untested audience for MyDocSafe, and we were interested to gauge the level of interest in our offering. Happily, within the first few conversations, we recognized excellent overlap in terms of the opportunity our product represents in this sphere.

As we mixed with the audience, one topic kept coming to the forefront of conversation.

“Everyone seems to be talking about customer onboarding in the context of a new business or product launches. Onboarding used to refer to AML/KYC checks but is now expanding to mean the entire customer registration process. The customer onboarding lawyer seems a prerequisite to innovation in the space but not a strong competency within the innovative circles.”

Daniel Stachowiak of MyDocSafe.

We quickly learned that a chief area of concern for attendees was the need for user-friendly, secure and streamlined methods of onboarding, which actively enhanced customer experience, as opposed to more traditional (and convoluted) ways of initiating engagements with new financial clients. There was increased curiosity and demand for the improvements that advances in onboarding technology could offer here.

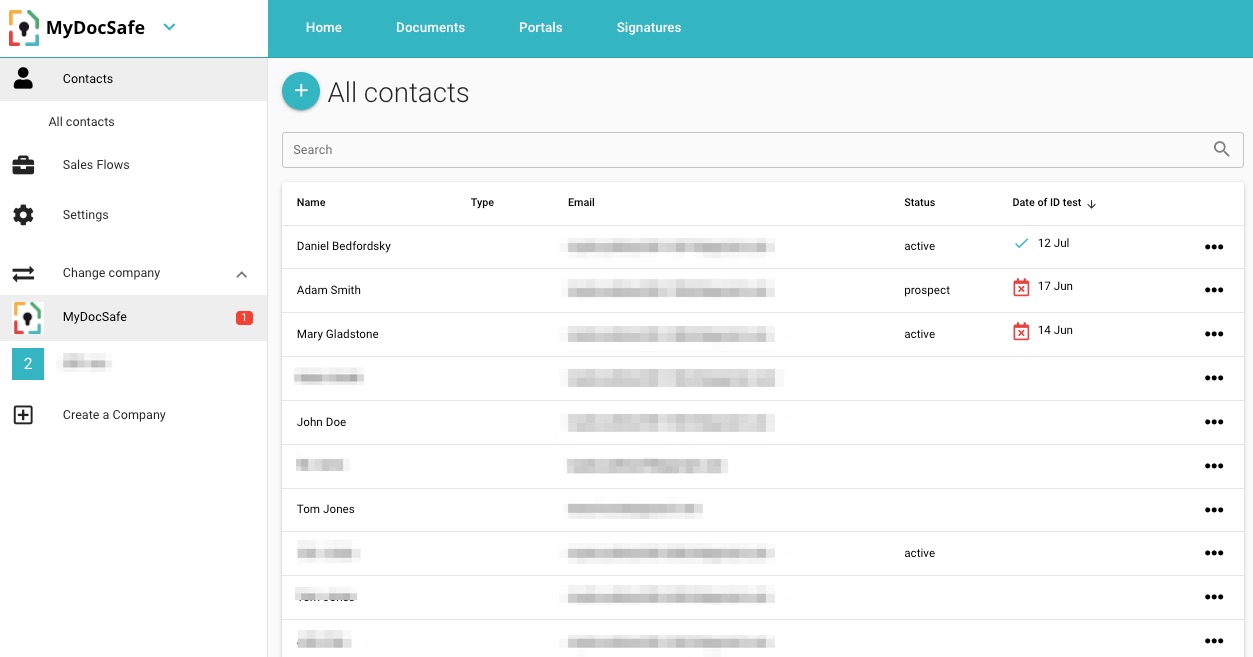

At MyDocSafe, onboarding represents a key specialism – our solutions have been designed from the ground up to offer exemplary function, in terms of both experience and outcome.

With the topic repeatedly coming up in conversation, we knew we were in the right place – offering a practical solution and helping the audience of Global WealthTech Summit learn more about the potential and possibilities offered by an advanced client onboarding system.

Why Is Client Onboarding Trending?

Onboarding represents such a familiar component of client-based business that it’s often somewhat overlooked within scheduling, in favor of more “cutting edge” topics. However, the level of interest at The Summit was notable, and we suspect this increased curiosity and demand stems from a number of key reasons.

Elevated client expectations

As technology evolves, expectations grow amongst our client base. Digital onboarding experiences have become slicker, fully digitized and multi-functional. There’s a need for businesses to keep up with the experiences delivered by other close competitors.

Compliance Requirements

There’s a pressing need to meet strict compliance requirements within a heavily regulated sector. Compliance laws and regulations are constantly changing, and therefore, companies must keep pace as well. An onboarding process that can keep pace here is essential.

As data privacy controls tighten, there’s an increased awareness of fines due to non-compliance. It’s vital to have a secure, organized and reliable system in place for the safe storage and processing of documentation. Businesses must invest in technology that keeps regulation compliance restrictions under control, within a seamless protocol.

The Rise Of Fintech

With the increasing number of FinTech products coming to market, there’s a desire to produce a seamless, single sign-on experience wherever possible, allowing for better flow and integrated operation. FinTech companies are focused on innovation and driving results – onboarding should elevate their offering and facilitate ongoing collaborations.

Our predictions for the future of client onboarding

Attending The Global WealthTech Summit gave us an exciting glimpse at what the future holds for the financial sector. Based on this year’s event, we’ve landed upon a few predictions for the evolution of onboarding in the near future.

- Clients’ expectations will continue to rise. Ultimately, there’s an expectation for technology to remain ahead of the curve. Clients won’t settle for providers who offer a sub-par digital experience when it comes to easy, initiative control of their finances and data.

- When it comes to the quality of onboarding delivered, the sky’s the limit. We expect superior onboarding experiences to allow companies to differentiate themselves from competitors, representing a great way to elevate customer experience. Companies are likely to compete based on style, ergonomics of the process (also known as user experience or ease of use) and true “front-of-house” portal experience, where everything a client needs to know is in a single place.

- The onboarding process will prove to be a crucial component in client retention strategy. Having a seamless onboarding process allows for higher retention, making data collection, renewal and deal progression seamless. Communication and authorization (via digital signature etc) is seamless and helps deals progress without impediment.

- Streamlined digital onboarding will provide essential paper trails when it comes to regulatory compliance. Compliance laws will continue to evolve and penalties for noncompliance will climb. For that reason, having a secure system and easy access to documentation will prove increasingly crucial for keeping up with regulation.

- Single sign-on and best-in-class security will be a top priority for all providers. Clients want simplicity and security, but it can be challenging to achieve both. Modern technology is changing this.

For The Future

Once again, we’d like to extend our gratitude to everyone involved in making The Global WealthTech Summit such a success. It was a wonderfully positive experience, and we will undoubtedly participate again next year.

From the conversations we participated in, we’re increasingly excited by the opportunity that MyDocSafe can offer financial advisors, wealth managers and beyond – offering a new standard of digital client onboarding experience, and facilitating ongoing engagement. We were honored to be recognized as a critical leader in the innovation of client onboarding technology by the event.