Maintaining Trust Without Face To Face Interaction As A Wealth Manager

Trust is arguably the most crucial element in any client relationship, but when finances are on the line, absolute faith is required.

In person meetings have always played a valuable role when it comes to relationship-building within Wealth Management, and until recently, face-to-face interactions have been the preferred means of attaining a close connection with clients. For clients with a lot on the line, there’s a distinct need to connect with their manager, and feel a dependable degree of security.

Then the pandemic hit, and as they say, necessity is the mother of invention. Without the ability to meet in person (or in many cases, even to travel to be in closer proximity,) the sector rapidly came to appreciate the importance of establishing other trust-building methods.

In this article, we’ll explore four ways that you can maintain a solid, trusting relationship with your clients through methods that go beyond in-person connections.

Demonstrate Respect For Clients’ Time And Input

As a wealth manager, you’re striving to make the financial life of your clients easier, more efficient and successful. In order to deliver the best results, your interactions should be seamless. Communication should flow easily, and procedures should be optimised for a friction-free experience.

In order to attain trust, show empathy – demonstrate an awareness of what you’re asking of your clients. How much of their time will your processes, workflows, checks, and requests take up? What steps are you taking to reduce this? Acknowledging your clients’ time and effort shows respect, the essential foundation of any trusting relationship.

Build a superior client experience by establishing optimum efficiency via well-built workflows. Working with a platform such as MyDocSafe means you’re able to create flows which automatically progress, and which can be pre-populated with previously held client data, to save time for both parties. This is particularly relevant to repeat-transactions such as instructions to transfer funds or to rebalance portfolios.

Provide A Secure And Seamless “Front Of House” Experience

User experience matters and client expectations are continuously rising here thanks to widespread digital transformation across all sectors. Interaction with the various interfaces required to do business with your clients should be seamless and intuitive.

Clients haven’t bought into the services of Wealth Manager in order to chase information or documentation. Finances move fast, and often, quick responses, answers and actions are necessary. With this in mind, a secure “single source of truth” – where clients can easily locate their files and access a wide range of functionality – is essential.

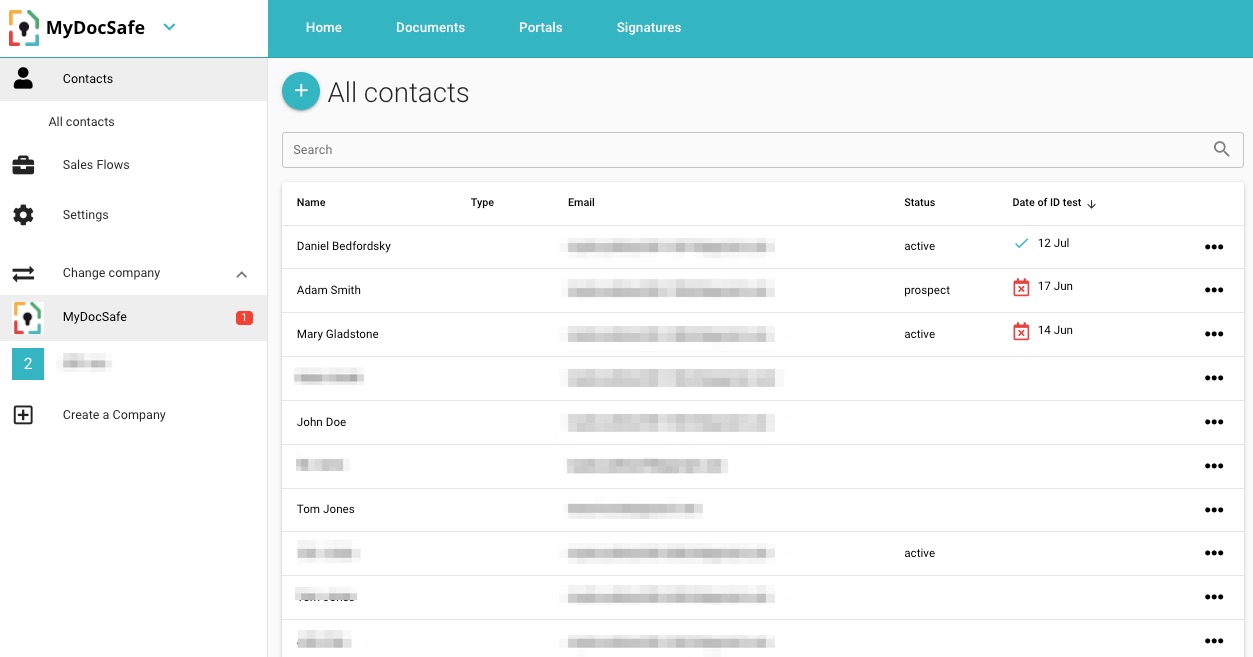

MyDocSafe offers the perfect “front of house” solution, combining top-level security with the ability to perform a wide range of practical tasks. Offering a convenient single sign-on, the platform enables clients to submit information, provide authentication, authorise instruction and much more. With so much personal and sensitive information at stake, one dependable, high security platform offers better information governance, and helps establish a greater sense of security and trust.

Offer Total Transparency

When finances are at stake, 360 degree transparency is essential. To feel fully secure with your services, your clients need to know they can access documentation at any point, quickly and without having to wait for your response. Don’t risk unsettling gaps in communication or lags in your response, and demonstrate your complete confidence in the service you provide by allowing “access all areas” wherever possible.

Client portals have an important role to play here. MyDocSafe offers the easy creation of client portals that are highly secure, fully brandable and able to provide a reassuring “self-service” approach to information.

Clear Channels Of Communication

Easy access to documentation is important, but sometimes clients will need a clear and official answer from you. When it comes to requesting and receiving this kind of exchange, it’s crucial to have clear channels of communication.

Email, SMS, Slack channels, social media, carrier pigeon… Today, we’re spoilt for choice when it comes to connecting – but without a clearly established “favoured” method, messages can be missed and matters quickly become complicated. Rather than maintaining multiple communication channels, again, lean on client portals to manage messaging through one dependable channel.

MyDocSafe portals hold all client information, and help to streamline the flow of communication through one secure platform. This keeps all communication in one place where everyone can access it, and provides an easily referenced record of everything that has been discussed, decided and signed off.

Trust Can Be Achieved

The value and power of face-to-face communication will never be replaced when it comes to establishing client trust within Wealth Management. But as digital transformation accelerates within the sector, other methods of indirect communication and management offer a great way to maintain good relationships and high levels of trust.

It’s becoming increasingly necessary (and wise) to double down on the digital factors that can help to underpin and reinforce the trust built between clients and their Wealth Managers. As we saw with the globally felt impact of the pandemic, alternative options can help provide essential pivots when unprecedented circumstances strike.

MyDocSafe offers the perfect foundation for these kinds of relationships to be developed and maintained – providing a secure, seamless system with transparency and ease of use at its very core. If in-person meetings are restricted, with a reliable and secure system, your clients can feel confident in your relationship and their ability to access sage advice quickly.